Data

Central banks play key role in sourcing and sharing data

Institutions gather data from many sources and most share it with external researchers

FCA details Mifid onshoring process post-Brexit

UK regulator has built equivalent systems to ensure firms can continue with Mifid reporting

Climate change on the agenda for most economics departments

Central banks explore a wide range of topics, with some differences between advanced economies and EMEs

Few central banks collaborate with private-sector researchers

Collaborations are common with academia, especially in advanced economies

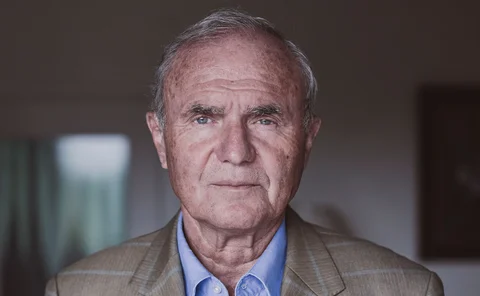

Otmar Issing on the art of central bank communications

EMU architect speaks about Draghi’s “whatever it takes” intervention, forward guidance failures, the Fed’s average inflation target ‘miscommunication’, and why the ECB may be overreaching in its strategy review

Agent-based models remain rare among economics departments

Economics Benchmarks 2020 highlights the varied applications of different model types at central banks

Forecast errors marginally higher for growth than inflation

Data shows contrast between advanced and emerging economies

Sri Lanka’s central bank picks SimCorp to manage reserves

Platform will handle both internally and externally managed funds

Semi-structural models are the forecast weapon of choice

Flexible modelling approach comes out on top; around half of central banks include a financial sector

FCA starts to move firms’ data to new platform

UK regulator says RegData platform is faster and more accessible than previous system

EBA wants Basel to revisit prudential rules on software

Banking regulator set to soften capital impact of IT assets, but proposals are still out of line with US

MAS encourages digital reporting through new grant

Firms can claim up to S$250,000 to implement new technology but only from pre-approved firms

BoE will not use climate stress tests to set capital buffers – Bailey

Andrew Bailey reveals new details of tests, with launch set for summer of 2021

Currency Benchmarks 2020 report – the data behind the cash cycle

Perspectives on staffing, circulation, forecasting, fraud, substrate choice, outsourcing and climate risk

Book notes: Austerity, by Alberto Alesina, Carlo Favero and Francesco Giavazzi

When it works and when it doesn’t; every chapter is thorough, informative and persuasive

Fed eases terms on emergency facility as uncertainty rises

High-frequency indicators suggest US recovery is slowing amid resurgence of virus cases

Fed paper presents model of Covid-19 trade-offs

Data-driven model implies lockdown can work if a vaccine can be developed quickly enough

The winners of the 2020 FinTech and RegTech Global Awards

Central banks and their partners have innovated across machine learning, cloud services, payments and more

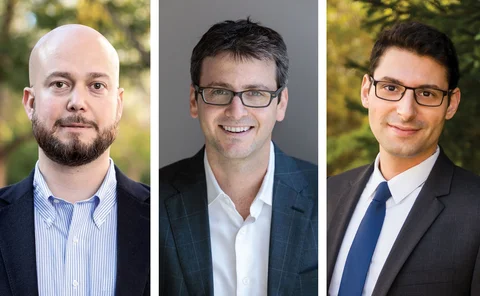

Maggiori, Neiman and Schreger on capital flows and Covid-19

The Global Capital Allocation Project sheds light on where vulnerabilities may lie

Georgia’s Gvenetadze on implementing an aggressive reform agenda

The National Bank of Georgia governor speaks about efforts to improve monetary policy, financial infrastructure, financial literacy, transparency and ESG

RBNZ warns of cyber risk from cloud

Draft guidelines would mandate firms to notify RBNZ over outsourcing critical functions to cloud

BIS tracks $1.1 trillion drop in cross-border claims

Lending surged and then fell back as banks reallocated funds during the Covid-19 crisis

Malaysia’s central bank to launch climate taxonomy in 2021

Information asymmetry among financial firms is hampering green lending, assistant governor says

Only 25% of central banks operate own printworks

Larger central banks from high income countries are more likely to print notes in-house