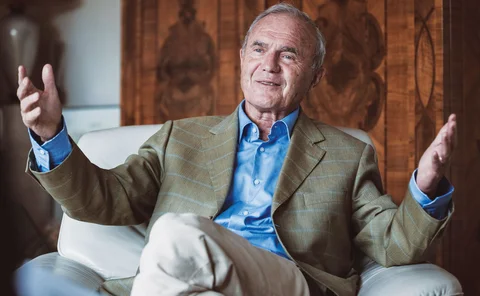

Otmar Issing

2016: The year in review

The past year was characterised by dramatic political events, and central banks did not always manage to stay above the fray; we look back at some of the biggest stories

Last stand for central bank independence?

Political attacks on Janet Yellen and Mark Carney appear to be just the start of a sustained assault on central bank independence. It’s a battle the central bankers may lose

AnaCredit: banking with (pretty) big data

The supranational credit database in Europe will help policy-makers and banks assess cross-border risk when it goes live in 2018, writes Aurel Schubert, director-general of the European Central Bank’s statistics department

Book notes: The curse of cash, by Kenneth S Rogoff

A well-written book and sincerely argued, but it is based on weak economic analysis and inadequate economic and political history

No ‘insidious’ German plan for EMU competitive advantage, says Issing

Otmar Issing says Germany didn't even have 'the economic intelligence' to design such a plan; country suffered years of high unemployment as others such as Italy failed to capitalise on price stability

Otmar Issing on why the euro ‘house of cards’ is set to collapse

Euro architect tells Chris Jeffery that muddling from one crisis to another cannot go on endlessly. Politicians need to admit “there is no likelihood” of political union to give EMU rules a chance

Euro architect says ECB has ‘destroyed’ market discipline in Europe

Otmar Issing, the man who designed the operational framework for the euro, says failures by European politicians and the ECB mean “all the elements” are in place to bring “disaster” to the monetary union

Issing says eurozone status quo is in danger

Former ECB board member says Europe’s monetary union is still plagued by problems caused by absence of political integration, which could pull the eurozone apart

Central bank 'silo culture' detracts from statistics, says ex-BoJ governor

Masaaki Shirakawa tells audience at Deutsche Bundesbank to expose economists to statistics and business contacts during their careers; Otmar Issing stresses value of good data

Blanchard leads calls for more ‘democratic input’ in central bank decision-making

Viral Acharya, Olivier Blanchard, Richard Fisher, Otmar Issing and Klaas Knot debate new ‘paradigm’ of central banks with ever more responsibilities; Blanchard prescribes an injection of democracy

Constâncio and Issing fear ‘zombie' bank dependency on central bank liquidity

Former ECB chief economist joins current vice-president in warning over weak banks becoming dependent on central bank money - but Constâncio says ECB is ‘exiting quietly and smoothly'

Asmussen: Eurozone governors should ‘withstand' pressure of public minutes

ECB executive board member Jörg Asmussen says eurozone central bank governors should be able to withstand the pressure of having their deliberations and voting made public

Issing brands calls for detailed ECB minutes disclosure ‘absurd'

Debate rages about the need for more transparency in ECB governing council decision-making, as Otmar Issing and Sharon Bowles enter the fray; Draghi says ECB is reviewing communications policy

Robert Pringle’s Viewpoint: How governments are undermining world finance

Central bankers need to forcefully express their concerns about the unintended consequences of new regulatory policies

Former ECB board members say OMTs are outside central bank’s mandate

Otmar Issing and Jürgen Stark both criticise ECB bond purchase plans in separate interviews; Issing calls political union a ‘dangerous idea’

Robert Pringle's Viewpoint: Fatal flaws in inflation targeting

Central bankers face a ‘lose-lose situation’ by accepting dual price and financial stability mandates when even their ability to achieve price stability via inflation targeting is in question

Interview: Otmar Issing

The architect of the ECB’s monetary policy framework talks to Robert Pringle about his new book and the challenges central bankers face at the moment

Dear Jean-Claude...

Changing the way the ECB works would improve its image and make your job easier, writes Charles Goodhart in an open letter to the ECB’s president.