International

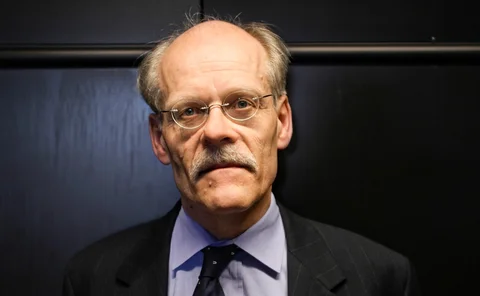

People: Bank of Finland to select new governor

Finnish governor Liikanen finishes final term in July; Seychelles reappoints governor and deputies; South Africa sets up foreign exchange committee; Atlanta Fed’s vice-president retires

FSB: cryptocurrencies too small to be major threat

Limited links to real economy imply crypto assets may avoid regulatory crackdown for now; work continues on consumer protection

Populism challenges central banking independence, Bruegel says

Brussels-based think-tank gathers various works on the matter; overdue debates on inflation targeting could open

Stock imbalances can stabilise or destabilise – BIS paper

Asymmetry implies burden of adjustment tends to fall on deficit countries

Bank of Israel profits from rising equities – market operations director

Andrew Abir says Israeli central bank has benefited from rising US equities

BIS’s da Silva defends DSGE modelling efforts

The models have not performed as badly as critics claim and new research efforts are creating fresh possibilities, says BIS’s deputy general manager

Central bank digital currencies could aid policy transmission – BIS

BIS says CBDC may boost transmission of rate changes, but could also lead to runs at “unprecedented speed and scale”

BIS research finds ‘scant evidence’ of shift away from cash

Rise of electronic payments is not reflected in falling demand for cash

MMFs lower risky investments in low-rate environment – paper

After a 1% rate cut, money market funds decrease risky investments by 25 percentage points

Return of volatility helps shatter market illusions – BIS’s Borio

Quarterly review focuses on recent market gyrations; researchers outline new early warning indicators for financial stress

Neural network learns ‘universal model’ for stock-price moves

Relationships between order flow and price “are stable through time, and across stocks and sectors”

Standard setters welcome effort to halt correspondent banking decline

Efforts to standardise data gathering aim to cut cost of correspondent banking, as latest FSB figures show further decline

Low rates likely to persist in global economy, Riksbank’s Ingves says

Inflationary pressures remain weak, governor says; economic growth is a prerequisite for higher price pressures

Measuring Venezuela’s hyperinflation

Steve Hanke discusses how economists can make use of high-frequency exchange rate data to track rapid price movements in Venezuela

Sovereign debt more ‘enforceable’ – ECB paper

Results show creditors have used courts to “pressure” foreign governments, resulting in restricted access to capital markets

Book notes: How global currencies work, by Barry Eichengreen, Arnaud Mehl and Livia Chiţu

A comprehensive introduction to the history of global reserve currencies, with analysis of how advances in technology and the structure of trade have reshaped the landscape

Remembering Charles Freeland

Charles Freeland, former deputy secretary-general of the Basel Committee and friend of Central Banking, died in 2017

ECB orders Latvia to close bank accused of money laundering

Latvian finance minister says 12 further banks in country may be at risk from money laundering

People: Slovakia appoints new deputy governor

Iceland reappoints MPC member; FDIC names new director of minority and women inclusion, and more

Researchers develop new index to measure geopolitical risk

Heightened threats slow growth and equities returns in advanced economies, paper finds

The winners of the 2018 Central Banking Awards

Bank of Canada wins Central Bank of the Year, Lesetja Kganyago picks up Governor of the Year and Perng Fai-nan receives Lifetime Achievement Award; 16 more awards unveiled

IMF stresses communication’s role in fostering stability

Neglecting its importance can lead to adverse reactions, such as misinterpretation of policies

Fed paper examines financial spillovers of US monetary policy

Authors find that conventional and unconventional policies create different spillover effects

Authorities need to deal with ‘limitations’ of global standards

The BIS’s Fernando Restoy says global standards do not cover all possible risks, and national supervisors need to fill in the gaps