Average inflation targeting

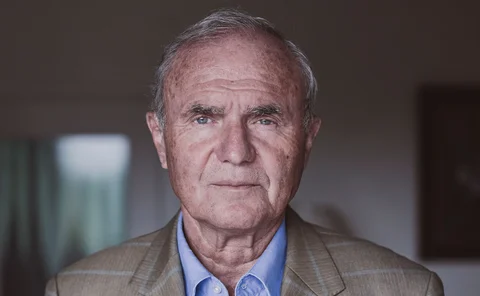

Charles Goodhart on inflation targets, financial stability and the role of money

The LSE professor says inflation targets should have been 0%, the Fed’s move to AIT is a mistake, independence is under threat from inflation, big balance sheets support liquidity, AI can help supervisors and climate stress tests are unconvincing

US CPI inflation reaches 5%

Figures follow predictions of “transitory” inflation rises by senior Fed officials

Yellen: ‘slightly higher interest rate’ would be fine

Treasury secretary says US should push forward with spending plans

‘Run it hot’: the risks and rewards of a new policy era

Covid-19 has added impetus to an emerging intellectual shift in policy-making. But central banks face unresolved issues – on expectations, on fiscal policy, and on the capacity of the economy to ‘run hot’

Fed’s Quarles says time is coming for taper talk

St Louis Fed’s Bullard says it is “too early” to talk of tapering asset purchases

A return of the inflation monster?

There are fears that a shift in intellectual approach towards running economies ‘hot’ could herald a return of the money-eating inflation era

Summers steps up attacks on Fed inflation stance

Inflation hawk warns of “complacency” after April CPI hike, but FOMC members have stood firm

Fed leaders hold dovish line as CPI surges

Board members and regional presidents say inflation and employment goals still far from met

Yellen unsettles markets with rate rise comments

Treasury secretary’s offhand comment about raising interest rates leads to stock selloff

New FOMC target may be shifting expectations – research

Cleveland Fed paper says some professional forecasters driving rise in inflation expectations

Central Banking Awards 2021: winners in full

Winners in 2021 include the Federal Reserve, Alejandro Díaz de León and Charles Goodhart

Central Banking Awards 2021: final winners unveiled

Awards announced for central bank of the year, economics, risk management and more

Central bank of the year: The Federal Reserve System

Overwhelming Fed interventions in March 2020 forestalled a damaging global financial crisis, as policy overhaul prompts introspection in Europe and Japan

New monetary frameworks involve risk trade-offs – IMF’s Adrian

Lower-for-longer rates may help to avoid deflation, but could contribute to medium-term volatility

Mário Centeno on monetary-fiscal interaction in the eurozone

Bank of Portugal governor says ECB is not being overrun by former finance ministers, must improve the definition of its inflation target and has no need for yield curve control. Centeno believes NextGenerationEU fund could serve as template for a future…

ECB leaves stimulus unchanged

Lagarde says prompt implementation of EU-wide fiscal stimulus is key to eurozone recovery

Inflation could ‘approach’ FOMC target quicker than expected – George

Kansas City Fed president says decline in inflation has been idiosyncratic

Hernández de Cos on ECB policy, crises responses and Basel reform

Spanish governor and Basel Committee chair Pablo Hernández de Cos favours a form of average inflation targeting, says ECB is willing to boost stimulus and Basel reforms not diminished by Covid-19 exceptions; stresses the need for structural reform and…

2020: The year in review

The past 12 months have been marked by crisis-fighting and losses, but also innovation

What does 2021 hold for the ECB?

Former officials reflect on AIT, how the strategy review may affect normalisation, QE options and the need for new tools

Fed faces longer-term challenges under new policy strategy

Steve Kamin warns central bank may not have paid enough attention to why r* has fallen

ECB is caught in a ‘communications trap’ – Issing

Monetary policy architect says ‘close to’ 2% inflation target was never part of original plan; urges ECB to reject Fed-like average inflation targeting

The dawn of average inflation targeting

The Fed has failed to explain how it will calculate the ‘average’ for its new AIT framework, raising new risks that central bankers would do well to reflect on

Otmar Issing on the art of central bank communications

EMU architect speaks about Draghi’s “whatever it takes” intervention, forward guidance failures, the Fed’s average inflation target ‘miscommunication’, and why the ECB may be overreaching in its strategy review