Liquidity

Collateral management services: National Bank of Georgia/Montran

The duo developed Georgia’s fully automated new collateral framework

Fed’s repo tapering plans hit snag

Banks demand double what was on offer at Fed’s first reduced repo offering

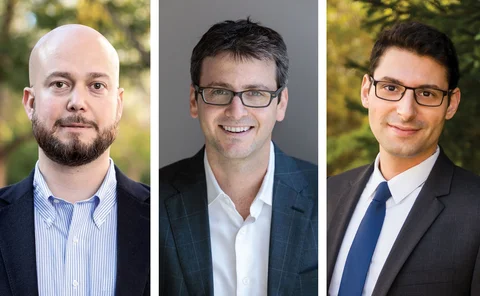

Economics in central banking: Matteo Maggiori, Brent Neiman and Jesse Schreger

The Global Capital Allocation Project has helped pick apart the tangled network of cross-border capital flows. The work may prove essential to those looking to shore up the international monetary system

Advisory services: Deloitte

The consultancy has shown its strength in a wide range of technological and governance advisory roles in the past year

Governor of the year: Mark Carney

Carney has played a vital role in managing Brexit risks while driving efforts towards climate, payments and dollar funding reform

PBoC injects 1.2 trillion yuan as markets plunge

Chinese central bank eases to support economy as coronavirus spreads; Q1 GDP growth could drop to 4%, economists say

Central bank of the year: Bank of Ghana

The African central bank has carried out extensive reform of Ghana’s banking sector

Financial market infrastructure services: Bloomberg

The US company has helped central banks improve monetary operations and deepen forex markets by scaling up technical infrastructure and database monitoring capabilities

Fed leaves monetary stance unchanged but tweaks IOER

FOMC also announces updated plans on its balance sheet and repo market interventions

PBoC extends market closure as coronavirus spreads rapidly

Chinese central bank extends interbank markets closure and vows to maintain ample liquidity

US mutual funds' liquidity risk on the rise – Boston Fed paper

Ratio of illiquid assets to net assets increased from 2009 to 2019, researchers find

Debt securities still key in capital flows to EMEs – BIS

Latest global liquidity statistics show ongoing growth in euro and dollar liquidity

BoE says no-deal Brexit now unlikely

Bank of England ends additional liquidity supervision after passage of withdrawal agreement

Hong Kong and Thailand launch next phase of cross-border CBDC project

CBDC-based payments can cut costs and boost speed, HKMA and Bank of Thailand study shows

Cyber attack could freeze liquidity in US financial system – NY Fed paper

Attack on one bank could affect more than a third of banking system’s assets, researchers warn

Non-bank growth slowed in 2018, says FSB

Riskiest forms of non-banks still growing, but overall assets went into reverse in 2018

Fed slims down repo market interventions

Relative to year-end, the Fed will cut $250 billion of the cash offered to banks

Fed to wean banks off daily repos later this year

Total reserves may need to be higher than Fed initially judged as demand for repo operations remains strong

Economists call for action on risk of dollar liquidity crunch

Credit to non-banks and currency mismatches have grown, while oversight is “fragmented”, report warns

New York Fed launches longer-term liquidity fix

Markets desk tells overseas central banks that foreign repo pool rate will be revised

New CBSL governor targets transmission mechanism

Priorities for 2020 include tackling bottlenecks, boosting transparency and improving analytics

Fed avoids year-end cash crunch

Repo market shows barely a ripple over New Year’s Eve after Fed injects a quarter of a trillion dollars

Monetary easing can boost birth rate, BoE paper finds

People had more children after rates were slashed post-crisis, researchers find

Markets surge as PBoC cuts RRR

Cut designed to support the flagging economy; PBoC insists it is retaining “sound” policy