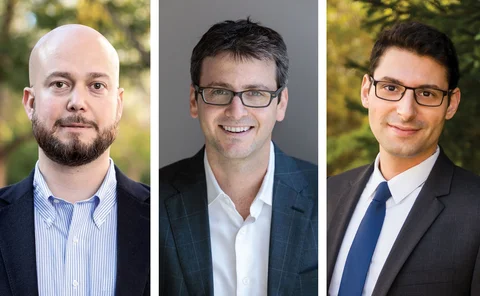

Daniel Hinge

Editor, Benchmarking

Daniel Hinge is editor of Central Banking’s benchmarking service and subject specialist for economics and monetary policy. He has reported on the central banking community since 2012, in roles including news editor and comment editor. He holds a degree in politics, philosophy and economics from the University of Oxford.

You can follow Daniel on Bluesky.

Follow Daniel

Articles by Daniel Hinge

Big data in central banks 2020–21 report: shifting to centre stage

The Covid-19 shock made big data a key input into policy at a time when data governance appears to be improving and central banks are embracing cloud technology

Greenpeace lands activists on ECB roof

Stunt publicises new study arguing collateral framework favours high-carbon industries

US spillovers might increase need for UK easing, says Hélène Rey

Andrew Bailey says policy will be “state contingent” but negative rates are possible

Judge questions Bailey’s account of LCF investigation

Elizabeth Gloster rejects BoE governor’s claim of a “misunderstanding” over his role

Bailey hits back at critics in new hearing on LCF scandal

“I am quite angry”, says BoE governor, as he denies accusation of cover-up

European central bankers see room for fiscal-monetary co-operation

Pandemic showed it was “critical” for both policies to work together, say central bank governors

RBI offers bond accounts to retail investors

Central bank to sell debt directly to public, as recent auctions show signs of strain

Fed on hold in first policy meeting under Biden administration

Unanimous vote comes amid signs of possible further fiscal stimulus; new voting members join FOMC

Central bankers debate next steps on climate change

Jens Weidmann argues for independent agency to relieve burden on central banks

BoE officials welcome stronger post-Brexit regulatory powers

Andrew Bailey says UK must not become a “rule-taker” on financial services

US may face ‘jobless recovery’ despite huge stimulus

Economists warn fiscal stimulus has been poorly targeted; Ben Bernanke defends Fed policy

Palestine Monetary Authority governor resigns early

Government quickly nominates senior PMA official to take place of Azzam Shawwa

2020: The year in review

The past 12 months have been marked by crisis-fighting and losses, but also innovation

Former RBI official Rabi Mishra on macro-pru in the post-Covid world

The former executive director discusses challenges for supervision, global governance reform and the rise of fintech

Economics Benchmarks 2020 report – new insights on research, policy and statistics

Benchmarking data sheds light on governance, salaries, forecasting, research, publications and more

Fed’s dollar swap lines and ‘Fima’ facility to run nine more months

FOMC keeps main policy tools on hold, but shifts guidance on asset purchases

US brands Switzerland a ‘currency manipulator’

Treasury also accuses Vietnam of manipulating exchange rate to gain “unfair competitive advantage”

BoE says banks can cope with Brexit and pandemic

But central bank warns EU actions are risking some disruption as transition period ends

Is the RBI doomed to fail its ‘quest for financial stability’?

Covid-19 has set back progress on hard-won reforms. As the economy struggles to recover, the RBI and government must walk a treacherous path back to safety

Sama changes name again under new central bank law

Law change updates and clarifies central bank’s role and responsibilities

FSB to tackle systemic risk in non-bank sector

Regulation likely but policy-makers want to avoid damaging an important funding source

BIS could play renewed role amid Covid crisis, scholar says

Fed’s role in dealing with Covid-19’s international effects has parallels with 1960s, historian argues

Maggiori, Neiman and Schreger on capital flows and Covid-19

The Global Capital Allocation Project sheds light on where vulnerabilities may lie

G20 delays decision on poor countries’ debt relief

International efforts have been “unambitious, unco-ordinated and uneven” – prominent economists