Liquidity

Shadow banking increases need for asset purchases – ECB paper

Large non-bank financial sectors can impair transmission of monetary policy, paper finds

Colombia cuts reserve requirements in extraordinary meeting

Measures permanently inject $2.3 billion in liquidity, says central bank

ECB sets up €2 billion swap line with Croatian National Bank

The line will remain in place until the end of 2020, but can be extended as long as it is needed

Fed takes first step to unwind repo support

Repo market is showing signs of “more stable” conditions, New York Fed says

Financial resilience may be tested further by Covid-19 – IMF

“Sudden stop” in credit markets could feed back to real economy, and requires a “forceful response”

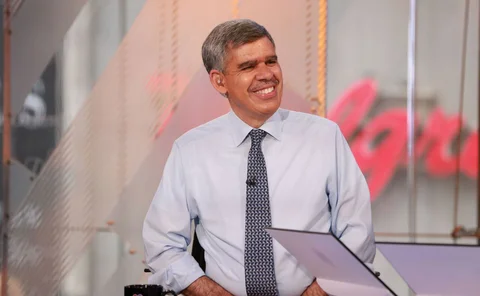

El-Erian on Covid-19 policy risks, ‘zombie’ markets and central bank capture

Former Pimco chief says Fed move into high yield is a step too far, new rules needed on leverage and false liquidity, and narrow window emerges for central banks to shed some of their policy load

Beware of capital: much ado about nothing?

Capital increases can be offset by asset valuation, provision and income recognition forbearance

IMF doubles emergency lending capacity

Fund considering other options including SDR issuance, says Kristalina Georgieva

Israeli reserves fall sharply on dollar liquidity provision

Central bank’s portfolio decreases by $5.1 billion in March

BIS paper finds little evidence of ‘liquidity trap’

Monetary policy remains effective even very close to the lower bound, economists find

Kosovan central bank rolling out response to coronavirus shock

Governor Fehmi Mehmeti says economy is vulnerable but the central bank is taking action

Central banks may have to become ‘dealers of last resort’ – BIS economists

EMEs have not overcome “original sin” by deepening local currency bond markets, authors warn

Riksbank expands incentives for lending to small firms

Central bank continues with flurry of crisis-fighting measures

China cuts rate on excess reserves for first time in 12 years

PBoC levels up stimulus, cutting rate on excess reserves while reducing RRR for the third time this year

Should the Fed be next to implement yield curve control?

The Reserve Bank of Australia is now the second G20 central bank trying to control longer-term interest rates. Could the Fed be next?

The long march to global growth

Liang Tao, vice-chairman of the China Banking and Insurance Regulatory Commission, says that China’s growth is fuelling innovation and modernisation, but financial regulation and governance needs to be tightened up for China to take its place at the top…

Official institutions shed US Treasuries in record amounts

Fed holdings of Treasury securities for foreign official institutions dropped by $127 billion in March

Fed eases capital restriction on large US banks

US repo rates stray into negative territory as investors make massive flight to safety

Fed opens dollar funding to majority of central banks

New repo facility aims to ease strains caused by global flight to the safety of dollars

‘Ostrich approach’ to financial stability is a mistake

Denmark’s top supervisor, Jesper Berg, says scaling back IFRS 9 would be a costly error, despite the economic challenges raised by Covid-19

Singapore eases monetary policy sharply and taps reserves

MAS flattens currency appreciation slope to zero after government unveils $34 billion stimulus

Central Bank of Colombia cuts rates and unveils liquidity support

Central bank cuts main rate and offers liquidity in US dollars and pesos

China makes surprise rate cut to resist crisis

PBoC unexpectedly cuts the seven-day repo rate while injecting liquidity, suggesting a willingness to deploy stronger countercyclical measures

Sarb consults on Covid-19 regulatory easing

Central bank mulls lowering Pillar 2A capital requirements