Debt

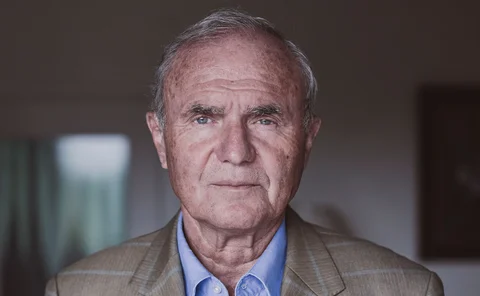

Governor of the year: Alejandro Díaz de León

Díaz de León has upheld the authority, integrity and independence of the Bank of Mexico against significant external and internal pressures

Yellen backs proposal for SDR issuance

G20 calls on IMF to develop proposal for “general allocation of SDRs”

Corporate Services Benchmarks 2021 report – trends in financial reporting and administration

Insights on staffing and salaries, technological automation, data security, rule compliance, gender equality and green office spaces in accounting, audit, HR and administration

BIS paper contrasts firm financing in US and Asia

Authors argue market segmentation drives different patterns of bond and loan financing

Bolivian central bank repays ‘unconstitutional’ IMF loan

Central bank says loan was illegal and threatens legal action against officials responsible

ESRB warns governments not to withdraw stimulus prematurely

New report highlights how support measures face trade-offs between cliff effects and debt sustainability

The Covid crisis, central banks and the future

Crisis responses have had positive initial outcomes, but also exacerbated significant underlying challenges that raise concerns related to exit strategies and the future for central banks

European central bankers see room for fiscal-monetary co-operation

Pandemic showed it was “critical” for both policies to work together, say central bank governors

HKMA defers trade facility repayments again

Loans may be extended further, HKMA says, as unemployment reaches 16-year high

Draghi accepts task of leading next Italian government

Former ECB president must first secure enough parliamentary support to become prime minister

IMF grants Tonga $10 million emergency loan

Fund’s Article IV report expresses concern about banking sector; predicts GDP contraction

Final NSFR rule unlocks subsidiary funding for US banks

Technical clarification allows subsidiary capital to be assigned as funding for consolidated group

IMF staff lay ground for $1.8 billion loan to Costa Rica

Staff set terms for three-year loan as high debt and Covid-19 take toll; earlier agreement foundered amid public protests

New macroeconomic framework needed for recovery – Ghana governor

Public debt levels have breached maximum thresholds and NPLs are likely to climb, Addison says

Debt-service ratio limits have greatest welfare benefit – BoE research

Authors find macro-prudential tools can also boost the transmission of monetary policy

The changing data landscape: Part 1

Central Banking speaks to Eyal Rozen, Ramūnas Baravykas and Wanpracha Chaovalitwongse about whether there is a need to change underlying infrastructure to bolster data-driven policy-making

Atlanta Fed creates new mortgage tool to track forbearance

Dashboard will provide policy-makers with data on which regions are using forbearance in response to Covid-19

Hernández de Cos on ECB policy, crises responses and Basel reform

Spanish governor and Basel Committee chair Pablo Hernández de Cos favours a form of average inflation targeting, says ECB is willing to boost stimulus and Basel reforms not diminished by Covid-19 exceptions; stresses the need for structural reform and…

Whither the age of ‘magic money’?

EME central banks are more exposed to changes in geopolitics, climate, demography, technology and inflation at a time when monetary theory is running well behind central bank practice

Few central banks forecast policy rates

Economics Benchmarks 2020 highlights wide variation in variables forecast by central banks

Monetary unions in the making in Africa

EAC, Ecowas and SADC can adopt practical steps learned from EMU to prepare for their own currency unions

Otmar Issing on the art of central bank communications

EMU architect speaks about Draghi’s “whatever it takes” intervention, forward guidance failures, the Fed’s average inflation target ‘miscommunication’, and why the ECB may be overreaching in its strategy review

Monetary-fiscal policy co-operation and the ‘slippery slope’

Barry Eichengreen assesses the risks central banks face from their closer links to fiscal policy

Olli Rehn on AIT, market neutrality and EU fiscal policies

The Bank of Finland governor talks about the ECB’s strategy review, market failure on climate change, lessons from the sovereign debt crisis, and the Draghi legacy effect on Covid-19 responses