Euro

Interview: Zdeneˇk Tu°ma

Martina Horáková speaks to the Czech governor about the crisis, calls for cross-border supervision and the process for adopting the euro

Are Libor spreads near the new normal?

A decline in interbank spreads shows confidence is returning. But, the margins at which spreads settle are likely to reveal much about how the crisis has changed the face of finance for years to come, Claire Jones, the editor of CentralBanking.com, says.

France explains Sepa delay

The French National Single Euro Payments Area (Sepa) Committee has justified its decision to delay the implementation of Sepa Direct Debit until November 2010, a year after the first available start date.

ECB's Papademos: injections staved off collapse

The expansion of liquidity to the eurozone's banks since August 2007 has ensured that a systemic crisis was averted, said Lucas Papademos, the vice president of the European Central Bank.

France bails on Sepa Direct Debit

The French National Single Euro Payments Area (Sepa) Committee, set up and chaired by the Banque de France and the French Banking Federation, has opted to delay the implementation of Sepa direct debit by a year to November 2010.

ECB's Bini Smaghi: credit easing won't work for us

Unconventional policy measures that would best suit the euro area are likely to differ in terms of scope and depth from those in the United States or other advanced economies, said Lorenzo Bini Smaghi, a member of the European Central Bank's (ECB)…

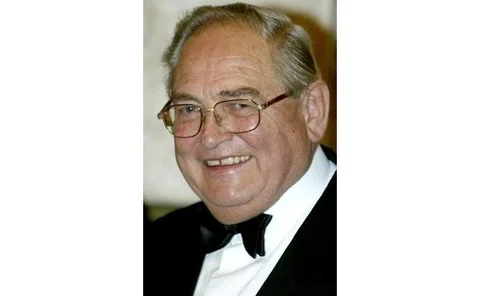

Eddie George on independence and supervision

In 2000, Sir Eddie George, the former governor of the Bank of England who died at the weekend, spoke on the Bank's then new-found independence and the loss of its supervisory function

Albania's Ibrahimi: euro liquidity crucial

It is important that a reasonable flow of euros from banking groups' headquarters to their foreign subsidiaries is maintained, said Fatos Ibrahimi, the first deputy governor of the Bank of Albania.

Euro adoption sparked some structural reforms

The adoption of the euro accelerated the pace of structural reforms in the product market, a research paper from the National Bureau of Economic Research (NBER) posits.

De Grauwe labels Maastricht rules political tools

The Maastricht criteria for euro adoption are political instruments, not economically-vital measures, a respected economist has said.

IMF: eastern EU states must adopt euro - report

The International Monetary Fund (IMF) is alleged to have advocated fast-track eurozone accession for eastern European countries grappling with high amounts of external debt.

Denmark's Bernstein plans to stock up on reserves

The National Bank of Denmark will need to maintain a larger foreign-exchange reserves stockpile than in recent years, said Nils Bernstein, the governor of the central bank.

Monetary union could improve British stability

The British economy's stability would be enhanced by euro adoption, a new paper from the St Louis Federal Reserve posits.

Sepa project must be extended

The scope of the Single Euro Payments Area (Sepa) project must be extended to include standardisation in the field of value-added services, such as e-invoicing, a new paper from the National Bank of Denmark states.

ECB issues Sepa "expectations"

The European Central Bank (ECB) published a list of expectations on Friday for how it would like to see stakeholders act to implement the Single Euro Payments Area or Sepa, amid concerns that the initiative will be swept aside by the financial crisis.

European banks to drop interchange fees by 2012

The European Commission and the European Central Bank (ECB) have told European banks to get rid of interchange fees on direct debit transactions by 31 October 2012 under EU antitrust rules.

Estonia to meet Maastricht criteria in 2009

Andres Lipstok, the governor of the Bank of Estonia, has said that the country will meet all the Maastricht criteria for euro entry later this year, reports say.

Buba's Weber: no surprise states keen on euro

It is no wonder that many of those in small boats are seeking to dock in the large ship European economic and monetary union (EMU), said Axel Weber, the president of the Bundesbank.

Switzerland to intervene to halt franc's gain

The Swiss National Bank pledged to curb the appreciation of the Swiss franc against the euro on Thursday and said that there was a risk of deflation over the next three years.

MNB responds to forint sell-off

The Hungarian National Bank said it is prepared to use all the policy tools available to defend the forint, which came under pressure on foreign exchange markets last week.

Ex-Buba's Pohl sees euro threat

Karl Otto Pohl, a former president of the Bundesbank, has said that he believes countries are considering quitting the eurozone and that German politicians are concerned that they will end up shelling out for any member's debt defaults.

Romania wants to accelerate euro adoption

Bucharest is looking in to adopting the euro before the current target of 2014 in order to more closely link Romania's economy with other members of the European Union.

Of currencies, crises and completions

The crisis presents an opportunity to complete Europe’s journey towards a true monetary union, argues John Nugée

Papademos on macroprudential supervision

The European Central Bank and the Eurosystem are well placed to assume the tasks of macroprudential supervision, said Lucas Papademos, the vice president of the ECB.