Collateral

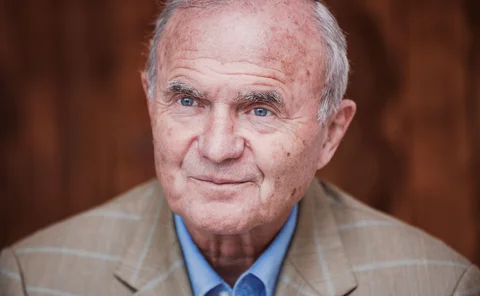

Lifetime achievement award: Otmar Issing

The architect of the euro’s monetary operating framework is still playing an important role in shaping the debate on monetary policy

Collateral management services: National Bank of Georgia/Montran

The duo developed Georgia’s fully automated new collateral framework

Treasury systems initiative: Calypso Technology

The tech company secured important breakthroughs including with its Maps treasury operations system

Paper takes ‘Hank’ approach to eurozone policy transmission

Authors identify three key dimensions of household heterogeneity

Will the Fed pass its year-end funding test?

An unprecedented rate spike in September prompted the Fed to inject billions into funding markets. But will its efforts be enough to foil year-end pressures? Could opening the standing repo facility to foreign central banks help?

Bank of Canada plans new emergency liquidity facility

Facility designed in response to new threats, such as cyber and extreme weather events

King calls for radical shake-up to escape ‘low-growth trap’

Central bank models fail to appreciate demand-side secular stagnation; IMF could help to drive country-specific policies to reallocate resources

Big tech: a threat to banks?

The explosive growth of financial services offered by big tech companies in China offers important lessons

Seven threats from big tech’s libra

Can central banks avoid a ‘big tech’ monetary meltdown?

Banque de France research takes fresh look at eurozone interbank markets

Secured interbank markets not bounded by ECB’s deposit facility rate, results show

BoE paper explores collateral’s impact on labour market

Collateral value affects hiring decisions by small businesses, authors find

BIS’s Borio warns of ‘troubling’ negative yields

BIS quarterly review highlights new peaks in negative-yielding debt and examines CLO risks

30 years of central banking

Central banks face credibility tests on a number of fronts

Norges Bank lays out plans for collateral management during resolution

Liquidity assistance in a resolution will “never” be a long-term solution, Torbjørn Hægeland says

Asset bubbles play role in macro-prudential policy – IMF research

Their size may determine optimal tax levels to address credit imbalances

Canadian collateral can withstand crisis-level systemic risk – BoC paper

Trading by bank customers could be a potential indicator of future crisis, researcher says

Finding the right partners with the right solutions

Over the past decade, the financial crisis, globalisation and technological changes have driven uncertainty and brought about drastic changes for central banks. Vermeg‘s Yamen Bousrih explores the importance of having a consolidated, coherent and…

IBM wins contract to support Canadian RTGS overhaul

Canada is preparing to replace its unusual high-value payment system with a new generation

Capital requirements impact collateral demands – BoE paper

Higher capital requirements can make banks demand more collateral, authors find

Risk management technology: Vermeg

Having successfully delivered the collateral management module of its Megara system to four major central banks, Vermeg has won a high-profile tender to deliver the technology for the Eurosystem Collateral Management System

The PBoC’s efforts to solve the ‘impossible trinity’

Chinese central bank intervenes to manage offshore renminbi rate; uses swaps, rather than selling reserves in latest currency interventions

BoE issues warning over global leveraged loan market

Scale, growth and lending standards similar to pre-crisis subprime lending, BoE reports

Information can substitute for collateral, BoE paper finds

Strong lending relationships can insulate a firm during booms and busts

Central banks could do more to tackle climate change – paper

Central banks may be mispricing assets due to climate change risk, paper argues