Expectations

Reputational risk tops central bank concerns

Cyber security and credit/counterparty risk followed

Peru hikes rates 50bp again

Central bank continues tightening programme begun in August

Bank of Jamaica hikes policy rate

Central bank raises rate by 50 basis points in bid to reverse inflationary trend

Russia orders seventh straight rate hike

Central bank continues protracted battle against high inflation

Colombia stays on trend with 50bp hike

Central bank board unanimous on raising rate, but splits 4–3 on size of increase

Bank of England raises policy rate

Tightening comes amid inflation surge and just after BoE completes asset purchases

Tackling surging inflation

Central banks around the world are grappling with rapid price rises, with some taking very different routes to one another

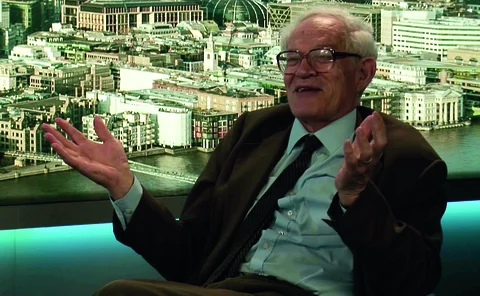

Mervyn King attacks central bank theories of inflation

Expectations are “too fragile” to serve as an anchor for inflation, former BoE governor says

Final frontier? Japan after the Kuroda experiment

The Bank of Japan has pushed monetary easing close to its limit, yet inflation is barely above zero. What happens now?

Should ESG reporting be made mandatory?

As concern around the impact of climate change on businesses grows, many regulators have announced their intentions to include ESG requirements in reporting frameworks

New York Fed opens new research centre

Marco Del Negro will lead work on research methods and issues in macroeconomics

Central bank signals could be impacting natural rate – BIS paper

“Learning process” could explain decline in interest rates without drop in productivity, authors say

Czech National Bank makes 125bp hike

Central bank promises aggressive action to resist “exceptionally strong price pressures”

‘Say what?’ Trust in central bank communications

Central banks are changing how they communicate with different audiences, but judging the success of these communication efforts is difficult

Forecaster surveys improve eurozone inflation modelling – ECB paper

Households’ and firms’ expectations do not provide useful data on inflation

Permanent or transitory? Officials wrestle with inflation uncertainty

Bailey warns of possible damage to credibility, but Carstens urges caution amid high uncertainty

James Bullard on Fed policy, action and governance

St Louis president calls for tapering amid “exceptional” job market and risk of “more persistent” inflation, quantifies ‘big tent language’ for pioneering AIT move, and details Congress’s role in Fed ethics oversight

Mexican inflation rising rapidly, warns deputy governor

Heath says prices increasing at “really phenomenal” rate but expects full pandemic recovery by 2023

US CPI inflation rises to 5.4%

Prices continue upward climb, but policy-makers still see pressures as temporary

Covid-19, crypto and climate weigh on global economy – GFSR

Central banks face difficult “intertemporal trade-offs”; poorer nations unlikely to regain pre-Covid growth levels for “many, many years”, says IMF’s financial counsellor Tobias Adrian

Summers fears for Fed’s ability to remove ‘punchbowl’

Central banks may not be able to counter inflation threat amid possible return to 1960s economics, says former US Treasury secretary

Peru central bank raises rates for third time in two months

BCRP forecasts inflation will return to target, but expresses concern over expectations

Larry Summers on stagflation risks, lessons from Delphi and never-ending ‘punch’

The former US Treasury secretary speaks about fiscal ‘overexpansion’, Fed/Treasury debt discord, the pitfalls of ‘unknown unknowns’ and central bankers ‘unable’ to remove the ‘punchbowl’

Goodhart, Gopinath and Lippi disagree on inflation

Central banks lack tools to deal with inflation, Goodhart warns, but IMF chief economist disagrees