United States

Federal Reserve joins NGFS

Seven other organisations join as Trump defeat frees Fed to join green network

Quarles: Fed’s supervision should evolve

Fed vice-chair says supervision has not been adequately scrutinised in the past

New Isda ‘fallbacks’ critical to making Libor transition a ‘non-event’

New protocol and supplement offer a transition away from Libor rates in 2021, despite CFTC saying 2,400 companies still exposed and Fed extending some US libor contracts until mid-2023

People: New deputies named in China and Mexico

Plus ECB appoints senior supervisors, and Donald Trump tries to install new OCC chief

The dawn of average inflation targeting

The Fed has failed to explain how it will calculate the ‘average’ for its new AIT framework, raising new risks that central bankers would do well to reflect on

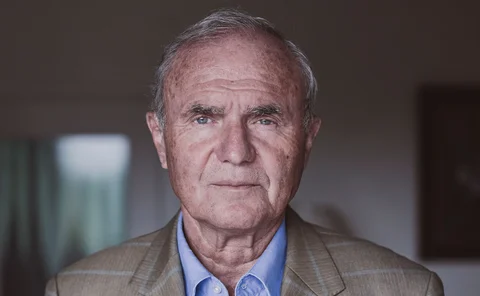

Otmar Issing on the art of central bank communications

EMU architect speaks about Draghi’s “whatever it takes” intervention, forward guidance failures, the Fed’s average inflation target ‘miscommunication’, and why the ECB may be overreaching in its strategy review

Christopher Waller narrowly passes Senate vote

St Louis Fed economist approved for Fed governor role, despite opposition from Democrats

Monetary-fiscal policy co-operation and the ‘slippery slope’

Barry Eichengreen assesses the risks central banks face from their closer links to fiscal policy

Olli Rehn on AIT, market neutrality and EU fiscal policies

The Bank of Finland governor talks about the ECB’s strategy review, market failure on climate change, lessons from the sovereign debt crisis, and the Draghi legacy effect on Covid-19 responses

Green firms see equities rise as climate concerns grow – NBB paper

Researchers track relationship between media coverage and large firms’ equity values

Biden to nominate Janet Yellen as Treasury secretary

Former Fed chair would become first person to have led central bank, Treasury, and Council of Economic Advisers

Is there a path between the Covid abyss and chasm of financial risk?

Macro-prudential policies are being used to prevent economies from falling into the Covid abyss while also ensuring that a correction in ever-higher asset prices do not crush the economy. Are both objectives achievable?

Fed and US Treasury in public dispute over emergency aid

Fed disagrees with Treasury secretary over proposal to end five stimulus programmes

Brainard criticises Fed’s diversity efforts

Lack of diversity is holding back the economics profession, says senior Fed official

US Senate rejects Shelton for Fed job

Republicans fail to muster enough support for controversial candidate, but second vote is possible

Public policy lines blur: implications for reserve managers

Crisis-fighting has pushed central banks into new forms of risk-taking, and this is now spilling into reserve management, says Jennifer Johnson-Calari

Trump nominee Shelton moving closer to Senate vote

Observers say Murkowski’s statement removes one potential barrier to Shelton being approved

Powell, Lagarde and Bailey express caution on CBDCs

Jay Powell says Fed must get any future CBDC right, rather than “being the first”

Regulatory frameworks should apply to activities not institutions – Mester

Cleveland Fed president says policy-makers must increase co-operation and co-ordination on fintech

Fed examines climate risks in stability report for first time

It is “vitally important” that climate risks are “assessed and addressed”, says Lael Brainard

Fed holds rates as US recovery falters

Powell calls for fiscal stimulus and says further Covid-19 wave is hitting poor hardest

BIS paper warns economies may stagnate after Covid-19

Author models the structural changes brought about by the coronavirus pandemic

Book notes: Austerity, by Alberto Alesina, Carlo Favero and Francesco Giavazzi

When it works and when it doesn’t; every chapter is thorough, informative and persuasive

Fed eases terms on emergency facility as uncertainty rises

High-frequency indicators suggest US recovery is slowing amid resurgence of virus cases