Collateral

LCH platform to provide risk calculations for margin hub

SwapAgent will send standardised sensitivities for bilateral trades to AcadiaSoft to make IM calls

FSB: ‘no immediate case’ for aligning rehypothecation rules

No pressing need to harmonise rules, but better monitoring of global collateral reuse will give regulators a clearer understanding, FSB says

ECB will stay in asset markets - Draghi

Asset purchases will continue, but at a lower monthly rate; ECB to accept cash as collateral in securities lending programme

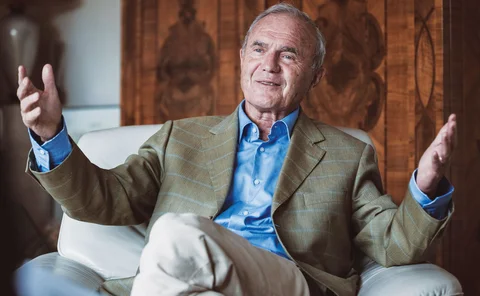

Euro architect says ECB has ‘destroyed’ market discipline in Europe

Otmar Issing, the man who designed the operational framework for the euro, says failures by European politicians and the ECB mean “all the elements” are in place to bring “disaster” to the monetary union

IMF’s Singh urges central banks to beware of collateral impact of policy

Senior economist says asset purchase programmes have drained quality collateral from the system, damaging the economy’s “financial plumbing”

RBI’s Mundra hopes to boost credit to small businesses

Deputy governor outlines “ABCD” of issues affecting small businesses’ ability to access credit, including better access to information and new forms of collateral

BoE researchers outline risk of collateral collapse

In stress periods, collateral chains could break, paper in forthcoming Journal of Financial Market Infrastructure warns

Network analysis sheds light on systemic risk – BoE paper

Pilot study of derivatives markets makes use of CDS data to map network of interlinkages, finding more than just immediate counterparty ties matter for systemic risk

ECB paper considers impact of loss in collateral value

Research examines how a loss in value will impact the wider economy by studying the effects of a legal reform in Sweden in 2004; sees potential for ‘negative consequences’

Paper models impact of ECB’s collateral policy

A working paper offers a model of the impact of the ECB’s collateral policy on the eurozone between 2009 and 2011; effects smoothed transmission of monetary policy, researchers argue

FSB looks to gauge risks around collateral reuse

Reusing collateral brings various benefits, but could also pose stability risks, report says; FSB outlines options for measures that could give supervisors a clearer picture of reuse patterns

Jamaica will require banks to have recovery plans to access emergency liquidity

Banks must provide recovery plans under new emergency liquidity facility, Jamaican bank governor says

Riksbank floats new collateral limits

Swedish central bank looks to limit the amount of covered bonds pledged as collateral for intraday credit; assessment suggests limited impact on banks

Central banks should prepare to deal with sharp drops in liquidity, IMF says

Policy-makers need to take action to halt rising risks relating to liquidity, IMF says; central banks may be able to use collateral policies to deal with crises

RBA paper finds distribution matters when assessing impact of wealth effects

Example of car buying highlights how different households adjust consumption in response to housing wealth effects, although channels remain unclear

China CLO market stutters on economic slowdown

Regulator's move to increase liquidity and a rise in NPLs have slowed China structured credit market

Dutch bulletin: T2S can only succeed if ‘many’ CSDs sign up

The Netherlands Bank's latest bulletin highlights the importance of more CSDs in Europe signing up to the Target2-Securities platform since the initial migration in June

Reform of Sterling Monetary Framework is ‘ongoing’, says BoE’s Salmon

Executive director for markets highlights potential for sharia-compliant facilities to be included in framework, among host of possible future developments

Regulators sound warning on collateral squeeze

Report calls on regulators to fix 'structural and regulatory limitations' around collateral

ECB paper flags risk of ‘collateral damage’ from financial transaction tax

Working paper finds an increase in transaction costs, such as the financial transaction tax mooted in the EU, could impact the availability of collateral and damage market liquidity

Collateral impact from eurozone QE still unclear, says Euroclear’s Evenepoel

Effect of new liquidity regulations and eurozone quantitative easing on collateral is still uncertain, but the market is ‘always creative’, according to Euroclear’s head of treasury

Eurozone moving towards ‘single market for collateral’, say central bankers

Panellists from Belgian, French and Dutch central banks discuss moves towards harmonised collateral markets in Europe at conference in Brussels

Repo market coping with liquidity regulations for now, panellists say

Participants at Euroclear’s Collateral Conference say repo markets have delivered new efficiency gains to keep collateral supply up, but the outlook over the coming year looks less certain

BIS committee urges central banks to consider collateral policies ahead of time

Central banks should be aware of the effects of their policies on collateral markets, and use this knowledge to prepare in advance for crises, CGFS report finds