Banks

A ‘love-hate’ relationship with ESG screens

ESG screens seen as a first step in adopting sustainable investment practices, so why do so few central banks use them?

Whither the age of ‘magic money’?

EME central banks are more exposed to changes in geopolitics, climate, demography, technology and inflation at a time when monetary theory is running well behind central bank practice

Quarles: Fed’s supervision should evolve

Fed vice-chair says supervision has not been adequately scrutinised in the past

China’s digital yuan kicks off test on e-commerce platforms

New round of tests in Suzhou allow use of CBDC for online shopping for the first time; new features designed to protect privacy

New Isda ‘fallbacks’ critical to making Libor transition a ‘non-event’

New protocol and supplement offer a transition away from Libor rates in 2021, despite CFTC saying 2,400 companies still exposed and Fed extending some US libor contracts until mid-2023

Monetary unions in the making in Africa

EAC, Ecowas and SADC can adopt practical steps learned from EMU to prepare for their own currency unions

APIs could help curb fintech operational risk – Sarb deputy

Data can give firms a competitive edge in South Africa’s financial services market

BIS warns of gap between cautious banks and buoyant markets

Report says exuberant market conditions may belie underlying risks

SNB’s Maechler: innovation hub in race to catch up with fast-paced markets

Swiss hub is laying foundations for a fast market-monitoring platform

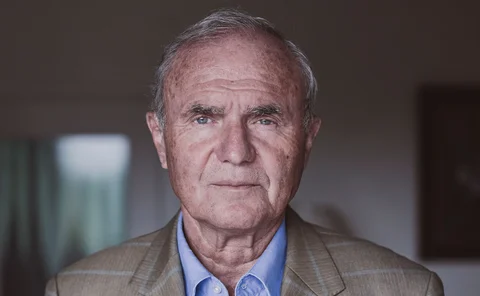

Otmar Issing on the art of central bank communications

EMU architect speaks about Draghi’s “whatever it takes” intervention, forward guidance failures, the Fed’s average inflation target ‘miscommunication’, and why the ECB may be overreaching in its strategy review

Bank of Spain paper looks at loan origination times

Loan origination data provides important insights into banking stability, researchers argue

Is the RBI doomed to fail its ‘quest for financial stability’?

Covid-19 has set back progress on hard-won reforms. As the economy struggles to recover, the RBI and government must walk a treacherous path back to safety

ECB sets new climate risk requirements for banks

Survey of eurozone banks shows most do not disclose basic climate-related data, ECB says

FCA starts to move firms’ data to new platform

UK regulator says RegData platform is faster and more accessible than previous system

ECB highlights new channel reinforcing sovereign-bank nexus

State guarantees indirectly increase banks’ exposure to sovereign risks through corporates

RBNZ to re-impose loan-to-value limits from March 2021

Central bank records increase in mortgages granted to high-risk lenders

US banks cede to SOFR lending as credit hopes fade

Critics of risk-free rate say dynamic spread will be too late for transition

MAS unveils yuan funding for banks in Singapore

New funding scheme of up to 25 billion yuan replaces overnight funding facility

Forensic auditors walk out of Lebanese central bank

Finance minister says central blank blocked audit as president stresses investigation must continue

Excess liquidity can weaken policy transmission – BoE paper

“Novel dataset” sheds light on possible unintended consequences of crisis-fighting measures

Ghana recovering faster than expected, says governor Addison

Growth has bounced back to double figures and inflation is expected to hit target by mid-2021

South Africa to stop cheque payments by 2021

Since August 2019, cheque usage has declined 59%

The world’s first retail CBDC tiptoes into existence

The Bahamas’ e-solutions manager Bobby Chen speaks about how Covid-19 brought forward the nationwide launch of the ‘sand dollar’, and how limits and wallet types are affecting usage