Global imbalances

Third of businesses think investment has been ‘too low’ – BoE survey

Bank of England publishes results of survey of UK firms in latest quarterly bulletin; businesses experienced both real economy and financial “obstacles” to investment

Current account imbalances need to be addressed, Furusawa says

IMF deputy says imbalances in current accounts could increase volatility in the global economy; development of a safety net could reduce the need to accumulate reserves

BoE paper calls for international standards on 'broader co-ordination'

Credit growth in the rest of the world has a large positive effect on the probability of domestic banking crises

IMF to tackle effects of globalisation in 2017

Fund says it will focus on bringing the benefits of globalisation and technology to a wider section of society, amid a populist backlash against openness

Inflation expectations more sensitive near the zero lower bound – IMF study

IMF study examines whether monetary policy can boost inflation in constrained environment; countries near zero lower bound could see inflation respond more to shocks

Mervyn King on Brexit, crisis supervision, economic rebalancing and reforming the IMF

The former Bank of England governor discusses Brexit, radical regulatory reform, the difficulties rebalancing the European and global economies and an overhaul of the International Monetary Fund

The growing role of China in an interconnected world

With global economic health ever more reliant on Chinese growth, Wang Yan, deputy director of the IFF Institute, looks at how structural reforms can help China take a leading role in the future

BoE economists map current account dangers across OECD

Treating the current account as equivalent to the balance of trade could blind economists to the risks posed by large deficits, say Kristin Forbes, Ida Hjortsoe and Tsvetelina Nenova

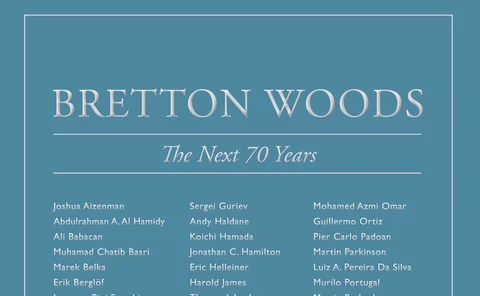

Book notes: Bretton Woods: the next 70 years

The Bretton Woods Committee has assembled a large number of distinguished authors for this volume, but ultimately the book ends up long on problems and short on solutions

Rajan and Mishra lay down rules of the monetary game

Authors warn current models may display the policy biases of those who built them, calling for better dialogue and analysis of monetary policy spillovers

US monetary policy contraction means drop in global output – paper

Raising interest rates in the US leads to lower global output and inflation in the short term; most 'pronounced' responses evident in the mid-1990s to mid-2000s

BIS’s Borio says current account obsession obscures important results

Focus on current account imbalances obscures many important – and often counterintuitive – results about global financial flows

Carney says BoE can stay independent in face of globalisation

BoE governor says global factors ‘influence but do not dictate’ policy in speech at Jackson Hole; other economists argue central banks should do more to set policy with global dynamics in mind

Global imbalances still on the rise, IMF paper shows

Though efforts have been made to cut current account imbalances since the financial crisis, ‘stock imbalances' continue to grow, find Milesi-Ferretti and Lane

IMF warns monetary tightening could hit EM growth

Advanced economies should collaborate with emerging markets, Fund says, to mitigate spillover effects of monetary tightening; says global imbalances remain too high

Broadbent says credible policy blunts current account deficit threat

UK current account deficit is historically large but is not threatening growth, new Bank of England deputy says, thanks in part to macroeconomic policy framework

SNB chair shrugs off critique of Swiss exchange rate ceiling

Thomas Jordan says Swiss franc peg prompted by 'safe haven' status is neither at odds with long-standing current account surplus nor undermining adjustment of global financial imbalances

‘Surplus' countries must act to help limit external imbalances, says BIS paper

BIS economist Philip Turner says external imbalances can threaten financial stability in creditor countries as well as in debtor countries; calls it ‘an important but unresolved issue of international monetary reform'

BIS’s Cecchetti discusses financial globalisation

Stephen Cecchetti considers whether financial systems can grow too big and assesses how far countries should go in outsourcing financial services

IMF paper analyses savings and investment response to shocks

IMF researchers study response of savings and investment to income shocks; find high volatility of permanent shocks creates “volatility trap”

Lagarde offers views on globalisation

Christine Lagarde discusses global connections and the future; takes feminist line in speech to graduating students

Choongsoo warns of lurching global crisis

Bank of Korea governor Choongsoo Kim says world risks another crisis if global imbalances are not addressed

The fractured global monetary system

Robert Pringle reflects on the 40th anniversary of Bretton Woods