European Central Bank (ECB)

Visco hits out at lack of ‘cohesion’ among Europe’s political leaders

ECB governing council member calls for targeted structural reforms in the euro area; says a euro area finance minister must have fiscal capability and not be “another referee”

Praet calls for further consolidation of eurozone banking

The ECB's chief economist says falling bank profits are not a concern for monetary policy and sector must improve business models while the central bank gives “regulatory clarity”

The data deluge

Big data can help economists overcome weak theories and improve our knowledge, but it also comes with with larger pitfalls

Constâncio rejects higher inflation targets and instrument rules

Higher targets would not re-anchor inflation expectations, ECB vice-president says

ECB says draft Croatian law could harm central bank independence

Proposals would give state auditor “undefined powers” over central bank, ECB says

Last stand for central bank independence?

Political attacks on Janet Yellen and Mark Carney appear to be just the start of a sustained assault on central bank independence. It’s a battle the central bankers may lose

Weighting models by performance is better than taking simple averages, researchers say

Weighting models by performance is better than taking simple averages, researchers say

Cœuré sets out sovereign debt reform ideas as Weidmann strengthens call to end QE

Two senior eurozone central bankers set out different visions for radical change to the handling of European sovereign debt

ECB paper assesses influence of international linkages on length and severity of recession

Credit growth combined with other vulnerabilities is important, authors argue

ECB’s economic bulletin paints mixed picture of eurozone investment

Business investment recovering overall but several factors may limit further growth, ECB says

More research needed on exchange rate pass-through, ECB article says

Research on effects of different shocks on inflation “still in an incipient phase”

Draghi and Mersch seek to calm German fears

The ECB’s task will be harder if Germans feel discriminated against, Mersch says; Draghi points to evidence that QE helped German savers

AnaCredit: banking with (pretty) big data

The supranational credit database in Europe will help policy-makers and banks assess cross-border risk when it goes live in 2018, writes Aurel Schubert, director-general of the European Central Bank’s statistics department

ECB issues latest macro-prudential bulletin

Papers look at second order effects of financial shock, de-risking and high-frequency trades

ECB's bank watchdog warned on NPL clean-up drive

SSM may need clearer enforcement process to boost bad loan provisioning, says regulator

Draghi postpones decision on extension of QE

ECB president is aiming to build governing council support for further asset purchases, one analyst argues

Output gap in euro area is much larger than official estimates – paper

Official estimates predict output gap 3–4% less negative than author’s results; current models do not “adequately capture” inflation developments

ECB’s Mersch: central banks have failed to correctly assess growth potential

Central banks were “over-reliant on pro-cyclical forecasts” before the financial crisis, ECB board member says; repeats call for fiscal stimulus and structural reform

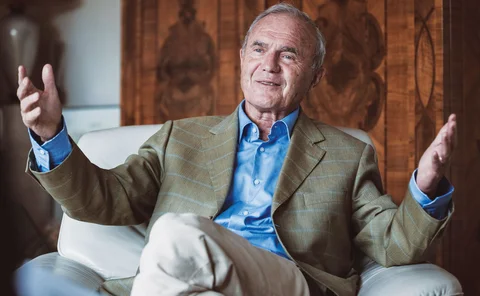

No ‘insidious’ German plan for EMU competitive advantage, says Issing

Otmar Issing says Germany didn't even have 'the economic intelligence' to design such a plan; country suffered years of high unemployment as others such as Italy failed to capitalise on price stability

Otmar Issing on why the euro ‘house of cards’ is set to collapse

Euro architect tells Chris Jeffery that muddling from one crisis to another cannot go on endlessly. Politicians need to admit “there is no likelihood” of political union to give EMU rules a chance

Euro architect says ECB has ‘destroyed’ market discipline in Europe

Otmar Issing, the man who designed the operational framework for the euro, says failures by European politicians and the ECB mean “all the elements” are in place to bring “disaster” to the monetary union

Greater role for capital markets would not necessarily harm policy transmission – ECB’s Praet

A ‘range of common factors’ is affecting both banks and non-banks, ECB chief economist says

Targets key tool in reducing NPL levels, Irish deputy governor says

Banks can be unwilling to start sustainable NPL restructuring, Donnery says; repeats call for reform of European restructuring processes

‘Moral suasion’ and yield-seeking intensified sovereign debt crisis – ECB paper

Researchers use information on 226 eurozone banks; publicly owned, recently bailed-out and less strongly capitalised banks engaged increased sovereign bond holdings during crisis