Germany

US and German economies suffer largest quarterly contraction in decades

Official figures say second quarter saw biggest US GDP decline since the Great Depression

What makes for good financial supervision?

The Wirecard debacle has led to calls for more effective oversight in Europe. Andreas Dombret identifies four essential elements

Peter Praet on Europe’s Covid-19 responses

The former ECB chief economist talks about threats to financial stability, negative rates, common debt issuance and steps to improve the EMU

Coronavirus panic fuels a surge in cash demand

Covid-19 has led to banknote hoarding in Australia, Brazil, Canada, the eurozone, Russia and the US, fuelled by concerns about financial system stress, write Jonathan Ashworth and Charles Goodhart

NGFS offers concrete next steps to assess climate vulnerabilities

New climate risk scenarios will be incorporated into Bank of England stress tests and Bundesbank economic modelling, write Sarah Breeden and Sabine Mauderer

Bafin says it did not supervise scandal-hit Wirecard

Official tells Central Banking he is “not aware” of any agency supervising firm implicated in fraud

German regulator faces questions after Wirecard admits huge possible fraud

Bafin brought criminal complaint against journalists who alleged wrongdoing at German company

Weidmann to testify quarterly in parliament to explain ECB policy

Measure follows constitutional court ruling requiring ECB to demonstrate proportionality of government bond purchases

Lagarde welcomes Franco-German fund plan

Covid-19 response fund would be drawn from common EU budget

The ECB, the lockdown and the monetary financing lock

The eurozone’s central bank may need to break its prohibition on monetary financing to fight the pandemic

German banks’ capital levels affect loan supply – Bundesbank paper

Authors find balance sheet data shows loan supply has positive elasticity to capital levels

German court leaves Bundesbank caught between two legal decisions

Ruling may hamper ECB’s new PEPP programme as it is not constrained by PSPP limits

German court rules ECB must provide more evidence on PSPP

Judges strongly criticise ECJ’s ruling on QE programme, but stop short of declaring it unlawful

Debts, deficits, central banks and inflation

Forrest Capie and Geoffrey Wood ask what insights history can provide for central banks and governments managing abrupt, large increases in debt

Individual German banks at risk from interbank shocks, paper finds

Bundesbank paper presents simulation method for analysing interbank markets

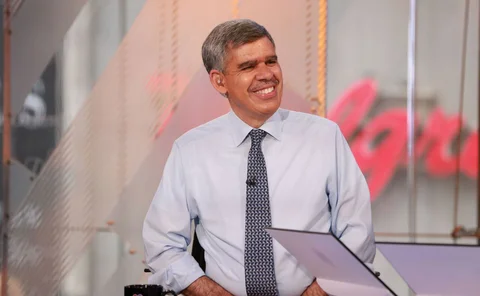

El-Erian on Covid-19 policy risks, ‘zombie’ markets and central bank capture

Former Pimco chief says Fed move into high yield is a step too far, new rules needed on leverage and false liquidity, and narrow window emerges for central banks to shed some of their policy load

Transfer season

Trade frictions with the US have caused a mass industrial transfer to China’s neighbours. Zhou Chengjun, IFF Academic Committee member and inspector of the Macro‑prudential Policy Bureau of the People’s Bank of China, says that shouldn’t stop China…

Lagarde misstep overshadows ‘bold’ measures, analysts say

ECB president seemed to have hampered governments’ debt financing at a critical juncture

How could the coronavirus affect the world economy?

Central banks may lack firepower, while public health readiness differs sharply between countries

Do low rates spur investment?

Many believe low interest rates spur investment, but there appears to be little hard evidence to support such claims, writes former IMF head Jacques de Larosière

German house prices rise by slowest rate since 2014 – Bundesbank

Housing prices continue to rise but at slower rate, especially in major cities

Schnabel takes on Germany’s ‘false narratives’ on ECB policy

Criticism based on “half-truths” imperils trust in single monetary policy and “undermines European cohesion”

ECB monetary policy was weakened by regulation – Bundesbank paper

Tighter regulation reduced lending by weakly-capitalised banks from 2008 to 2018 – researchers

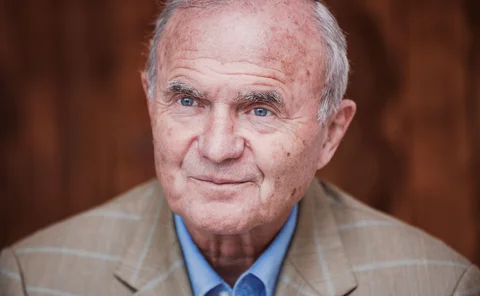

Lifetime achievement award: Otmar Issing

The architect of the euro’s monetary operating framework is still playing an important role in shaping the debate on monetary policy