Bank of England (BoE)

BoE tells firms to prepare for negative rates

Preparation is not a signal that negative policy rates will be adopted, Bailey stresses

BoE paper seeks origin of systemic risk

Network analysis tool can overcome problems with other approaches, authors say

Central clearing proved resilient in ‘dash for cash’ – BoE’s Segal-Knowles

Challenge now is to “sustain and strengthen” the system, says executive director

BoE paper explores macroeconomic impact of macro-pru

Authors build DSGE model featuring “detailed banking sector” and sticky interest rates

BoE scolded for carbon-heavy investments

Parliamentary committee says current bond buying undermines “diplomatic leadership” on climate change

BoE adjusts stress-testing framework

Tests this year will be based on 2020’s reverse stress test, as banks face “ongoing operational challenges”

Banque de France pledges to drop coal-linked assets by 2024

French central bank will also cut oil and gas exposures, and oppose new fossil fuel projects

People: Philippines governor recovering after medical procedure

Benjamin Diokno steps back from duties temporarily, plus appointments in UK, Singapore and more

BoE reassures foreign banks on post-Brexit booking models

EU banks that lost passporting rights after Brexit are unlikely to have to establish UK subsidiaries

Debt-service ratio limits have greatest welfare benefit – BoE research

Authors find macro-prudential tools can also boost the transmission of monetary policy

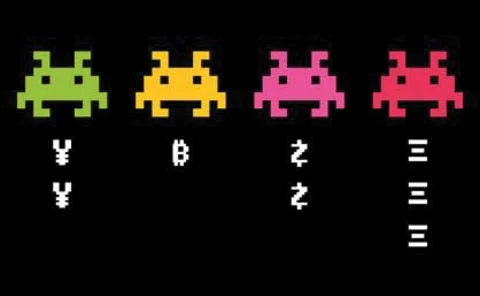

Book notes: The currency cold war, by David Birch

Pleasant and interesting read on whether digital money will jeopardise the US dollar’s dominant role in global trade and finance

BoE must improve understanding of QE – report

Lack of understanding has prevented BoE’s ability to build public trust in new policy tool, report says

BoE’s Tenreyro says negative rates likely to work in UK

Looser monetary policy might help limit “scarring” to the economy, says MPC member

Some firms need to provide ‘better’ information to BoE – David Bailey

Executive director says BoE must have sufficient influence over supervisory outcomes post-Brexit

Terms of trade shocks not symmetric – BoE paper

Developing countries particularly vulnerable to export shocks, study finds

Central banks must become ‘market-makers of last resort’ – BoE’s Hauser

Measures used in Covid-19 crisis are insufficient for the long term, BoE official says

BoE officials welcome stronger post-Brexit regulatory powers

Andrew Bailey says UK must not become a “rule-taker” on financial services

BoE’s Bailey explores future of balance sheet policy

Question of whether QE is “state contingent” could impact how it is deployed through the cycle

Covid-19 likely harms productivity – BoE paper

Private sector could lose 5% of its productivity in Q4 this year, authors estimate

BoE’s inflation target may hamper response to no-deal Brexit – IMF

Report urges BoE to bolster market communication in the event no deal is reached

BoE’s MPC says UK outlook is ‘unusually uncertain’

Outcome of Brexit talks and evolution of pandemic leave future cloudy, BoE says

The long-term impact of Covid-19 on banknote demand

The coronavirus pandemic has challenged cash usage assumptions at a time when central banks make only limited use of longer-term forecasts

BoE considering legal action over hoax press release

Group calling themselves the ‘Yes Men’ claimed credit for the fake

The dawn of average inflation targeting

The Fed has failed to explain how it will calculate the ‘average’ for its new AIT framework, raising new risks that central bankers would do well to reflect on