Governor of the year: Alejandro Díaz de León

Díaz de León has upheld the integrity and independence of Banxico against significant pressures

The leadership skills of most central bank governors were tested to the full in 2020 as they implemented emergency actions aimed at preventing financial and economic meltdown as the Covid-19 pandemic hit. The health crisis also caused severe logistical and operational challenges as central banks scrambled to implement a range of policies to support their economies. The task was harder for governors in countries that entered the crisis with weakened economic fundamentals – more difficult still in countries where crisis responses fell more heavily on the central bank versus the fiscal authorities.

By any benchmark, Alejandro Díaz de León displayed exceptional leadership skills during the past year. The Bank of Mexico (Banxico) governor had to implement prudent monetary policy loosening at a time when the peso was under pressure and the central bank managed a disproportionately heavy load in terms of Covid-19 economic crisis responses. At the same time, he had to defuse several attempts to restrict the independence of the Bank of Mexico – now one of the most trusted institutions in the emerging markets. All the while, Díaz de León continued to improve the capacity, transparency and functioning of the central bank, for example, by developing a new instant payments system, for the benefit of Mexicans.

Pandemic problems

Prior to the arrival of Covid-19, the Bank of Mexico had to deal with an economic downturn with limited fiscal support from the country’s government. In 2019, Mexico suffered a mild recession, with its GDP declining by 0.05% over the year, according to World Bank estimates.

In November that year, the International Monetary Fund granted the Mexican authorities a flexible credit line worth around $61 billion. Past fiscal discipline and central bank capacity building under the successful governorships of Agustín Carstens (2010 to 2017) and Guillermo Ortiz (1998 to 2009) had helped to secure Mexico’s reputation for economic discipline. In 2020, the IMF’s review of the arrangement found that the Mexican authorities had maintained “a track record of sound policy management”.

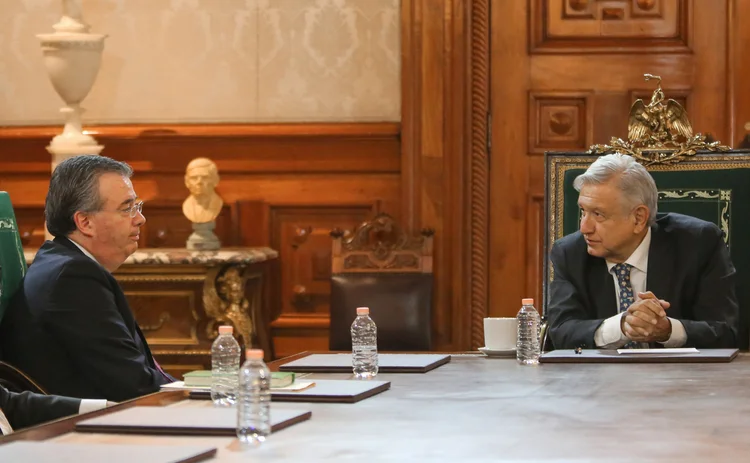

Yet, as the Covid-19 virus spread in the early months of 2020, Mexico did not follow the numerous other governments that made huge fiscal injections to support their economies as lockdowns were imposed in a bid to reduce the number of coronavirus infections. Mexico’s populist, leftist president, Andrés Manuel López Obrador, opposed any large fiscal expansion, due to a deep-rooted fear that such a move could result in Mexico having to depend on the IMF.

“The commitment is to get out of this crisis without indebting Mexico,” the president told a press conference on April 16.

[Díaz de León] struck the right balance in monetary policy management: ambitious, but cautious at the same time, carrying most of the burden of Mexico’s economic recovery

Agustín Carstens, Bank for International Settlements

History will judge whether López Obrador’s refusal to embark on a major fiscal programme was the right one. But there is no doubt his decision had important consequences for the Bank of Mexico. The central bank was left as almost the only economic agency responding to the country’s economic downturn – even though its options for easing were limited, given that it could trigger further portfolio outflows from the country.

The Bank of Mexico’s five-member monetary policy board, chaired by Díaz de León, responded to the arrival of the Covid-19 virus by cutting policy rates, and introducing extraordinary measures to bolster liquidity and strengthen credit-provision channels. And on March 19, the central bank agreed a bilateral dollar swap line with the US Federal Reserve. The central bank cut its policy rate by 3 percentage points between March and September to 4.25% – still a relatively high rate. It then paused the easing cycle for five months.

“He struck the right balance in monetary policy management: ambitious, but cautious at the same time, carrying most of the burden of Mexico’s economic recovery,” says Carstens, now general manager at the Bank for International Settlements.

“This in the face of an extremely difficult external and internal scenario, Covid-19 being the main source of instability.”

Carstens’ predecessor, Ortiz – now senior adviser and board member at BTG Pactual – agrees: “He has been cautious because there is a risk premium in Mexican assets. This is the reason interest rates have not come down faster in Mexico. Díaz de León has handled this brilliantly, in my opinion.”

Resisting political pressure

One key theme in Díaz de León’s tenure has been his need to navigate and negotiate Mexico’s difficult political environment. López Obrador won Mexico’s presidential election in late 2018, just as Díaz de León was completing his first year as governor. The president has pursued an idiosyncratic economic policy, which has complicated the task of the central bank.

In April 2020, López Obrador requested the Bank of Mexico bring forward its transfer to the government of the profits from its international reserve portfolio. Díaz de León issued a rare, polite but firm, statement rebuffing the president. The governor stressed “the importance of observing the procedure and timing” of annual transfers to the government. Instead of complying with López Obrador’s wishes, the central bank transferred the profits at the legally prescribed time. Because of the peso regaining much of the value it had lost earlier in the year, the transfer at the end of the year was much lower than the amount it would have been, had the transfer taken place when requested by López Obrador.

Fake news?

Then, on August 26, López Obrador appeared to accuse Díaz de León of having authorised a controversial loan made by Bancomext, the export-import bank. He said the central bank governor ran Bancomext when it financed a controversial loan by national oil company Pemex.

Media outlets and politicians have alleged the loan, approved in October 2015, was used to pay over the odds to buy a fertiliser plan – charges the oil company has denied. Mexico’s president was effectively accusing his central bank governor in public of having been involved in an allegedly corrupt transaction.

One key theme in Díaz de León’s tenure has been his need to navigate and negotiate Mexico’s difficult political environment

The next day, Díaz de León told a press conference that the loan had been approved one month before he joined Bancomext as its chief executive: “Those are things that were approved by the Bancomext governing body prior to my arrival at that institution.”

The governor added politely that he was grateful for the chance to clarify what had happened. His account was accepted by Mexican politicians and media.

Several highly respected Mexican officials spoke out in defence of Díaz de León’s integrity at the time. Gerardo Esquivel, a Bank of Mexico deputy governor appointed by López Obrador, said Díaz had provided a “very important clarification”.

Gerardo Rodríguez, a former deputy finance minister, wrote on Twitter that in all of Mexico, one could not find a more honourable official than the current governor of the central bank. Referring to the president’s attack on the central bank governor, Rodríguez said that what had transpired was “incredible”.

US dollar deposits

Then, in December, another major disagreement between the government and the central bank came into the open – this time, potentially opening the way to legal changes in the operations of the central bank. Lawmakers in Mexico’s upper chamber, led by López Obrador’s National Regeneration Movement, called for the introduction of a controversial new draft law.

The draft law concerned US dollars physically deposited in Mexican banks, which the lenders could not return abroad. If the law passed, it would compel the central bank to buy the dollars and add them to its international reserves. It would also establish a mechanism for other amendments to be made to the central bank law. The proposal appears to have originated from Banco Azteca owner Ricardo Salinas Pliego, a long-time friend of López Obrador and member of his business advisory council. Those in favour of the law claim that many migrant Mexicans returning home with US dollars receive a punishing rate of exchange when cashing them in for local currency. But research indicates approximately 99% of foreign cash remitted to Mexico is made electronically.

The Bank of Mexico took the rare step of issuing a public statement that strongly criticised the proposed legislation. It warned that the money had a high risk of being associated with illicit activity, and was likely to be treated as such by US authorities. The draft law could mean that the central bank’s reserve portfolio would be treated by international authorities as partly comprising laundered money, it warned. Foreign or international authorities could well impose restrictions on dealing with the Bank of Mexico as a result, the statement said. The draft law would also force it to take actions that would reduce the performance of its foreign currency portfolio.

Díaz de León’s response firmly stated the problems of the draft law, but, once more, he avoided a public war of words with the president. There were soon signs that this approach was working. López Obrador initially said that the arguments against the draft law were exaggerated.

But, on December 31, his government’s finance minister, Arturo Herrera Gutiérrez, publicly criticised the measure: “This change would only transfer the problem commercial banks have to the central bank because the central bank would have the same problem: how to export dollars.”

On January 20, 2021, president López Obrador publicly conceded that the draft law needed revision, using an argument that had been strongly made by the central bank. He said that the Bank of Mexico had to safeguard financial stability. Any tension between Mexico and foreign or international financial authorities “must be avoided”, he told a press conference. Lawmakers needed to find a new way to deal with any problems in converting dollars to pesos, he said.

On February 10, the Bank of Mexico, the finance ministry and the country’s banking association presented a joint plan to do so. Both Mexican migrants in the US and their families in Mexico will be able to open accounts with the Banco del Bienestar, a bank owned by the finance ministry. The plan almost certainly took considerable behind-the-scenes work by the central bank and other agencies. If accepted, it should negate the risks raised by the original draft law.

More importantly, it appears to have closed the door on other potential amendments to the law covering the operating framework of the central bank.

Salary freeze

The importance of central bank autonomy was highlighted during another important episode where Díaz de León stood firm against the president. It occurred after López Obrador, who cut his own salary when he took office, sought to limit salaries of many government staff, including those at the Bank of Mexico. This was legally questionable, as the Mexican central bank is defined in law as an autonomous institution – not only for its policies, but also in its internal management. Díaz de León took the matter to the courts. Ultimately, the Supreme Court ruled in favour of the Bank of Mexico, and the salary cuts did not take place because they were deemed unconstitutional.

[Díaz de León] has defended Banxico’s staff remuneration, which was essential, given that staff is the main asset of the bank

Agustín Carstens, Bank for International Settlements

“He has defended Banxico’s staff remuneration, which was essential, given that staff is the main asset of the bank,” says Carstens.

Indeed, the morale of central bank staff seems to be high, observers say, even though many of them could have attractive options in the private sector.

Improved communications

Díaz de León has also introduced notable changes in other fields. He has increased the level of transparency practised by the central bank. Under his leadership, the Bank of Mexico now publishes its inflation reports, which are introduced by the governor. It has also started publishing all speeches by its officials, and its statements have become clearer and more succinct. Many statements are also published in both Spanish and English on the same day. The central bank has also improved its website.

The Bank of Mexico continues to develop its strong reserve management and currency management capabilities, as well as its Cobro Digital national digital instant payments platform that allows users to transact with mobile devices, harnessing Mexico’s real-time gross settlement payments system.

Many of these capacity-building efforts are included in a newly redesigned strategic work report that details achievements the central bank is making across seven core areas, as well as its objectives for the following year. The redesigned report explains the impact of central bank activities on the economy, the financial system and, ultimately, Mexican society, with some of the content published on Twitter, Facebook and Instagram. The aim is to further strengthen the link between society and the central bank.

Institutional strength

In 2021, the Bank of Mexico once more began cutting its overnight interbank interest rates again, by 25 basis points to 4%, by unanimous vote at its first meeting on February. It was the first meeting when the majority of its board had been appointed by López Obrador – Galia Borja Gómez joined as a deputy governor.

But the institutional strength of the Bank of Mexico and weight of responsibility on its representatives means policy decisions in the future may well remain focused on best fulfilling the mandate of the central bank. The two other deputy governors appointed by López Obrador appear to have fully embraced the spirit of autonomy of the central bank, likely, in part, due to the leadership of Díaz de León. The net result is that the credibility of the Bank of Mexico has been enhanced.

But the damage caused to the Mexican economy by Covid-19 is far from over. In September 2020, the Bank of Mexico published three possible scenarios for GDP growth in 2021, with an upper limit of 5.3%, a lower limit of 0.6% and a baseline figure of 3.3%. In other words, all predict an economy well below its 2019 level by the end of 2021.

Despite the challenges, Díaz de León has improved the Bank of Mexico’s operations in several respects during the past year. He has led the central bank to address an extraordinarily severe and rapid economic downturn with limited fiscal support from the country’s government. He has had to face down a series of attempts – deliberate or otherwise – by Mexico’s president to lessen the central bank’s autonomy. He has responded to these attempts with firm statements of principle, a refusal to be cowed, and a willingness to seek practical solutions to problems. It is not yet clear how matters will end, but under Díaz de León’s leadership, the Bank of Mexico appears only to have reinforced its autonomy.

The Central Banking Awards were written by Christopher Jeffery, Daniel Hinge, Dan Hardie, Rachael King, Victor Mendez-Barreira, William Towning and Alice Shen

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: http://subscriptions.centralbanking.com/subscribe

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com