France

Gontareva on Ukraine’s funding, NBU policy and reconstruction

Former NBU governor Valeria Gontareva speaks about donor funding shortfalls, NBU policy and financial stability challenges, Nabuillina and the seizing of Russian assets, and post-conflict rebuilding and modernisation

How central bank mistakes after 2019 led to inflation

Central banks must acknowledge their own mistakes and outline concrete steps to restore the public’s confidence in their ability to ensure price stability, write Graeme Wheeler and Bryce Wilkinson*

DNB fines Binance for ‘grave’ regulatory breach

Netherlands sanctions exchange over failure to register, but other regulators are more welcoming

The Central Banking Awards 2022 virtual ceremony

View the trophy presentations and acceptance comments from the winners of the ninth annual Central Banking Awards

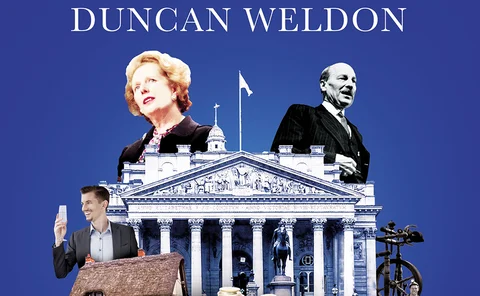

Book notes: Two hundred years of muddling through, by Duncan Weldon

Insights into UK economic history offer lessons for today’s policy-makers

Small drop in US CPI hints at inflation reprieve

Economists estimate US is past inflation peak, but other G7 nations may still be on the upward leg

Tech talent: a global bottleneck for central banks?

Central banks are struggling to recruit people with the right fintech expertise. The search for talent may also create new ethical challenges in managing links to industry

ECB supervision and the state of the eurozone’s banks

ECB banking supervision has passed the first stage of the Covid-19 test. But many challenges remain, including banks’ internal governance and data processing, excessive leveraged lending in some segments, and a lack of progress towards a more competitive…

Central Banking Awards 2022: first winners unveiled

Governor of the year, Risk manager, two Green initiative awards and more announced today

Green initiative – regulatory: Banque de France and ACPR

The French central bank and prudential regulator created an innovative stress-test methodology

Change at the Bundesbank: from Weidmann to Nagel?

Joachim Nagel’s appointment highlights the importance of politics at the apex of German central banking. Veteran central bank watcher Klaus C Engelen looks at the media reaction and asks if Buba/ECB discord is set to continue

Benoît Cœuré to lead French competition authority

BIS Innovation Hub chief and former ECB executive set to return to Paris

Joint CBDC project highlights promise of interoperability

Banque de France, HSBC and IBM find different technologies can still work together

Trade credit helped amplify initial Covid-19 shock – BdF paper

Net borrowers of trade credit faced sharper liquidity squeeze, researchers find

Project Jura executes ‘real-life’ cross-border CBDC settlement

“Dual-notary” structure could help protect monetary sovereignty, says Benoît Cœuré

Tackling surging inflation

Central banks around the world are grappling with rapid price rises, with some taking very different routes to one another

Advanced economies more likely to outsource counterfeit detection

Emerging market economies more likely to outsource distribution

Group tests bond settlement on French CBDC platform

Euroclear says CBDC-driven system can plug into existing market infrastructure

Third parties often develop RTGS technology

Seventy-one percent of respondents said the technology underpinning their RTGS system was developed solely by a third party or in collaboration with the central bank

France and Tunisia carry out cross-border CBDC transfer

Latest BdF experiment sees central banks make wire transfer using wholesale CBDC

Three ways to bolster flawed AML/CFT in the EU

The EU needs to significantly improve the structure and resourcing of its AML/CFT oversight if it really wants to combat illicit money flows, write Panicos Demetriades and Radosveta Vassileva

BIS and French and Swiss central banks announce joint CBDC project

Project Jura will link national CBDC initiatives in bid to facilitate cross-border payment

Central bank profits under pressure

The structure of a central bank’s portfolio and its relationship with shareholders can affect shock-absorbing capital and the amount of profit distributed

‘Preventive restructuring’ reduces unnecessary bankruptcies – BdF paper

Researchers compare data from French preventive restructuring and traditional bankruptcy systems