Economics

Gita Gopinath to leave IMF

Fund’s first female chief economist is set to return to Harvard

Delta variant had smaller impact on US consumer spending

Cleveland Fed finds weaker or no link between hospitalisation and spending in 2021

ECB paper examines ‘euroised’ economies

European countries’ informal adoption of euro places limits on central banks, says working paper

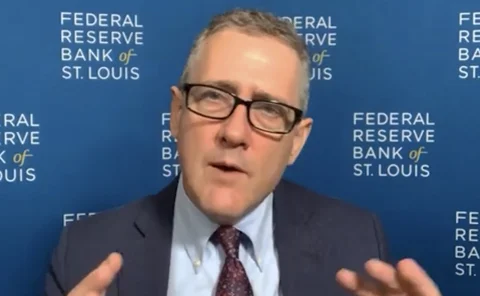

Fed’s Bullard believes a ‘five-year window’ for AIT is ‘realistic’

St Louis Fed president says “big tent language” was a reason overshoot details were not specified; “precise numerical implementations” can “get you into trouble”

James Bullard on Fed policy, action and governance

St Louis president calls for tapering amid “exceptional” job market and risk of “more persistent” inflation, quantifies ‘big tent language’ for pioneering AIT move, and details Congress’s role in Fed ethics oversight

IMF: growth prospects dim as pandemic lingers

Fund revises down growth forecasts, warning of inflation, disruption and divergence

Cubero calls for expanded IMF role

Costa Rica governor endorses Resilience and Stability Trust proposal

Empirical economists win Nobel Prize

Card, Angrist and Imbens share prize for work on labour markets and causality

Greater competition cut US banks’ ‘insider lending’ – BdF paper

Researchers quantify bank owners’ and executives’ loans to themselves and their interests

Larry Summers on stagflation risks, lessons from Delphi and never-ending ‘punch’

The former US Treasury secretary speaks about fiscal ‘overexpansion’, Fed/Treasury debt discord, the pitfalls of ‘unknown unknowns’ and central bankers ‘unable’ to remove the ‘punchbowl’

Inequality sharpens monetary policy’s effects – ECB paper

Author analyses “inequality channel” using model with three types of heterogeneous agent

Agustín Carstens on BIS strategic priorities, innovation and central bank policy

The BIS general manager speaks about policy trade-offs at critical time, tackling NBFIs and the dearth of ‘green’ assets, tech collaboration, and why he favours Biden’s $3.5trn infrastructure bill

Bundesbank paper looks at short sellers in the pandemic

Short sellers saw Covid-19 would strongly affect fiscally constrained countries - paper

BDF paper analyses banks’ capital buffers

Researchers suggest new approach to setting banks’ structural and cyclical reserve levels

Book notes: Robert Triffin, by Ivo Maes with Ilaria Pasotti

Triffin’s story is well told by Maes, whose extensive personal and academic research shines through on page after page

Central banks set monetary policy around eight times a year

African central banks reported setting monetary policy less frequently than peers

Strategies for change: central banks’ quest for diversity

Dedicated diversity strategies remain uncommon among central banks, despite growing recognition of the need for better minority representation

Policy-makers and staff often determine headline forecasts

Joint approach may help conquer systemic bias

Majority of central banks do not take account of forecast errors

Surveys of inflationary expectations used widely, alongside macroeconomic and market indicators

Some philosophical questions about the future of central banking

Kenneth Rogoff weighs up the many challenges facing central banks in the years ahead, from debt and inflation to negative rates and the dangers of ‘mission creep’

Dutch households to keep most pandemic savings

DNB still expects strong recovery in household consumption if social distancing measures are lifted

Jackson Hole conference switches to online-only model

Kansas City Fed cancels Wyoming get-together, citing Delta variant

How we can improve gender diversity in economics

Mary Suiter and Oksana Leukhina say gender diversity in economics must be championed

Eurozone returns to growth in Q2

Employment increases, but economic expansion is uneven across economies