Economics

Economist salaries outpace GDP per capita

Salaries were six times higher than GDP per capita, on average

How Turkey’s president created chaos in economic policy-making

Observers allege presidential domination of the central bank, unauthorised FX transactions and untrustworthy statistics

Policy economists outnumber research economists

Central banks with their own pure research departments tend to employ more policy economists

Nearly 40% of central banks have financial sector in main forecast model

Semi-structural models remain favoured option for producing key forecasts

Economists tend to perform both policy and research duties

Only around a quarter of economics departments have a pure research function

Fed's monetary policy ‘spillbacks’ have significant effects – ECB paper

Researchers estimate how impact of Fed policy on foreign economies in turn affects US

ECB paper examines exchange rates and household consumption

Exchange rate elasticity of household consumption driven largely by industrial goods - researchers

Should ESG reporting be made mandatory?

As concern around the impact of climate change on businesses grows, many regulators have announced their intentions to include ESG requirements in reporting frameworks

New York Fed opens new research centre

Marco Del Negro will lead work on research methods and issues in macroeconomics

Bank of Israel calls on divided parliament to pass budget

Central bank stresses it includes key investments to boost productivity and growth

‘Say what?’ Trust in central bank communications

Central banks are changing how they communicate with different audiences, but judging the success of these communication efforts is difficult

Biden stimulus will cause small, short price spike, says paper

San Francisco Fed predicts American Rescue Plan will boost inflation by 0.3%

Gita Gopinath to leave IMF

Fund’s first female chief economist is set to return to Harvard

Delta variant had smaller impact on US consumer spending

Cleveland Fed finds weaker or no link between hospitalisation and spending in 2021

ECB paper examines ‘euroised’ economies

European countries’ informal adoption of euro places limits on central banks, says working paper

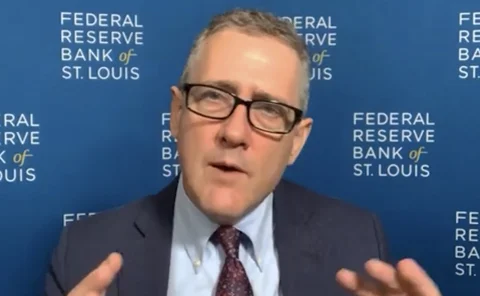

Fed’s Bullard believes a ‘five-year window’ for AIT is ‘realistic’

St Louis Fed president says “big tent language” was a reason overshoot details were not specified; “precise numerical implementations” can “get you into trouble”

James Bullard on Fed policy, action and governance

St Louis president calls for tapering amid “exceptional” job market and risk of “more persistent” inflation, quantifies ‘big tent language’ for pioneering AIT move, and details Congress’s role in Fed ethics oversight

IMF: growth prospects dim as pandemic lingers

Fund revises down growth forecasts, warning of inflation, disruption and divergence

Cubero calls for expanded IMF role

Costa Rica governor endorses Resilience and Stability Trust proposal

Empirical economists win Nobel Prize

Card, Angrist and Imbens share prize for work on labour markets and causality

Greater competition cut US banks’ ‘insider lending’ – BdF paper

Researchers quantify bank owners’ and executives’ loans to themselves and their interests

Larry Summers on stagflation risks, lessons from Delphi and never-ending ‘punch’

The former US Treasury secretary speaks about fiscal ‘overexpansion’, Fed/Treasury debt discord, the pitfalls of ‘unknown unknowns’ and central bankers ‘unable’ to remove the ‘punchbowl’

Inequality sharpens monetary policy’s effects – ECB paper

Author analyses “inequality channel” using model with three types of heterogeneous agent

Agustín Carstens on BIS strategic priorities, innovation and central bank policy

The BIS general manager speaks about policy trade-offs at critical time, tackling NBFIs and the dearth of ‘green’ assets, tech collaboration, and why he favours Biden’s $3.5trn infrastructure bill