Central Banking Newsdesk

Follow Central Banking

Articles by Central Banking Newsdesk

Route ahead unclear for Italian banks

At least one bank faces major loan book problems; European law may present difficulties with recapitalisation and “bad banks”

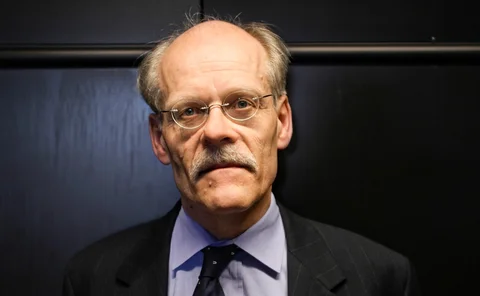

Ingves: internal modelling may create too much complexity

Basel Committee chair says complexity created by internal modelling has a range of adverse effects, though more research is needed

Tajik central bank launches consumer protection push

Plan could create stability and growth if it is successful, but resource constraints are a challenge, National Bank of Tajikistan says

BoE unveils database of macro-prudential policies

Researchers attempt to classify the myriad forms of macro-prudential policy, compiling panel data on when policies were tightened and loosened in different countries

Singapore fines two foreign banks for 1MDB-related breaches

Investigations continuing into Goldman Sachs’ role, the regulator says

French paper presents macro-prudential early warning system

Authors advocate aggregating results of larger number of models

Fed ‘well positioned’ to regulate fintech firms – Brainard

Tech mantra of “run fast and break things” is not well suited to financial services, Fed governor says, although the central bank does not want to stifle innovation either

Norges Bank recommends higher equity share for oil fund

Declining global growth and lower volatility suggest a larger equity share is both desirable and manageable, central bank says

Carstens to succeed Caruana at BIS

Bank of Mexico governor will step down in 2017 to take on top job at the Bank for International Settlements

Finnish paper rethinks transmission of financial shocks

Researcher’s model uses search and matching approach

ECB publishes latest eurozone trade and investment guide

“Bop and IIP book“ explains compilation of national and eurozone figures

Ukrainian central bank proposes abolition of forex restrictions

The central bank’s multi-stage plan includes a draft law, despite political disputes

Rate pass-through 'weaker and slower' in Mongolia – paper

Reforms at the Bank of Mongolia have improved the transmission mechanism, authors say, but there is plenty more work to do

Deal on output floors and op risk approach likely – Ingves

Revised standardised approach to credit risk will be “capital neutral” and more compatible with IRB

Eurozone must urgently raise productivity, Draghi warns

ECB policy provides governments with "window of opportunity" for reform, ECB president says

Unreported assets worth $6–7 trillion, Italian researchers say

“Areas of opacity” remain, despite recent anti-evasion initiatives, authors say; paper estimates the global levels of personal tax evasion and undeclared assets held overseas

New Zealand central bank asks for more macro-prudential powers

Capital’s housing prices "among the highest in the world", report says; heightened debt levels among farmers leave sector "vulnerable to future shocks"

Austrian central bank gives award to two young economists

Papers study responses to shocks in structural funds and effects of trade on business cycle

People: Tobias Adrian to replace Viñals at IMF

New York Fed economist to take over IMF’s monetary and capital markets department; Malaysia appoints new financial stability board; vice-chair picked for FinCoNet

‘Significant’ housing market risks in eight EU states – ESRB

UK outlook “highly uncertain”, while regulatory mandate in Sweden is “not clear”

BoE’s Vlieghe dismisses neo-Fisherian idea that low rates cause low inflation

MPC member says “small minority” of academics who suggest lower rates may cause low inflation do not present particularly compelling arguments

Praet calls for European ‘fiscal backstop’ and deposit insurance scheme

Limited banking union leaves Europe more open to country-specific shocks, ECB economist says

Cœuré spells out ECB’s stance on Greek reforms

The Greek government must reform the legal process and status of banks, senior ECB figure says

Banks have still not fixed ‘poisonous mix’ of problems – BIS’s Borio

Claudio Borio warns that in some respects, banks have still not solved the problems revealed by the 2008 crisis, which leaves them vulnerable