Supervision

Singapore’s financial system resilient amid increased global risks – MAS

Despite headwinds the financial system can withstand ‘severe shocks’, the central bank says

Interview: Clair Mills on the meaning of fintech

The Bank of England’s head of change and data management discusses why fintech is so important for a financial sector going into uncharted territory

Minneapolis Fed ‘deeply troubled’ over regulatory reforms

Minneapolis Fed backs Brainard against “alarming” regulatory reforms

People: US Senate confirms new Fed board member

Bank of Mexico deputy will leave central bank by the end of November; new Fed governor approved by Senate; and more

Brainard: Fed keeping open mind on AI regulation

Some rules already apply to AI tools, but Fed “still learning” about AI’s impact

Fed plans further cuts to regulation for community banks – Quarles

Further regulatory easing announced alongside greater stress test transparency plans

ECB prepares to supervise largest Bulgarian banks

Move comes as Bulgarian government attempts to join single currency

US banking system responding well to post-crisis reforms, says Fed

Banking system shows healthy rebound despite supervision uncovering weaknesses, the Fed reports

Supervisory lessons: the need for intrusive supervision

Former Bank of Spain head of supervision Aristóbulo de Juan reveals his central principles for the (intrusive) supervision of banks in the third of a four-part series

MAS chief laments ‘data localisation’

Misguided notions of data security threaten digital growth, says Menon; central bank further strengthens fintech support

RBNZ launches review into collapsed insurer

CBL Insurance to be liquidated after failing to assemble rescue plan

The euro: a troubled third decade?

Italy’s pact-busting budget highlights ongoing eurozone frailties

ECB nominates Enria as next head of banking supervisor

Italian candidate likely to be accepted as next head of SSM

Review into New Zealand bank conduct reveals failings

New Zealand’s central bank urges government to provide regulators with sufficient powers to address conduct, as significant weaknesses appear in the sector

The EU tries to rethink its faltering AML regime

The European Union plans to centralise its anti-money laundering efforts following a series of scandals this year. Dan Hardie looks at the options available and the multitude of challenges that remain

Fed proposes lightening regulations for large banks

Lael Brainard objects to plans, warning they could leave taxpayers “on the hook”

Carstens: regulators must promote ‘orderly assimilation’ of tech

Technology should bring benefits, but may threaten “integrity” of financial markets, BIS chief says

Government steps in as RBI row escalates

Governor Patel rumoured to have threatened resignation

Cuban senate issues new financial system laws

Central bank, financial institutions and market infrastructure entities are all impacted

UAE government overhauls central bank law

Move is “significant step” to reinforce central bank’s independence, says governor

Acharya makes pointed defence of RBI’s independence

Governments may “ignite economic fire” if they undermine the central bank, deputy says

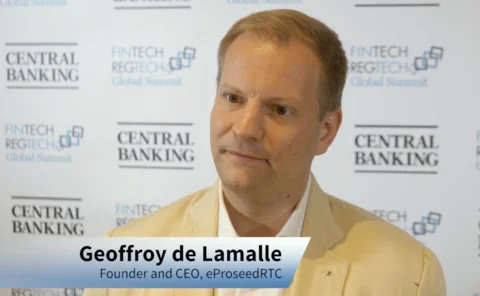

Video Q&A: Geoffroy de Lamalle, eProseedRTC

Central Banking spoke to Geoffroy de Lamalle, founder and chief executive at eProseedRTC, at the FinTech and RegTech Global Summit in Singapore

RBNZ plans tougher discipline on banks’ regulatory breaches

Proposals would see major breaches linked to disclosure dashboard, highlighting when a bank has broken the rules

RBI fights plan to strip it of payment powers

Central bank fears move would undermine its ability to regulate currency