Expectations

Mexican inflation rising rapidly, warns deputy governor

Heath says prices increasing at “really phenomenal” rate but expects full pandemic recovery by 2023

US CPI inflation rises to 5.4%

Prices continue upward climb, but policy-makers still see pressures as temporary

Covid-19, crypto and climate weigh on global economy – GFSR

Central banks face difficult “intertemporal trade-offs”; poorer nations unlikely to regain pre-Covid growth levels for “many, many years”, says IMF’s financial counsellor Tobias Adrian

Summers fears for Fed’s ability to remove ‘punchbowl’

Central banks may not be able to counter inflation threat amid possible return to 1960s economics, says former US Treasury secretary

Peru central bank raises rates for third time in two months

BCRP forecasts inflation will return to target, but expresses concern over expectations

Larry Summers on stagflation risks, lessons from Delphi and never-ending ‘punch’

The former US Treasury secretary speaks about fiscal ‘overexpansion’, Fed/Treasury debt discord, the pitfalls of ‘unknown unknowns’ and central bankers ‘unable’ to remove the ‘punchbowl’

Goodhart, Gopinath and Lippi disagree on inflation

Central banks lack tools to deal with inflation, Goodhart warns, but IMF chief economist disagrees

Agustín Carstens on BIS strategic priorities, innovation and central bank policy

The BIS general manager speaks about policy trade-offs at critical time, tackling NBFIs and the dearth of ‘green’ assets, tech collaboration, and why he favours Biden’s $3.5trn infrastructure bill

Central banks set monetary policy around eight times a year

African central banks reported setting monetary policy less frequently than peers

Majority of central banks do not take account of forecast errors

Surveys of inflationary expectations used widely, alongside macroeconomic and market indicators

Too great expectations from the ECB’s strategy review

The review process represents operational best practice, but will fail to unify the Governing Council

Is the ECB’s strategy review enough?

The reformed framework may allow greater stimulus to tackle weak inflation expectations, but the Governing Council is already divided on what to do next

Fed decisions barely noticed by households – BIS paper

Researchers find even major events have only a muted impact on household inflation expectations

An assessment of the ECB’s strategy review

A number of aspects of the new framework raise challenges for implementation and credibility, while the inclusion of climate change may politicise the institution, writes euro architect Otmar Issing

The evolution of the renminbi

Central Banking speaks to five policy-makers about their thoughts on the prominence of the renminbi within central bank reserves following its inclusion in the International Monetary Fund’s special drawing rights.

Communications Benchmarks 2021 report – executive summary

Insights into staffing and salaries, channels, social media, new technology and strategies

Bank of Russia increases policy rate 100bp

Central bank announces fourth rate hike of year amid rising inflation expectations

The ‘golden age’ of central banking has passed

Central banks face multi-faceted challenges and weakened autonomy amid highly polarised inflation expectations

Paper analyses eurozone consumers’ inflation expectations

Short-term views, trust and Covid-19 shaped medium-term expectations – Bank of Finland paper

Communications often involved at early stages of central bank policy

Most central banks say comms teams are involved in early planning stage of policy decisions

Fintech communication is most challenging for central banks

Central banks view fintech as greatest challenge, but rate monetary policy communication highly

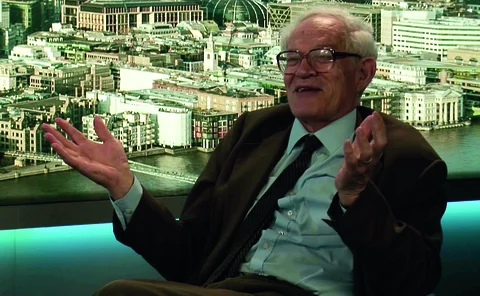

Charles Goodhart on inflation targets, financial stability and the role of money

The LSE professor says inflation targets should have been 0%, the Fed’s move to AIT is a mistake, independence is under threat from inflation, big balance sheets support liquidity, AI can help supervisors and climate stress tests are unconvincing

A return of the inflation monster?

There are fears that a shift in intellectual approach towards running economies ‘hot’ could herald a return of the money-eating inflation era

Firms are ‘inattentive’ to inflation and monetary policy – NBER paper

Authors present new survey data indicating firms’ expectations are “anything but anchored”