Sponsored content

Video Q&A: Richard Gilmartin, Wellington Management

Central Banking met with Richard Gilmartin, product manager, fixed income at Wellington Management, following his presentation at the National Asset Liability Management Conference in Mexico City about the opportunities for reserve managers to consider…

Green solutions – Supporting our clients along their green investment value chain

From extreme weather to transition risks, the systemic challenge of climate change lies in the interconnectedness of risk. Amundi is helping to shape solutions by integrating climate risks across its asset classes and pushing public debate forward.

Climate change – Where can central banks contribute?

Climate change is becoming increasingly important to central banks thanks to its implications for financial stability. In a forum sponsored by Amundi, Central Banking convened a panel of experts to discuss the latest innovations, regulations and…

Sponsored forum: Climate change – Where can central banks contribute?

This webinar examines how reserve managers and those responsible for official sector portfolios can tackle the challenges climate change poses in the modern investment paradigm

A powerful new force – Central banks and climate-related risks

Increasing global concern about climate change is causing central banks to take notice of the issue and its potential implications. Frédéric Samama, head of institutional client coverage at Amundi, examines the findings of Central Banking’s survey on…

Time for resilience

Events that impact markets have made it crucial to build resilient portfolios that are aware of downside risks. BlackRock explores the importance of protection in downturn scenarios for reserve managers.

Finding the right partners with the right solutions

Over the past decade, the financial crisis, globalisation and technological changes have driven uncertainty and brought about drastic changes for central banks. Vermeg‘s Yamen Bousrih explores the importance of having a consolidated, coherent and…

Video Q&A: Moritz Plenk and Mark Shead, BearingPoint

Central Banking met with Mark Shead and Moritz Plenk of BearingPoint at the Central Banking FinTech and RegTech Global Supervisory Summit in London to discuss the challenges faced by central banks and regulators, and how regulatory and financial…

Video Q&A: Natalie Dempster, World Gold Council

Central Banking met with Natalie Dempster, head of the World Gold Council's central bank and policy team, at the Central Banking Awards 2019 ceremony to discuss key trends of central banks' gold purchasing, what gold adds to a reserve portfolio and the…

Sponsored interview: Henri Fouda, Wellington Management

Central Banking met with Henri Fouda, portfolio manager at Wellington Management at the National Asset-Liability Management Africa 2018 conference to discuss the current outlook for fixed income investment on a global and regional basis. Fouda shares his…

Video Q&A: Maciej Piechocki, BearingPoint

Central Banking met with BearingPoint’s Maciej Piechocki at the Central Banking FinTech RegTech Global Summit in Singapore to discuss financial and regulatory technology – known as fintech and regtech respectively – solutions, how technology can help in…

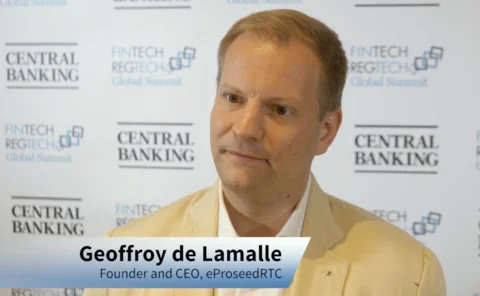

Video Q&A: Geoffroy de Lamalle, eProseedRTC

Central Banking spoke to Geoffroy de Lamalle, founder and chief executive at eProseedRTC, at the FinTech and RegTech Global Summit in Singapore

Insights from network analytics in suptech

With regulators leveraging technological innovations to move towards informed, data‑driven decision‑making and automation, supervisory technology is attracting enhanced interest. Kimmo Soramäki and Phillip Straley examine how regulators are gaining…

Distributed ledger technology in regulatory reporting

Satisfying regulatory demands can be made cheaper and more straightforward via distributed ledger technology as regulatory reporting has a transformational effect on the regulatory value chain. Maciej Piechocki, Moritz Plenk and Noah Bellon of…

An informed approach to banknote security and durability

De La Rue explains how its data consultancy service, DLR Analytics, allows central banks to ensure notes in circulation are secure and durable, and offers value for money in spite of increasingly prominent alternative payment solutions. By facilitating…

Big data in central banks focus report 2018

The third Central Banking big data focus report delves further into recent trends as central banks grapple with the question of upgrading their approaches to data

Sponsored forum: Putting big data into action

Central Banking convened a panel of experts to discuss how central banks and other supervisors can maximise the potential of data, while overcoming hurdles to its collection and deployment

Putting big data into action

Big data is changing the way central banks think about the economy and oversee the financial system. In a forum sponsored by BearingPoint, Central Banking convened a panel of experts to discuss the innovative ways central banks are making use of big data.

Turning data challenges into opportunities

With central banks becoming increasingly reliant on data, BearingPoint elaborates on the increasing role of innovative regulatory and supervisory technology in supervision.

Suptech: More than just a new name for solving an old problem

The global financial crisis sparked a far-ranging overhaul of the international architecture for financial regulation, coupled with a deep reflection around the fitness-for-purpose and effectiveness of supervisory efforts, writes Anne Leslie-Bini.

Is this the beginning of a new era of credit risk management technology?

In the aftermath of the 2008 financial crisis, inadequate credit risk management systems have been widely held responsible by regulators for spreading the crisis’ germs all over the financial sector. As a result, a myriad of regulations affecting credit…