Gold Standard

Debts, deficits, central banks and inflation

Forrest Capie and Geoffrey Wood ask what insights history can provide for central banks and governments managing abrupt, large increases in debt

Shelton gets little respite in Fed nomination hearing

Lawmakers unimpressed by her previous remarks and poor attendance record at EBRD meetings

How might Shelton and Waller reshape the Fed?

The Fed board nominees face Senate hearings later this week

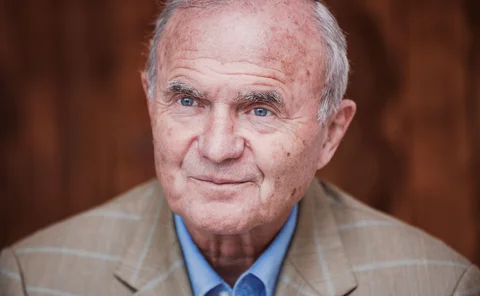

Lifetime achievement award: Otmar Issing

The architect of the euro’s monetary operating framework is still playing an important role in shaping the debate on monetary policy

Central banks face loss of independence – Central Banking survey

A new survey of Central Banking’s Editorial Advisory Board points to central banks facing existential challenges with little change in their frameworks or toolkits

The IMF should adopt a ‘real SDR’

The creation of a vibrant market in SDR linked to commodity prices could create a powerful new monetary anchor, argues Warren Coats

Trump nominates two candidates for Fed board

Judy Shelton and St Louis Fed’s Christopher Waller will now face Senate confirmation hearing

Potential Fed nominee wants changes to interest rate policy

IOER hurts private sector entrepreneurialism and gives banks wrong incentive, Judy Shelton says

Judy Shelton could be Trump’s next Fed pick

Shelton, like Trump’s two previous picks, is a gold standard advocate

Trump plans to nominate second loyalist to Fed board

Herman Cain has strongly supported a return to gold standard in the past

Book notes: Keeping at it, by Paul Volcker with Christine Harper

Volcker, a man who has made history, delivers a fascinating memoir, providing insights into the key lessons learned during his decades of public service, writes Jean-Claude Trichet

Book notes: Till Time’s Last Sand, by David Kynaston

Kynaston allows readers to develop their own understanding of how the BoE has had to refind its place in a country where the political system has migrated from commercial republic to full-franchise democracy

Book notes: American default, by Sebastian Edwards

Edwards’ book is fascinating, well written and enjoyable, and provides an account of one of the US’s forgotten chapters of history

Is the pursuit of a common accounting standard for monetary gold a fool’s errand?

More consistent accounting for monetary gold could address transparency concerns and help smaller emerging economies to achieve greater independence by clarifying treasury transfers

New risks and opportunities

Central Banking convened a panel of experts to discuss how central banks and other authorities are making use of new risk-based assessment techniques to remain ahead of the fintech curve.

Measuring Venezuela’s hyperinflation

Steve Hanke discusses how economists can make use of high-frequency exchange rate data to track rapid price movements in Venezuela

Economists are misinterpreting ‘Triffin dilemma’, says BIS paper

Michael Bordo and Robert McCauley argue there was nothing certain about the collapse of Bretton Woods, but Triffin’s successful prediction led others to mistakenly reapply his theory

Alan Greenspan says gold standard would have reined in debt

Former Fed chair says US would not be so indebted if it was on the gold standard; gold is the “primary global currency”, Greenspan says

Balance sheet policy matters for credibility – Norges Bank paper

Researcher argues a central bank’s financial strength may affect its ability to meet its monetary policy mandate, based on evidence from the UK’s gold standard period

Book notes: The Dollar Trap, by Eswar S Prasad

A lively and compelling analysis on currency wars in the wake of the financial crisis – and the likely persistence of the US dollar as the world’s pre-eminent currency

Currency peg speculation can 'damage' balance sheets

Researchers find that questions over the credibility of a currency peg can have ‘damaging effects’ on bank balance sheets – consistent with monetary mismatch theory

‘Striking similarities' between eurozone and the pre-1914 gold standard

Both monetary arrangements provide underdeveloped peripheral countries with easy access to capital from the core countries, triggering asset price booms via the banking system in peripheral countries

Book notes: The Money Trap

Robert Pringle’s new book is driven by a sense of missionary zeal

The end of a monetary phenomenon

A gold-backed currency is the only viable alternative to failing fiat money, argues Kevin Dowd.