Growth

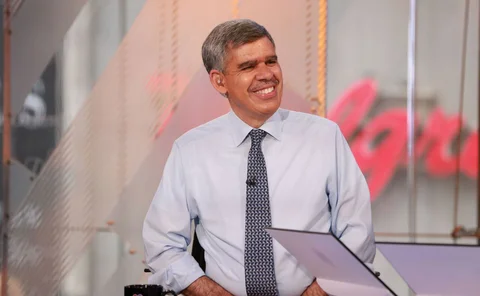

El-Erian on Covid-19 policy risks, ‘zombie’ markets and central bank capture

Former Pimco chief says Fed move into high yield is a step too far, new rules needed on leverage and false liquidity, and narrow window emerges for central banks to shed some of their policy load

Sarb cuts rates to historic low

Unanimous decision comes as growth outlook and inflation forecasts revised; South Africa’s risk profile has increased

World Bank says sub-Saharan Africa destined for first recession in 25 years

Growth could fall as low as -5.1% as largest economies struggle with Covid-19 repercussions

Kosovan central bank rolling out response to coronavirus shock

Governor Fehmi Mehmeti says economy is vulnerable but the central bank is taking action

Banque de France predicts 6% economic contraction

Confinement laws have had a significant impact on activity

Bank of Israel launches targeted lending operations

Central bank offers cheap loans to banks as part of Covid-19 response package; research department estimates point to major growth impact from virus

Malaysian central bank says economy likely to shrink

Bank Negara Malaysia says pandemic already having “significant impact”

Some thoughts on CBDC operations in China

People’s Bank of China deputy governor Fan Yifei outlines why he favours an indirect approach to introducing a CBDC in China

East Asian economies face ‘profound’ impact from Covid-19 – World Bank

Report estimates growth could turn negative for the region in “lower-case” scenario

Covid-19 uncertainty to have long-lasting impact – SF Fed paper

Inflation may turn negative over the near and medium term, researchers estimate

Singapore eases monetary policy sharply and taps reserves

MAS flattens currency appreciation slope to zero after government unveils $34 billion stimulus

BoE on hold as early indicators point to rapid UK downturn

Policy on hold after extraordinary actions in recent weeks; network of agents reports credit conditions are tightening

Philippines, Taiwan and Indonesia cut rates; Singapore on watch

Asian central banks continue easing to boost virus-hit economies; Singapore slips into deflation for the first time in a decade

US economy could face largest quarterly contraction in history – Bullard

$2.5 trillion in national income might be wiped out, St Louis Fed president says; Congressional leaders agree $2 trillion stimulus package

Bank of Mexico cuts rates 50bp in emergency meeting

Analysts expect further cuts as the economy is expected to enter a sharp recession

China will suffer recession, say Bank of Finland experts

Economic policy response has been fragmented and banks may not respond to PBoC incentives – research

Bank of Mauritius launches Covid-19 response package

Bank unveils five measures designed to bring relief for businesses and keep credit flowing

The Tokyo Olympics: downside risks prevail

The Bank of Japan’s latest stimulus effort seems to be weak, and comes at a time when the benefits of hosting the Tokyo Olympics may be overstated – even if the games still take place

RBNZ reduces rates by 75bp in emergency meeting

Central bank says future purchases of government bonds preferable to lower rates

Bank of Israel unveils actions to boost market function

Repo operations and asset purchases designed to tackle high volatility

PBoC injects $79 billion into virus-hit economy

Targeted RRR cut encourages smaller banks to lend to SMEs; more easing steps expected to stabilise economy

Norges Bank cuts rates 50bp in emergency meeting

Central bank offers extraordinary three-month loans to banks and calls on government to reduce countercyclical buffer

Lagarde seems to stumble as ECB announces coronavirus response

ECB announces more QE, expanded financing and loosening of banks’ capital and liquidity buffers

Bank of Spain paper looks at macro-pru and growth at risk

Financial cycle, time elapsed and type of measure has major impact on effectiveness – researcher