Regulation

Accounting overstates banks’ health: IMF paper

International Monetary Fund research finds banks not as healthy as their balance sheets suggest

Honohan clashes with Dublin on bankers’ pay

New central bank governor suggests government’s attempts to limit pay will hinder recovery of Ireland’s banks

UAE gives go-ahead for Basel II

Central Bank of the United Arab Emirates says it will begin implementing capital adequacy standards

IIF’s Abed: financial stability a central bank task

Institute of International Finance’s George Abed says the crisis casts the role of central banks in a new light

What living wills should do: Bank’s Bailey

Andrew Bailey, the Bank of England’s head of banking services, explains the form and objectives of recovery and resolution plans

Buba’s Weber: Germany finance held its own

Bundesbank’s Axel Weber says Germany’s financial sector coped well with the crisis overall

Regulation “not rocket science”: FSA retail markets head

The head of the British regulator’s retail markets division outlines changes made since the crisis; pushes for income verification and affordability checks

UK regulator to be allowed to “tear up” bankers’ contracts

Britain’s financial regulator will have its powers increased, allowing it to punish errant banks and bankers for excessive risk-taking

Bank’s Tucker details root-and-branch reform proposals

Bank of England’s Paul Tucker outlines reforms necessary to curb systemic risk build-up

Spain’s Ordóñez plays down dynamic provisioning

Bank of Spain’s governor modest on much-vaunted regulatory tool

Fed bans ATM, debit-card overdraft fees

Federal Reserve says banks will no longer be able to charge overdraft fees for ATM and debit-card payments

BuBa’s Weber: no global regulator without global law

Bundesbank’s Axel Weber says global financial regulator not a good idea as international law not in place

Italy’s Draghi welcomes Islamic finance

Bank of Italy’s Mario Draghi says sharing information crucial to the smooth integration of Islamic finance

Separating the casino from the retail bank will not work

A division between investment and retail banking will not prevent future financial crises, Clive Briault, the founder of Risk and Regulation Consulting and a former managing director at the Financial Services Authority, argues

Senator calls for Fed’s powers to be cut

Chris Dodd, head of the Senate Banking Committee, submits bill demanding reduction in Fed’s supervisory ambit; calls for one overall regulator

Multilaterals define systemic importance

Report suggests an initial framework that can be adapted by individual countries

Fed’s Tarullo warns against another Glass-Steagall

Fed governor Daniel Tarullo says split between investment and commercial banking would do little to abate too-big-to-fail problem

Morocco to cap reform with price target

Governor tells CentralBanking.com that Bank Al-Maghrib is preparing to adopt inflation target

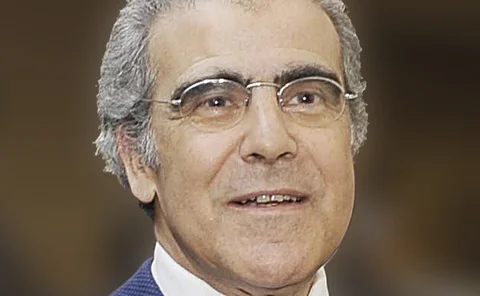

Interview with Abdellatif Jouahri

The governor of Bank Al-Maghrib talks to CentralBanking.com about the success of the country’s financial reform efforts

Social contract needs a revamp

Bank of England’s Andrew Haldane finds that social contract between banks and the state needs to revised

RBA’s Lowe: approaches to financial stability vary

Reserve Bank of Australia’s Philip Lowe says there is no one-size-fits-all approach to financial resilience

Financial regulation needs unorthodoxy – Gopinath

Reserve Bank of India’s Shyamala Gopinath says financial regulatory framework needs to move away from orthodoxy

Pillar 3 crucial for bank safety

Bank of Finland examines the combined effect of the Pillar 1 minimum capital requirements and Pillar 3 disclosure requirements of Basel II on bank safety

Interview: Heng Swee Keat

In an exclusive interview, the managing director of the Monetary Authority of Singapore discusses the impact of the financial crisis and how monetary and regulatory policies will change as a result