Europe

Stability versus solvency

There is still far too much regulatory forbearance on troubled bank debt. More on-site inspections and genuine writedowns are needed to fix the banking system

Book notes: The power of money, by Robert Pringle

Economists would benefit from reading this “remarkable” book, which contains “brilliantly written snapshots” about money’s historical and social roles

ECB’s TLTRO2 eased Italian credit conditions – BoI paper

QE measure lowered loan interest rates while increasing credit quantities, researchers find

Should the ECB add owner-occupied housing costs to its inflation measure?

Yves Mersch argues broader measure of housing costs would give more realistic inflation picture

Interview: Luiz Awazu Pereira da Silva

BIS deputy general manager talks about the obstacles central banks face with regard to climate change and why the status quo needs to evolve

ECB and BoJ point to major problem in DLT-based payments

Latest “Project Stella” report says central source of information could create single point of failure

BoE paper highlights non-linearities in bank funding and solvency

Results could be important consideration in stress-test design, authors say

Wider use of LEIs will improve stability, says DNB president

LEI system should be improved and made compulsory for more types of financial data – Klaas Knot

Schnabel takes on Germany’s ‘false narratives’ on ECB policy

Criticism based on “half-truths” imperils trust in single monetary policy and “undermines European cohesion”

Bulgaria: long live the currency board

Bulgaria should reject the euro and extend its currency board to cover bank deposits

Global governance is getting harder, warns BoE’s Cunliffe

Fading memories of crisis, new players and Brexit all create challenges, deputy says

DNB to tighten macro-pru over real estate fears

EBA says Dutch central bank fears overheating after house prices in large cities exceed previous peak

Central Banking Awards 2020: the winners

All the winners in the 2020 Central Banking Awards

ECB paper looks at professional inflation forecasters

No statistically significant evidence of some forecasters being worse than others, researcher says

EU regulators must end ‘tick-box’ approach to money laundering - EBA

First EBA report on national supervisors’ AML/CFT approaches says many agencies fail to co-operate

People: Fed governor gets new term; IMF’s Poul Thomsen to retire

New appointments made and portfolios reshuffled in the US, UK and more

ECB monetary policy was weakened by regulation – Bundesbank paper

Tighter regulation reduced lending by weakly-capitalised banks from 2008 to 2018 – researchers

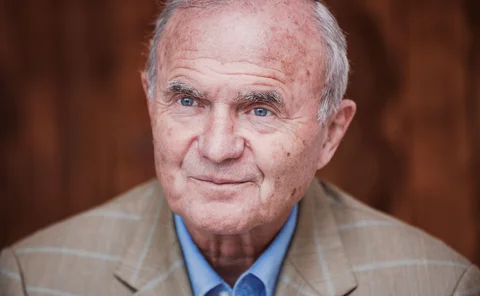

Lifetime achievement award: Otmar Issing

The architect of the euro’s monetary operating framework is still playing an important role in shaping the debate on monetary policy

Specialised lending initiative: BNP Paribas

A new ‘global’ setup helped secure US dollar-denominated assets from a Eurosystem central bank

Collateral management services: National Bank of Georgia/Montran

The duo developed Georgia’s fully automated new collateral framework

Global markets award: HSBC

The UK-headquartered bank is a leader in green finance and helped its clients navigate the low-rate environment over the past year

ECB officials lay out positions on future inflation target

Weidmann and de Cos set priorities as strategy review focuses on inflation measurement and target

Eurozone banks increase illiquid assets after solvency shocks – DNB paper

Shift in asset holdings could create asset price distortions after banking crises, researchers say

Governor of the year: Mark Carney

Carney has played a vital role in managing Brexit risks while driving efforts towards climate, payments and dollar funding reform