International

Payments Benchmarks 2021 report – executive summary

Insights into staffing, mandates, oversight and RTGS management

Governance Benchmarks 2021 – presentation

Central Banking’s governance subject matter specialist Dan Hardie speaks with Christopher Jeffery about policy committees, governor salaries and terms, and board compositions and functions

BIS to throw open doors for 90th anniversary

Delayed celebration will invite public to multimedia exhibition in main tower

Central banks can improve reserves handling – World Bank

Direct board involvement, trading office setups and finance ministries all matter, report finds

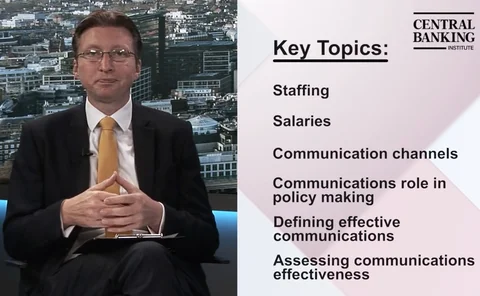

Communications Benchmarks 2021 – presentation

Central Banking’s communications subject matter specialist Daniel Hinge speaks with Christopher Jeffery about communications staffing and salaries, effective approaches and favoured channels

Book notes: How boards work, by Dambisa Moyo

Moyo offers insights into the skills required to be a valued board director, as well as a thought-provoking list of issues that may appear with greater frequency on future board agendas

Some philosophical questions about the future of central banking

Kenneth Rogoff weighs up the many challenges facing central banks in the years ahead, from debt and inflation to negative rates and the dangers of ‘mission creep’

Majority of central banks use corridors to set market rates

A handful use floors due to unconventional policy, and some use other methods

Is the ECB’s strategy review enough?

The reformed framework may allow greater stimulus to tackle weak inflation expectations, but the Governing Council is already divided on what to do next

BIS and HKMA start work on green bond infrastructure project

Digital platform based on blockchain aims to improve green bond market’s transparency

Fixing market-based finance: duct tape or deep reform?

Central banks are increasingly having to act as market-makers of last resort. But deeper reforms may be needed to avoid stretching their balance sheets to breaking point

Less chance of “taper tantrum” in emerging markets – Dallas Fed paper

Emerging markets have larger dollar reserves to meet financing disruptions

The renminbi’s rise to prominence: focus report 2021

Central Banking explores the impact the addition of the renminbi to the SDR basket has had on internationalising the Chinese currency; central bank reserve managers share their views on including the renminbi in their portfolios; and we take a look at…

How we can improve gender diversity in economics

Mary Suiter and Oksana Leukhina say gender diversity in economics must be championed

Green finance and mispricing: what role for central banks and governments?

Governments and central banks cannot stay on the sidelines if they are to fix market mispricing, says Sayuri Shirai

Digital revolution: perks of a global Chinese CBDC

Chinese central bank digital currency has the potential to boost the renminbi’s internationalisation further, but only if international investors have access.

SNB research highlights trade-offs in use of capital controls

Financial stability benefits come at cost of curbing job creation, authors find

Systemic banks shrink balance sheets at reporting dates – BIS paper

Authors find “systematic” balance sheet compression often results in lower capital requirements

Real-time payment systems for the real world

ACI Worldwide has joined forces with Mastercard to create a unique partnership capable of leading the world towards advancing the on-demand economy through payment system modernisation.

Global economy faces ‘decisive moment’ – IMF’s Gaspar and Gopinath

Policy-makers have “window of opportunity” to help those falling behind in Covid-19 recovery

Viruses of a different kind: bolstering central bank IT frameworks

Remote working on a large scale had never been done before, but central banks appear to have successfully adapted IT and cyber frameworks

OECD flags early signs of ‘moderating’ growth

Slowdown is widespread in advanced economies, but emerging markets see greater divergence

An assessment of the ECB’s strategy review

A number of aspects of the new framework raise challenges for implementation and credibility, while the inclusion of climate change may politicise the institution, writes euro architect Otmar Issing

BIS paper highlights ‘ripple effect’ of monetary policy

Balance sheets of upstream and downstream firms “salient, yet mostly overlooked”, authors say