Europe

BoE’s inflation target may hamper response to no-deal Brexit – IMF

Report urges BoE to bolster market communication in the event no deal is reached

EBA sets out methods for AML risk assessments

Reports can be triggered by concerns over authorities’ anti-money laundering frameworks

Size matters for central bank research publishing

Staff numbers have strongest association with central banks’ research output

ECB establishes tough conditions for banks to resume dividends

Dividends must remain below 15% of cumulative profits in 2019-20 and not higher than 0.2% of CET1 ratio

Economists earn more than number-crunchers at central banks

On average, statisticians take home 88% of what economists earn

Loans to SMEs should have lower capital requirements – BdF paper

More SME lending boosts banks’ portfolio diversity and decreases systemic risk exposure, paper finds

Maltese ex-finance minister becomes governor despite political dispute

Opposition alleges Edward Scicluna is “bad choice” but Labour government dismisses claims

Few central banks forecast policy rates

Economics Benchmarks 2020 highlights wide variation in variables forecast by central banks

Monetary unions in the making in Africa

EAC, Ecowas and SADC can adopt practical steps learned from EMU to prepare for their own currency unions

ECB adds crucial tweak that could limit PEPP purchases

Hawkish governors secured wording that bond-buying allocation “need not be used in full”

MAS strengthens fintech co-operation with Ghana and Hungary

Agreements will help connect SMEs and foster discussions around regulation and emerging trends

BoE says banks can cope with Brexit and pandemic

But central bank warns EU actions are risking some disruption as transition period ends

ECB announces major boost to pandemic programmes

New TLTRO programme will offer banks financing at negative rates to maintain consumer lending

The long-term impact of Covid-19 on banknote demand

The coronavirus pandemic has challenged cash usage assumptions at a time when central banks make only limited use of longer-term forecasts

ECB set to boost QE purchases and extend duration of stimulus

Eurozone central bank is widely expected to increase emergency asset purchases by around €500 billion on December 10

People: New deputies named in China and Mexico

Plus ECB appoints senior supervisors, and Donald Trump tries to install new OCC chief

ECB is caught in a ‘communications trap’ – Issing

Monetary policy architect says ‘close to’ 2% inflation target was never part of original plan; urges ECB to reject Fed-like average inflation targeting

Could AI ever replace human bank supervisors?

Data collection and processing remains key in leveraging artificial intelligence

Danish central bank moves closer to Target settlement systems

National Bank of Denmark applies to use T2 RTGS system and may start using Tips

FCA details Mifid onshoring process post-Brexit

UK regulator has built equivalent systems to ensure firms can continue with Mifid reporting

The dawn of average inflation targeting

The Fed has failed to explain how it will calculate the ‘average’ for its new AIT framework, raising new risks that central bankers would do well to reflect on

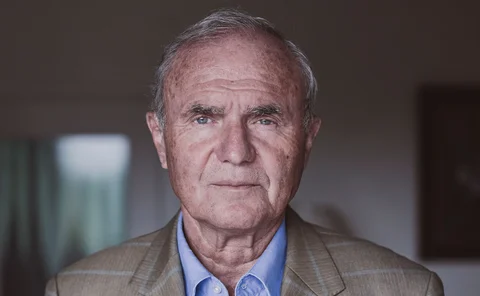

Otmar Issing on the art of central bank communications

EMU architect speaks about Draghi’s “whatever it takes” intervention, forward guidance failures, the Fed’s average inflation target ‘miscommunication’, and why the ECB may be overreaching in its strategy review

Norges Bank deputy governor resigns over security clearance

Deputy governor in charge of world’s largest SWF denied clearance because of wife’s residence in China

Lane’s calls to investors stir controversy ahead of key ECB meeting

Chief economist’s private discussions with investors after policy meetings come under scrutiny