Data

Initiative of the year: RBNZ’s Financial Strength Dashboard

The Reserve Bank of New Zealand’s Financial Strength Dashboard offers a window into the nation’s banking system

UK lawmakers demand fix for RPI miscalculation

House of Lords says Statistics Authority’s failure to fix error has left many members of public poorer

Google’s data tool has potential for countries with data gaps – IMF research

Authors explore how search queries can be used to track human behaviour, which could be used to map macroeconomic indicators

Angola improves data transparency with new hub

Statistics deemed “critical” by the International Monetary Fund will be published in one place

Fed to expand market data collection efforts

The scope and availability of data must keep up with evolving markets, Lael Brainard says

Bank of England to overhaul consumer interest rate statistics

Changes are designed to ensure the statistics reflect consumers’ experiences “as closely as possible”

FCA survey reveals significant increase in tech failures

Cyber incidents represented 18% of incidents reported to the FCA in year to October, despite firms appearing confident with current systems and processes

Interview: Clair Mills on the meaning of fintech

The Bank of England’s head of change and data management discusses why fintech is so important for a financial sector going into uncharted territory

Bank of Canada steps up financial stability research efforts

Economy faces risks from in-household debt, housing and cyber attacks, senior policy adviser says

ECB paper examines banks’ responses to unconventional policy

Weaker banks’ sheets reduce credit supply in response to conventional policy shocks, paper finds

Bank of Canada to weigh up alternatives to inflation targeting

Central bank will hold “full horse race” between nominal GDP targeting and other alternatives, Wilkins says

PRA using AI to understand connectivity of rulebook

UK regulator is using Google search engine algorithm to see if rulebook can be streamlined, says BoE’s Proudman

Atlanta Fed launches new rental market data tool

The affordability tracker sheds a new light on how many households in the region are struggling to find affordable housing

US banking system responding well to post-crisis reforms, says Fed

Banking system shows healthy rebound despite supervision uncovering weaknesses, the Fed reports

MAS chief laments ‘data localisation’

Misguided notions of data security threaten digital growth, says Menon; central bank further strengthens fintech support

RBNZ launches review into collapsed insurer

CBL Insurance to be liquidated after failing to assemble rescue plan

Fed proposes further regulatory loosening for small firms

Governor Lael Brainard voted against the last proposed reductions in regulation

BoE paper proposes nowcast method for GDP revisions

Dynamic factor model reveals information on how early estimates may be revised, authors say

Bank of Canada publishes 30 years of staff forecasts

Online database “further step” in transparency efforts, deputy governor Wilkins says

BIS committee finds inadequacies in derivatives data

Challenges remain, despite significant progress, Irving Fisher Committee reports

Agent-based models: a new frontier for macroeconomics?

Agent-based modelling is opening up new possibilities for economics, but the discipline is still struggling to move from the sidelines to the mainstream

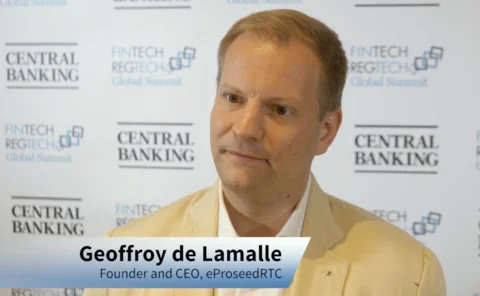

Video Q&A: Geoffroy de Lamalle, eProseedRTC

Central Banking spoke to Geoffroy de Lamalle, founder and chief executive at eProseedRTC, at the FinTech and RegTech Global Summit in Singapore

Swift calls for standard API methodology

Open banking ecosystem will only succeed if standard-setters create universal method for API specifications, payment provider says

Canada’s Sabean on tackling a data governance overhaul

The Bank of Canada has been making “significant investments” in data, says senior director