Productivity

The ‘golden age’ of central banking has passed

Central banks face multi-faceted challenges and weakened autonomy amid highly polarised inflation expectations

Spanish governor favours green monetary policy

Hernández de Cos stresses ECB should account for climate risks in its price stability mandate

A return of the inflation monster?

There are fears that a shift in intellectual approach towards running economies ‘hot’ could herald a return of the money-eating inflation era

Central banks take less than 50 minutes to fix critical outages

Time tolerances for critical system downtime range from one to 32 hours

Lifetime achievement: Charles Goodhart

The LSE and BoE veteran economist has his own ‘law’, and played a key role in the establishment of monetary policy in the UK, Hong Kong’s peg and the ‘New Zealand model’, which influenced a generation of central bankers

The Covid crisis, central banks and the future

Crisis responses have had positive initial outcomes, but also exacerbated significant underlying challenges that raise concerns related to exit strategies and the future for central banks

European central bankers see room for fiscal-monetary co-operation

Pandemic showed it was “critical” for both policies to work together, say central bank governors

NBER paper seeks lessons for home working in Industrial Revolution

Move to remote working could be undermined by organisational problems, authors warn

Covid-19 likely harms productivity – BoE paper

Private sector could lose 5% of its productivity in Q4 this year, authors estimate

Whither the age of ‘magic money’?

EME central banks are more exposed to changes in geopolitics, climate, demography, technology and inflation at a time when monetary theory is running well behind central bank practice

Haldane explores long-term consequences of home working

Welfare impact seems broadly positive, but it is uneven and may not last, says BoE chief economist

BoE officials fear long-term ‘scarring’ as uncertainty hits record high

MPC members broadly gloomy on the outlook, but there is “huge” uncertainty, says Andrew Bailey

BIS paper studies lifecycle of zombie companies

Number of zombie firms has risen substantially, and their future prospects are not good, authors say

James Bullard on the Fed’s policy review, FSOC and forecasting jobs data

St Louis Fed president discusses his support for average inflation targeting, his concerns about US Treasuries market function, non-bank regulatory weakness and negative rates, as well as the unexpected success in using Homebase data to predict highly…

BoE partners with QA Media to benchmark software investments

Central bank aims to improve own software development processes, and those in the banking sector

Should the BoE go negative?

Much research into negative rates suggests central banks should have little to fear, but there are plenty of caveats

Campos Neto on reforming Brazil’s economy amid Covid-19 distress

The Central Bank of Brazil governor speaks about how Brazil is managing fallout from the coronavirus pandemic, the benefit of large reserves, his plans to deploy emergency asset purchases and why he favours extending the IMF’s SDR funding

The ECB, the lockdown and the monetary financing lock

The eurozone’s central bank may need to break its prohibition on monetary financing to fight the pandemic

Fed set to adopt ‘elements’ of price-level targeting

Covid-19 could act as a catalyst for a Janet Yellen-supported Fed move to adopt elements of price-level targeting. But questions remain about the timing of such a move

Can growth in developing Asia be made more sustainable?

The structure of the global economy will be reshaped by Covid-19, and what happens in Asia will be crucial, writes Philip Turner

Trump’s NAFTA replacement could harm car production – Dallas Fed research

Authors say Mexico could face biggest loss from USMCA deal

IMF projects deepest recession since Great Depression

Global growth could contract by between -3% and -6% this year, a combined loss of output of $9 trillion for 2020 and 2021

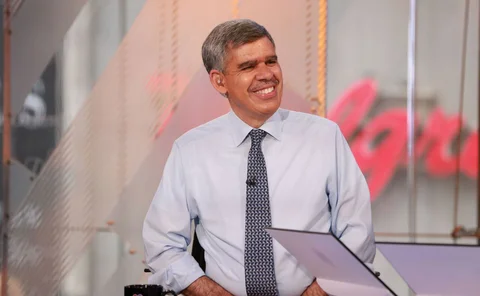

El-Erian on Covid-19 policy risks, ‘zombie’ markets and central bank capture

Former Pimco chief says Fed move into high yield is a step too far, new rules needed on leverage and false liquidity, and narrow window emerges for central banks to shed some of their policy load

Transfer season

Trade frictions with the US have caused a mass industrial transfer to China’s neighbours. Zhou Chengjun, IFF Academic Committee member and inspector of the Macro‑prudential Policy Bureau of the People’s Bank of China, says that shouldn’t stop China…