CB In Depth

Cash infrastructure as public good – implications for the cash cycle

Efforts are under way in the Eurosystem to safeguard cash infrastructure as a ‘public good’ even as transaction volumes have fallen significantly. How can policy-makers strike the right balance?

Book notes: The handbook of China’s financial system, edited by Marlene Amstad, Sun Guofeng and Xiong Wei

An important, comprehensive and informed overview of the current state of the Chinese financial system

The evolving ‘strategy function’ in central banks

Some institutions participating in a survey of 27 central banks still struggle to fully harness an effective ‘strategy function’, according to the ECB’s Jean-Charles Sevet and Alejandro de la Cuesta

Governors Nabiullina, Tabaković and Bezhoska on systemic risk and women in power

Russia, Serbia and North Macedonia governors discuss bank reforms, corruption and the Covid-19 crisis

Zhang Tao on the IMF’s fintech agenda, CBDCs and big tech oversight

IMF deputy managing director speaks about the fund’s perspectives on CBDC operating frameworks, regulating big tech and macrofinancial oversight in a digital world

Book notes: The political economy of bank regulation in developing countries, edited by Emily Jones

A pioneering academic – but reader-friendly – monograph on the response of peripheral countries to Basel standards

Book notes: Central banks as fiscal players, by Willem Buiter

Buiter puts a real economic problem into a convincing theoretical frame, and translates it into applicable policy advice

Regulating big tech and non-bank financial services in the digital era

Big tech incursions into financial services in China and elsewhere demonstrate the potential benefits of adopting a digital-bank or holding-company approach to financial regulation

A rebuttal of Philip Turner’s criticism of the BIS ‘house view’

Robert Pringle critiques the key findings raised in Philip Turner’s occasional paper, ‘The new monetary policy revolution: advice and dissent’

Book notes: Economic philosophies, by Alessandro Roselli

Roselli’s analytical and historical exploration is especially valuable now, writes Robert Pringle

Central Banking Awards 2021: winners in full

Winners in 2021 include the Federal Reserve, Alejandro Díaz de León and Charles Goodhart

Big data in central banks 2020–21 report: shifting to centre stage

The Covid-19 shock made big data a key input into policy at a time when data governance appears to be improving and central banks are embracing cloud technology

Data-driven policy-making for central banks focus report 2021

In this report, Central Banking discusses why data is so crucial for central banks to make effective policy decisions and why current traditional indicators that are no longer fit for purpose. The pandemic has highlighted the need for an overhaul of data…

Mário Centeno on monetary-fiscal interaction in the eurozone

Bank of Portugal governor says ECB is not being overrun by former finance ministers, must improve the definition of its inflation target and has no need for yield curve control. Centeno believes NextGenerationEU fund could serve as template for a future…

Book notes: Capital and ideology, by Thomas Piketty

A political pamphlet like Milton’s ‘Areopagitica’, but longer

Kenneth Montgomery on the Fed’s progress with instant payments

The FedNow project leader speaks about Covid-19 payment behaviours, a new liquidity management tool and what it will take to achieve ubiquitous instant payments in the US

Book notes: Asset management at central banks and monetary authorities, edited by Jacob Bjorheim

This excellent book fills a critical gap existing since IMF guidelines on asset management were revised

The Covid crisis, central banks and the future

Crisis responses have had positive initial outcomes, but also exacerbated significant underlying challenges that raise concerns related to exit strategies and the future for central banks

Book notes: The political economy of the special relationship, by Jeremy Green

Unsatisfactory story about the decline and resurgence of the UK’s importance in the global financial system

Ulrich Bindseil on the launch of the digital euro

The ECB’s director-general for market infrastructure and payments speaks about the functionality, tiering approaches, privacy policies, ledger technology and ecosystem impact of the eurozone's planned CBDC

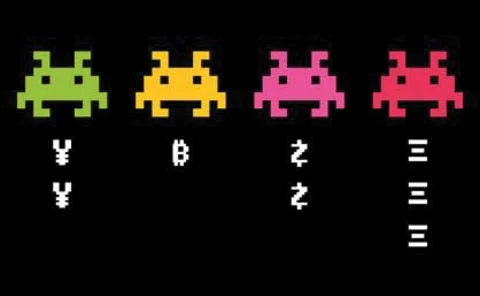

Book notes: The currency cold war, by David Birch

Pleasant and interesting read on whether digital money will jeopardise the US dollar’s dominant role in global trade and finance

The role of Tips for the future payments landscape

Tips could support euro CBDC plus cross-border payments in many currencies

Hernández de Cos on ECB policy, crises responses and Basel reform

Spanish governor and Basel Committee chair Pablo Hernández de Cos favours a form of average inflation targeting, says ECB is willing to boost stimulus and Basel reforms not diminished by Covid-19 exceptions; stresses the need for structural reform and…

Central bank social media usage continues to evolve

User growth among central banks has started to level off, but those that use social media platforms are seeing growing subscriber bases and an increase in engagement