Federal Reserve Bank of New York

Fed will begin ETF purchases today

Central bank outlines fund selection strategy but keeps investors guessing on specifics

Fed set to adopt ‘elements’ of price-level targeting

Covid-19 could act as a catalyst for a Janet Yellen-supported Fed move to adopt elements of price-level targeting. But questions remain about the timing of such a move

New York Fed paper finds possible failings in US pandemic aid

Research on Paycheck Protection Program says some heavily virus-affected areas of US may be losing out

Tighter supervision improves bank performance – NY Fed paper

Researchers examine performance of heavily and lightly regulated banks from 1991 to 2014

Fed’s balance sheet increases by 50% since March

Total assets now just shy of $6.4 trillion, a new record high

Fed takes first step to unwind repo support

Repo market is showing signs of “more stable” conditions, New York Fed says

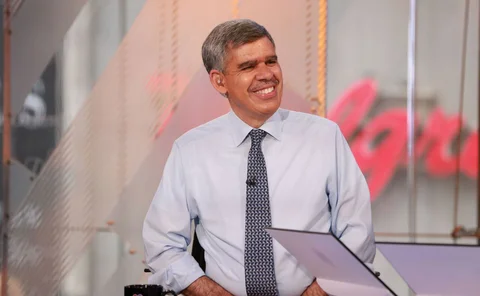

El-Erian on Covid-19 policy risks, ‘zombie’ markets and central bank capture

Former Pimco chief says Fed move into high yield is a step too far, new rules needed on leverage and false liquidity, and narrow window emerges for central banks to shed some of their policy load

People: Sarb and BoE renew senior appointments

Senior Sarb and BoE officials receive new terms; MAS picks new assistant managing director; ECB appoints director; William Dudley takes consulting job

Fed opens dollar funding to majority of central banks

New repo facility aims to ease strains caused by global flight to the safety of dollars

Fed’s balance sheet could see massive further growth

Response to coronavirus has already pushed Fed’s holdings up to record levels

New York Fed to offer $1 trillion per day in repo funding

Move sends message the Fed stands ready to meet any increase in funding demands over coming period

Central banks step up liquidity support

RBA, Bank of Canada, Norges Bank and Riksbank all increase their liquidity interventions

Fed to flood repo market with up to $5.5 trillion

NY Fed unveils substantial liquidity package as analysts warn massive market disruption is possible

Book notes: After the crash, by Sharyn O’Halloran and Thomas Groll

The book seeks to identify seeds of the next crisis, and the overriding impression is a plea for more regulation

Fed’s Brainard backs ‘flexible inflation averaging’

Governor hints at possible outcome of Fed’s policy framework review

Fed could postpone stress buffer beyond CCAR – experts

Delays prompt speculation that the new rules will only be known after the stress-test results in June

UK's FCA dismisses Libor credit component concerns

Regulator bemused by distress raised by US regional banks to Fed

Fed’s repo tapering plans hit snag

Banks demand double what was on offer at Fed’s first reduced repo offering

Custody initiative: Euroclear

The securities depository has debuted instant dollar settlement in central bank money outside the US – a service that has virtually eliminated settlement risk

Cyber attack could freeze liquidity in US financial system – NY Fed paper

Attack on one bank could affect more than a third of banking system’s assets, researchers warn

Fed slims down repo market interventions

Relative to year-end, the Fed will cut $250 billion of the cash offered to banks

Inflation expectations risk continuing downward trend – John Williams

New York Fed president urges policy-makers to hold themselves accountable for below-target inflation

New York Fed launches longer-term liquidity fix

Markets desk tells overseas central banks that foreign repo pool rate will be revised

Fed avoids year-end cash crunch

Repo market shows barely a ripple over New Year’s Eve after Fed injects a quarter of a trillion dollars