Single supervisory mechanism (SSM)

Nouy: Europe’s bankers need courage for cross-border mergers

Bankers have “turned inwards” in the face of difficulties, says ECB supervisor

ECB wants ESAs to focus on ‘European dimension’

The central bank says supervisors should be reshaped to better promote European interests; it recommends greater powers and a governance shake-up

Dombret defends SSM as a ‘supervisory framework’

Bundesbank board member acknowledges there are issues, including communication, with the SSM and suggests targeting language barriers to reduce “home bias”

ECB sets out standards for bank board members

New guidelines are an effort to harmonise standards across eurozone states

ECB issues final guidance on NPLs

Supervisors are writing to larger eurozone banks with high NPL levels

Angeloni cautions over Commission’s SREP proposal

ECB regulator also welcomes EC’s Pillar 2 capital suggestion

ECB gives green light to Italian recapitalisation law

ECB raises no objection to decree but other obstacles may remain

Czech Republic closer to euro adoption but still not ready – CNB

Economy is converging with Europe but costly accession to single supervisory mechanism means country is not ready to begin formal process, CNB says

Auditors’ report notes staffing and governance issues at ECB arm

National supervisors provide insufficient staff for inspection teams, report says

ECB's bank watchdog warned on NPL clean-up drive

SSM may need clearer enforcement process to boost bad loan provisioning, says regulator

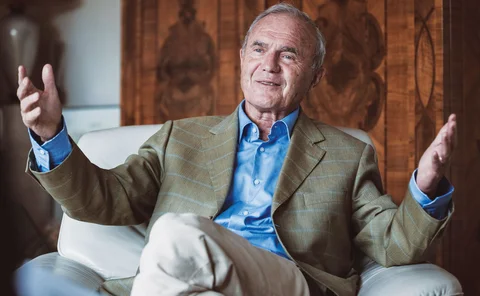

Euro architect says ECB has ‘destroyed’ market discipline in Europe

Otmar Issing, the man who designed the operational framework for the euro, says failures by European politicians and the ECB mean “all the elements” are in place to bring “disaster” to the monetary union

Regulations gave eurozone banks incentives to downplay credit risks, paper argues

Bank of Slovenia paper analyses whether banks correctly assessed corporate borrowers’ creditworthiness before the financial crisis, and what incentives they faced

EBA says European banking supervision practices are converging but some areas lag

European banking supervisors achieved considerable cross-border convergence in some areas in 2015, but other fields retain differences, EBA report says

Nouy sees need for rethink of reporting systems

Danièle Nouy says new thinking is needed to help banks and supervisors deal with a ‘paradigm shift’ in data collection; European reporting framework for all banks should be considered

Italian banking system sees first major test of European bail-in regime

Leaked letter from ECB triggers sell-off in major Italian commercial bank; European and Italian authorities still fail to reach agreement on resolving NPL problems

SSM challenges eurozone banks to improve governance

Supervisor warns most significant banks in eurozone fall short of international best practices; presents lessons from assessment of management bodies and risk appetite frameworks

Nouy renews calls for Pillar 2 'guidance'

European supervisors should employ "capital guidance", Danièle Nouy says; large eurozone banks currently disadvantaged compared with competitors, ECB's supervisory head argues

Lautenschläger floats idea of two-tier capital regulation for eurozone banks

Capital positions for large eurozone banks could be split into "requirement" and "guidance" levels, Sabine Lautenschläger says

ECB to conduct comprehensive assessment of four more banks

European Central Bank is assessing four banks it may come to directly supervise; supervision fees charged to European banks set to rise over 45% in 2016

Ingves raises fundamental questions about central banking

Riksbank governor sets out questions around monetary policy and macro-prudential framework in Sweden, raising the prospect of a merger with the FSA and joining the SSM

European Central Bank outlines three models underpinning macro-prudential analysis

First biannual macro-prudential bulletin lays out details of three key models, dealing with capital requirements, household finances and bank vulnerabilities

Low profitability and NPLs remain top of the eurozone supervisory agenda

European Central Bank presents annual report for supervision, with major concerns including profitability and non-performing loans; supervisors are working closely with the single resolution board

European supervisors must improve consistency on capital requirements, Angeloni says

European regulators must take more consistent approach to capital requirements, Ignazio Angeloni says; authorities have to improve macro-prudential policy co-ordination

‘Substantial drawbacks’ remain in European supervisory colleges’ work, EBA says

European supervisory colleges still have ‘substantial’ drawbacks in key aspects of their work, despite making improvements in 2015, the European Banking Authority says