US dollar

US dollar has become ‘risk barometer’ – BIS economists

Role of dollar has changed since 2008 due to major changes in global financial sector, authors say

Major economies already engaging in ‘currency wars’ – former IMF chief

De Larosière floats new commodity-based exchange rate regime; says “trust” is key to avoiding “beggar-thy-neighbour” policies

New York Fed to offer $1 trillion per day in repo funding

Move sends message the Fed stands ready to meet any increase in funding demands over coming period

Dollar crunch eases as central banks step up swaps action

Core swap recipients will offer daily dollar auctions; cross-currency basis narrows

Fed expands network of swaps to emerging markets

Emerging markets will now have direct access to a dollar backstop, but it is still limited

Banks rush to tap new dollar liquidity facilities

IIF warns of major capital flight from emerging markets as demand for Fed-backed repos surges

Central banks grapple with dollar funding crunch

Indicators of stress hit highest levels since global crisis; dollar backstops may soon be tested

The Tokyo Olympics: downside risks prevail

The Bank of Japan’s latest stimulus effort seems to be weak, and comes at a time when the benefits of hosting the Tokyo Olympics may be overstated – even if the games still take place

Fed cuts rates 100bp as central banks launch joint action

US central bank unveils unprecedented coronavirus response package as global swap lines are bolstered through co-ordinated action

Do low rates spur investment?

Many believe low interest rates spur investment, but there appears to be little hard evidence to support such claims, writes former IMF head Jacques de Larosière

Central Banking Awards 2020: third group launched

Awards unveiled for currency manager, initiative, economics, currency services, advisory and data

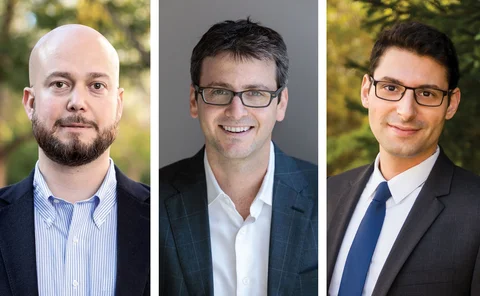

Economics in central banking: Matteo Maggiori, Brent Neiman and Jesse Schreger

The Global Capital Allocation Project has helped pick apart the tangled network of cross-border capital flows. The work may prove essential to those looking to shore up the international monetary system

Custody initiative: Euroclear

The securities depository has debuted instant dollar settlement in central bank money outside the US – a service that has virtually eliminated settlement risk

Chilean central bank holds rates, citing uncertain outlook

Central bank warns of impact of fall in demand for Chile’s major export as mass protests continue

Debt securities still key in capital flows to EMEs – BIS

Latest global liquidity statistics show ongoing growth in euro and dollar liquidity

Economists call for action on risk of dollar liquidity crunch

Credit to non-banks and currency mismatches have grown, while oversight is “fragmented”, report warns

Argentina woes deplete Uruguay’s reserves – IMF

Reserves drop from $15.6 billion to $14.3 billion in 12 months as dollar deposits also begin to rise

Paul Volcker, 1927–2019

The Fed chair made his name battling inflation, and left his mark on independence and post-crisis financial regulations

Chile’s forex intervention likely to stabilise peso – experts

Much depends on the reform programme the government chooses to adopt, however

Greater exchange rate flexibility warranted in Peru – IMF

Limiting interventions would help reduce dollarisation further, says fund

Chile launches biggest forex intervention in 20 years

Chilean peso has fallen by 14% against dollar since mid-October amid massive street protests

Brazil sells dollars as real falls to record low

Currency has fallen by 11.3% against dollar since July, as central bank cut interest rates by 150bp to new low of 5%

Canada’s Poloz on monetary policy limits, transparency and cyber recovery

Bank of Canada governor Stephen Poloz speaks about stagflation risks from trade wars, the importance of market signals, Canada’s CBDC plans and why he is not a fan of minutes

Bank of Zambia cuts rates as food crisis mounts

Zambian central bank calls for better government policy as drought causes a sharp rise in food prices