Research

Dealing with ‘insidious' crises a ‘difficult proposition' for policy-makers, argues IMF paper

Conventional balance-sheet crises, however, are more effectively detected and contained than before the financial crisis, paper adds

Norges Bank paper finds ‘booming' resource sector has ‘significant' productivity spillovers

Working paper also finds evidence of two-speed economies, with non-traded industries growing at a faster pace than traded

Colombian economist extends Bernanke-Gertler model for open economies

Model holds for open as well as closed economies, Central Bank of Colombia paper finds, concluding that they are even more vulnerable to asset price bubbles

Bundesbank paper explores liquidity shock transmission

Claudia Buch and Linda Goldberg summarise the findings of empirical studies conducted across 11 countries to explore liquidity risk transmission

Small eurozone countries can use government spending to combat imbalances

ECB-published working paper examines small open economies in a monetary union, whose options for dealing with shocks are limited

ECB prize winners size up shadow banking

Working paper published by the ECB considers how regulatory arbitrage and the shadow banking sector can undermine commercial bank safety nets

Finnish paper says Sepa 'not enough’ on its own

Researchers argue that Sepa is an ‘important’ initiative but further measures will be needed to create an efficient payments system; call for ‘vigorous’ competition policies

BoE paper finds QE did boost bank lending - slightly

New data set shows effect of increased deposits did feed through to lending, though the effect was dampened by lower levels of capital during the crisis

The ‘Great Moderation' shows no sign of ending, Spanish paper finds

The great recession did not mark an end to the great moderation whose low volatility could be hampering a recovery, according to a new paper

ECB economists design early-warning guide to trigger macro-prudential intervention

Working paper isolates key indicators to tell policy-makers when to use macro-prudential measures, and which ones to use

Irish economists estimate property debt overhang on SMEs

Central Bank of Ireland researchers find a minimum of 20% of SMEs have direct exposures to property debt, which makes them more likely to default

One in 10 eurozone households spend more than they earn, Bundesbank paper finds

Households with female, young, or divorced heads have harder time making ends meet, but ‘rather confident in the possibility to get funded through informal lending channels'

Portfolio flows to emerging markets make asset prices volatile - IMF paper

Working paper unpicks domestic pull factors versus global push factors, finding the latter more powerful in determining portfolio flows

Korea needs more women and young people in work, paper finds

Labour market ‘duality' and low youth and female employment are holding back growth, according to paper written by Bank of Korea and IMF economists

Capital lured to EMs by interest rate differentials, CBRT paper finds

Inflation and global liquidity other important drivers of international capital flows post-crisis, but countries' growth rates have less effect

Limits to foreign lending would cut bail-out risks, Banque de France paper claims

Paper examines why countries bail each other out, and argues a tax on lending to foreign countries would stop investors betting on an implicit guarantee

Unconventional monetary policy has heightened medium-term risks to banks, IMF paper finds

No evidence that unconventional monetary policies has ‘helped' banks, according to paper; finds deterioration of medium-term bank credit risk in US, UK, and the eurozone

IMF paper finds Latam growth likely to slow even if commodity prices remain elevated

Growth over next half-decade expected to be 150bp lower than during boom years; need for 'ambitious structural reforms' to secure 'medium-term growth'

Southern African economies appear to be converging

Bank of Botswana economists find SADC countries are moving in the same direction, but probably more by accident than by design

Firm-level characteristics affect monetary policy transmission, Czechs find

Working paper finds firm-specific characteristics like size, age, collateral and profit, affect the way in which monetary policy changes are reflected in the external financing decisions of firms

Paper examines optimal monetary policy for wages and hours worked

Firms tend to pay too little for too many hours, economists argue in ECB-published paper; monetary policy should not target inflation too strictly, they say

Global imbalances still on the rise, IMF paper shows

Though efforts have been made to cut current account imbalances since the financial crisis, ‘stock imbalances' continue to grow, find Milesi-Ferretti and Lane

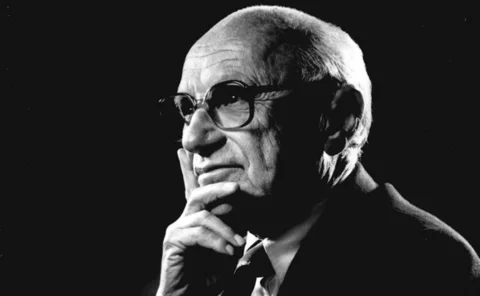

IMF paper finds ‘robust' relationship between exchange rate flexibility and external adjustment

Using a data set of bilateral exchange rate regimes, study revives Milton Friedman's argument that a flexible rate facilitates external adjustment

US and Europe more vital for Australian trade than thought

Australian goods being exported to western markets indirectly via east Asia, skewing statistics, according to paper using ‘complementary' estimates of value-added trade