Demand

Consultancy and advisory provider of the year (currency management): De La Rue

The UK-based company is helping central banks monitor the lifespan of banknotes in a bid to improve stock management and cost-effectiveness of currency operations

Banknote and currency services provider of the year: Landqart

The leading hybrid substrate provider offers the durability and increased security of polymer combined with the security features and customer familiarity of paper

Central Banking Awards: Perng Fai-nan recognised for lifetime achievements

The first four 2018 Central Banking Awards are unveiled – banknote and currency management, consultancy, innovation in reserve management, and lifetime achievement

Egypt’s new banknote facility to be built by G&D

German firm awarded over $300 million for successful tender which will see “majority” of Egypt’s banknotes printed at the plant

Bundesbank to begin investing in renminbi

Executive board member says the bank is considering investing in other foreign currencies

Central Bank of Kenya to challenge banknote tender nullification

Central bank to challenge ruling which revokes De La Rue’s tender win following claims of favouritism

Philippines admits to circulating ‘faceless’ banknotes

Printing error results in missing portraits on several banknotes; the central bank urges the public not to circulate the images on social media

Botswana chooses polymer for latest banknote launch

African nation partners with UK printer De La Rue for new banknote launch, opting for polymer to prolong life

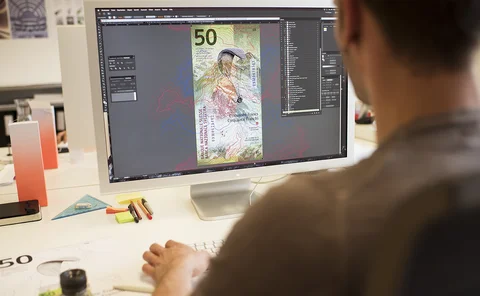

SNB buys banknote company ‘to ensure its survival’

Company that provides substrate for Swiss banknotes came into liquidity difficulties following the cancellation of a tender from an international client

Sarb closes branches to optimise cash management

Inefficiencies prompt central bank to close three of its branches, while remaining three are ‘converted’ into cash centres

Denmark ‘not heading for cashless society’ – research

Central bank recognises cash transactions are in decline, but says consumers will always have the option to pay with cash

Change in fees could lead to ATM ‘deserts’ – MP Nicky Morgan

Chair of UK Treasury committee concerned that changes to ATM networks could threaten financial inclusion as cash continues to be important to 2.7 million people

Central bank demand boosting banknote sector – RBA’s Boulton

Asian security printers are showing faster growth as central banks turn to more sophisticated designs, says Lindsay Boulton

Bank of Canada paper investigates the ‘burden of coins’

Research sheds light on consumer behaviour when making low-value transactions with cash, suggesting cards more likely to be used if large amount of coins will be received

San Francisco Fed study: cash is not dead yet

Demand for notes and coins is “strong”, says the study, with cash in circulation growing in the majority of nations

Book notes: Hole in the Wall, by James Shepherd-Barron

Cash machines have changed the way cash is managed, but is there a future for such machines in a world looking to go cashless?

Mauritius governor opens new currency museum named after first governor

Museum ‘Aunauth Beejadhur’ will exhibit Mauritian currency throughout the ages, with plans to expand scope to include financial literacy at a later date

Venezuela launches new higher-denomination banknote

Banknote worth $2.50 enters circulation as estimated inflation exceeds 2,500%

New Russian banknote provokes anger in Ukraine

Ukrainian central bank prohibits institutions from handling new note, which depicts scenes from Crimea region; design was chosen by the public in 2016

BoE introduces new counterfeit initiative for ‘front line of defence’

New checking scheme will employ “targeted training” for cash handlers while retailers will help central bank gather data on current practices

Cleland outlines uncertainty of future cash demand

BoE chief cashier says people will move away from cash, but the rate of change is uncertain

Central banks unlikely to issue digital money, argues author

David Birch’s book discusses how communities could be at the heart of the new electronic monetary system

Zimbabwe central bank has ‘little choice’ but to increase bond notes

Research says bond-note expansion sets the country on path to de-dollarisation; rise in tobacco output and gold prices unlikely to offer sufficient liquidity relief

RBI data casts doubt on value of demonetisation

Scheme receives fresh criticism after revelation that 99% of all notes have been returned; RBI emphasises long-term benefits