Christine Lagarde

ECB will consider dropping market neutrality – Lagarde

Policy review will consider abandoning principle guiding asset purchases, but Bundesbank’s Weidmann is opposed

Eurogroup nominates Elderson to ECB board

European Union’s governments and parliament must now consider DNB official’s appointment

ECB open to above-target inflation – Lagarde

President lays out strategy review goals, hinting approach could bring ECB closer to the Fed

Is there a rift in the ECB governing council?

Mixed messages from Christine Lagarde were followed by sharp divergence among board members

ECB has ‘no room for complacency’, Lane says

Chief economist stresses ECB is ready to expand stimulus after Lagarde appeared to downplay risks

ECB leaves policy unchanged

Lagarde says she will not comment on euro’s exchange rate against the dollar

Klaas Knot on ECB policy-making, the FSB and central bank ‘capture’

DNB president talks about the temporary nature of unconventional policies, the importance of inflation target ‘bands’, the role of central banks as ‘circuit-breakers’ and ECB decision-making under Christine Lagarde

ECB says pandemic measures have been effective

Response to Covid-19 pandemic lowered bond yields and may have stopped financial panic

ECB slows down PEPP purchases

Emergency asset buying fell to lowest level since programme was launched in April

Lagarde hails EU fiscal-monetary co-ordination

Recovery fund will support economy from 2021, avoiding fiscal tightening once national stimulus lapses, stresses ECB president

EU recovery fund set to ease ECB’s burden

Common debt issuance likely to significantly reduce fragmentation risks, taming sovereign bond spreads, say analysts

Eurozone outlook is ‘highly uncertain’, says Lagarde

ECB maintains stimulus package unchanged as lower energy prices weaken inflation

Peter Praet on Europe’s Covid-19 responses

The former ECB chief economist talks about threats to financial stability, negative rates, common debt issuance and steps to improve the EMU

Weidmann to testify quarterly in parliament to explain ECB policy

Measure follows constitutional court ruling requiring ECB to demonstrate proportionality of government bond purchases

Central banking enters a new era

Central banks face a delicate balancing act to preserve their reputations as they evolve into ‘buyers of last resort’ and some of their actions appear functionally equivalent to ‘monetary financing’

ECB expected to sharply increase PEPP purchases

Central bank could start reinvesting PEPP securities and increase supranationals’ share

Eurozone approaching ECB’s worst-case scenario – Lagarde

Economy likely to shrink by over 10% in 2020, says ECB president

ECB to integrate climate risks into supervision

Climate change is pushing banks to adapt risk management, disclosure, governance and business strategies

Lagarde welcomes Franco-German fund plan

Covid-19 response fund would be drawn from common EU budget

The ECB, the lockdown and the monetary financing lock

The eurozone’s central bank may need to break its prohibition on monetary financing to fight the pandemic

German court leaves Bundesbank caught between two legal decisions

Ruling may hamper ECB’s new PEPP programme as it is not constrained by PSPP limits

ECB launches new lending facility, but holds rates

Lagarde announces cut for banks’ borrowing rate, but the ECB has not expanded asset purchases

The Belt and Road Initiative 2020 Survey – A more sustainable road to growth?

The third annual Belt and Road Initiative (BRI) survey reveals that central banks view BRI investment as sustainable compared with other forms of external debt, particularly given it is often proportionally less significant. Despite growing global trade…

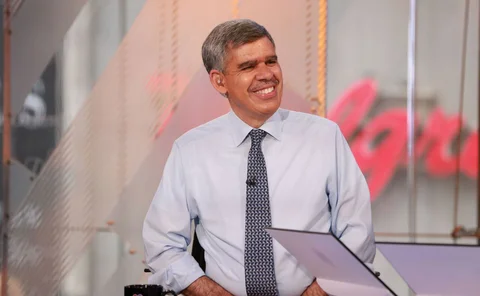

El-Erian on Covid-19 policy risks, ‘zombie’ markets and central bank capture

Former Pimco chief says Fed move into high yield is a step too far, new rules needed on leverage and false liquidity, and narrow window emerges for central banks to shed some of their policy load