United States

US exporters hit by Trump’s import tariffs – Fed paper

Firms making 80% of US exports affected by tariffs on input goods, researchers find

Shelton gets little respite in Fed nomination hearing

Lawmakers unimpressed by her previous remarks and poor attendance record at EBRD meetings

Fed could postpone stress buffer beyond CCAR – experts

Delays prompt speculation that the new rules will only be known after the stress-test results in June

US is still an attractive FDI destination – Fed paper

FDI slowdown in 2017–18 due to corporate restructuring and reversing debt flows, researcher argues

UK's FCA dismisses Libor credit component concerns

Regulator bemused by distress raised by US regional banks to Fed

Fed open to more than one Libor replacement – Powell

Lawmaker voices concerns that current replacement rate lacks credit sensitivity

Stress test capital buffer ‘on track’ for 2020 testing – Powell

Plans were floated nearly 22 months ago, but Fed yet to offer final rule

MAS to allow financial data transfer to US

Data-sharing agreement could see personal data shared across borders, as data localisation inhibits supervisory processes

Yield curve models overstate chances of US recession – ECB research

Models need to account for effects of QE asset purchases on bond premia, authors say

Fed forecasters now less optimistic on growth – San Fran Fed paper

Forecasters have eliminated “overoptimism” bias in recent years, researchers find

How might Shelton and Waller reshape the Fed?

The Fed board nominees face Senate hearings later this week

Fed to stress-test banks’ leveraged loan exposures

Test features leveraged loan shock; scenario includes biggest-ever rise in unemployment

Coronavirus is new risk to US outlook – Fed report

Virus risks disruption in China spilling over to the global economy, the Fed says

Fed’s Quarles warns big balance sheet could harm credibility

Fed official proposes tweaks to discount window and G-Sib surcharges to improve monetary framework

US must review payments system oversight, Brainard says

Big tech’s currency plans could mean payments oversight is further weakened – senior Fed official

Fed’s repo tapering plans hit snag

Banks demand double what was on offer at Fed’s first reduced repo offering

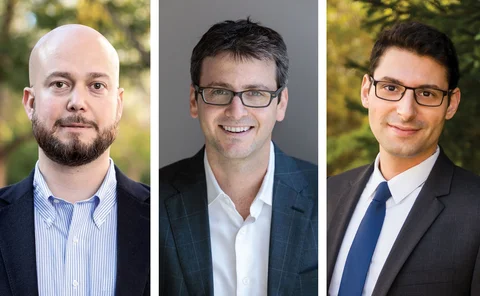

Economics in central banking: Matteo Maggiori, Brent Neiman and Jesse Schreger

The Global Capital Allocation Project has helped pick apart the tangled network of cross-border capital flows. The work may prove essential to those looking to shore up the international monetary system

US regulators propose third Volcker rule revision

Banks could soon regain permission to invest in speculative funds, but one official dissents

Rising US rates can be ‘good news’ for EMEs – Fed paper

Researchers examine difference in spillovers from growth- and inflation-driven rate increases

Custody initiative: Euroclear

The securities depository has debuted instant dollar settlement in central bank money outside the US – a service that has virtually eliminated settlement risk

Innovation in reserve management: BlackRock

The US asset manager has made great strides in its technology, research and advisory capabilities, allowing clients to implement ESG while preserving financial returns

US leveraged lending rose further from 2018–19

Regulators urge banks to adopt risk-management measures to reflect changing market conditions

Fed will ‘probably’ join green central banking group – Powell

Public has right to expect the Fed to ensure the system is resilient against climate change, says governor

US Democrats strongly criticise regulator

Some lawmakers accuse OCC head Otting of ignoring Congress over controversial lending proposals