Debt

New macroeconomic framework needed for recovery – Ghana governor

Public debt levels have breached maximum thresholds and NPLs are likely to climb, Addison says

Debt-service ratio limits have greatest welfare benefit – BoE research

Authors find macro-prudential tools can also boost the transmission of monetary policy

The changing data landscape: Part 1

Central Banking speaks to Eyal Rozen, Ramūnas Baravykas and Wanpracha Chaovalitwongse about whether there is a need to change underlying infrastructure to bolster data-driven policy-making

Atlanta Fed creates new mortgage tool to track forbearance

Dashboard will provide policy-makers with data on which regions are using forbearance in response to Covid-19

Hernández de Cos on ECB policy, crises responses and Basel reform

Spanish governor and Basel Committee chair Pablo Hernández de Cos favours a form of average inflation targeting, says ECB is willing to boost stimulus and Basel reforms not diminished by Covid-19 exceptions; stresses the need for structural reform and…

Whither the age of ‘magic money’?

EME central banks are more exposed to changes in geopolitics, climate, demography, technology and inflation at a time when monetary theory is running well behind central bank practice

Few central banks forecast policy rates

Economics Benchmarks 2020 highlights wide variation in variables forecast by central banks

Monetary unions in the making in Africa

EAC, Ecowas and SADC can adopt practical steps learned from EMU to prepare for their own currency unions

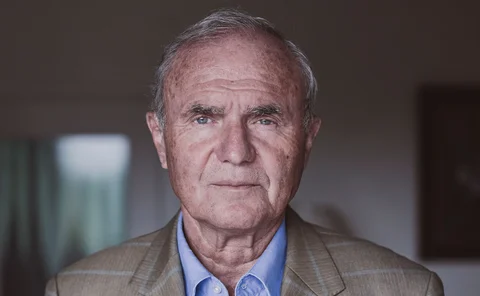

Otmar Issing on the art of central bank communications

EMU architect speaks about Draghi’s “whatever it takes” intervention, forward guidance failures, the Fed’s average inflation target ‘miscommunication’, and why the ECB may be overreaching in its strategy review

Monetary-fiscal policy co-operation and the ‘slippery slope’

Barry Eichengreen assesses the risks central banks face from their closer links to fiscal policy

Olli Rehn on AIT, market neutrality and EU fiscal policies

The Bank of Finland governor talks about the ECB’s strategy review, market failure on climate change, lessons from the sovereign debt crisis, and the Draghi legacy effect on Covid-19 responses

G20 agrees ‘common framework’ on debt relief

Leaders welcome decision, but criticise private sector for failure to act

Is there a path between the Covid abyss and chasm of financial risk?

Macro-prudential policies are being used to prevent economies from falling into the Covid abyss while also ensuring that a correction in ever-higher asset prices do not crush the economy. Are both objectives achievable?

The ultimate store of value

Róbert Rékási, head of foreign exchange reserves management at the Central Bank of Hungary, speaks to Central Banking’s Victor Mendez-Barreira about how Covid-19 has changed gold investment trends

Zambia MPC holds rates despite stability concerns

New governor notes a cut to interest rates would have been “expected”

PBoC makes $122 billion injection as default fears rise

Chinese central bank makes year’s largest market injection days after large power firm defaults

Zambia prepares for debt default

Talks on payment freeze fail as G20 prepares to debate further debt relief

Baltic central banks aim for joint commercial paper market

Estonian, Latvian and Lithuanian central banks to work with EBRD on creating short-term debt market

Sri Lanka central bank sees signs of ‘strong recovery’

Signs of bounce-back in the economy but recent surge in virus cases could cause problems

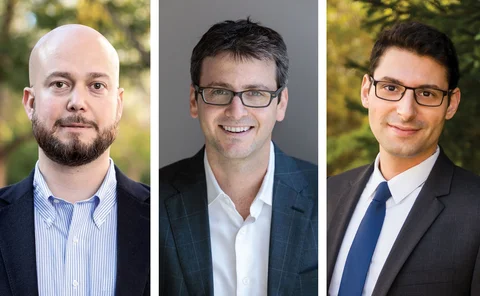

Maggiori, Neiman and Schreger on capital flows and Covid-19

The Global Capital Allocation Project sheds light on where vulnerabilities may lie

Georgia’s Gvenetadze on implementing an aggressive reform agenda

The National Bank of Georgia governor speaks about efforts to improve monetary policy, financial infrastructure, financial literacy, transparency and ESG

Canadian opposition says central bank ‘must not become government ATM’

Bank of Canada to end some emergency financing programmes as lawmaker calls more QE “insane”

Frank Smets on the ECB’s strategy review

The ECB’s DG of economics explains how expectations, communication, fiscal dominance, climate change and the Fed’s actions will be factored into the ECB’s delayed strategy review

G20 delays decision on poor countries’ debt relief

International efforts have been “unambitious, unco-ordinated and uneven” – prominent economists