G7

Estimating the cost of a pandemic grant for the world’s poorest economies

The cost of support measures for vulnerable economies is manageable, says Steve Kamin, but political leadership may be lacking

Facebook may bow to regulatory pressure on libra

Basic goals have not changed, says tech giant, but reports suggest network will offer libra alongside other assets

G7 leaders avoid committing to co-ordinated virus response

Central bankers and finance ministers “stand ready”; Carney says BoE has launched contingency measures

ECB’s Löber: Facebook’s libra a “black hole” of legal certainty

But current global standards fit for purpose to underpin digital assets

G7 group warns of stablecoin risks as FSB sets out plans

Group’s final report says global stablecoins could generate “significant adverse effects”; FSB outlines plan for review of stablecoin regulation

Seven threats from big tech’s libra

Can central banks avoid a ‘big tech’ monetary meltdown?

Stablecoins raise ‘sovereignty challenge’, says de Galhau

French governor says rise of stablecoins highlights need for pan-European action on payments

Regulators meet in Basel to grill stablecoin backers

Conference convened by G7 stablecoins group included Libra Association, Fnality and JP Morgan

IMF’s Adrian on the big tech threat and why a ‘non-system’ works

The IMF’s financial counsellor speaks about risks from big tech’s move into fintech, the fund’s efforts to craft well-targeted policy guidance and why the current international monetary ‘non-system’ works

Official reserve management in the 21st century

A lack of operational clarity and reluctance to view reserve portfolios holistically have prevented optimal, rules-based approaches to reserve management becoming commonplace. BlackRock‘s Terrence Keeley, Stuart Jarvis and Michael Palframan explain how…

Balancing reserves’ effectiveness and transparency

Why do countries accumulate more and more reserves if they know intervention may prove ineffective? Iris Yeung speaks to Canada’s Eric Wolfe

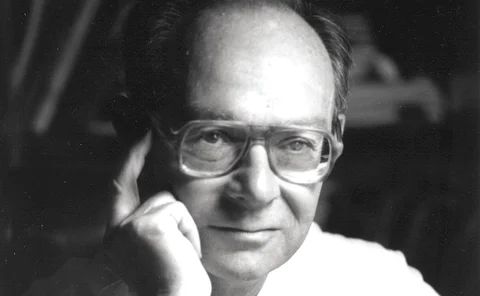

Archive – Interview: Allan Meltzer

Robert Pringle talks to Allan Meltzer, Carnegie Mellon professor and chair of the US Congress’s International Financial Institution Advisory Commission (the “Meltzer Commission”); first published in February 2003

BIS urges policymakers to exploit ‘window of opportunity’

Financial cycles are getting close to turning in many economies and central banks and governments must make sure they are prepared, the BIS warns in its 2017 annual report

G7 sets out cyber security ‘building blocks’

Eight “elements” published to guide the financial sector when implementing cyber security provisions; information sharing and contingency planning are important

Research considers effects of delaying fiscal consolidation on GDP

Working paper published by the IMF finds there are no ‘substantive gains’ to be had in GDP from delaying consolidation if multipliers are constant

Falling asset prices 'significantly associated' with onset of G-7 recessions

IMF working paper examining the usefulness of asset prices in predicting recessions in the G-7 countries finds equity price drops are larger and more frequent than house price drops

ECB paper models heterogeneous shock transmissions

Working paper examines macroeconomic and financial linkages between countries; finds significant but heterogeneous transmission of shocks

IMF paper studies fiscal impact of ageing population

Working paper analyses the effect of ageing populations on 'fiscal space' in G-7 countries; finds a greater impact on countries with larger governments

G-7 leaders pledge co-ordinated effort to tackle economic crisis

G-7 finance ministers and central bank governors say concerted effort will be made to co-ordinate action against global economic slowdown

Lagarde adds to pressure on G-7 meet

Lagarde calls for global action; Canada set to raise dissatisfaction with Swiss franc exchange rate limit at G-7 gathering in France

Japan takes unilateral action to counter currency appreciation

Japanese government and central bank on Thursday move to weaken yen as country recovers from the earthquake and tsunami tragedies

G-7 pledges intervention to stem yen appreciation

Finance ministers and central bank governors say they will cooperate to counter volatility of Japanese currency in aftermath of Tohoku earthquake

Imbalances could treble in next two decades: Bank's Haldane

Bank of England executive director Andy Haldane charts course of global imbalances, pointing to trends likely to widen them

Britain unveils sweeping, cross-border bank levy

UK government publishes draft bank tax law which will affect domestic banks operating overseas and foreign bank operations in Britain; proposal highlights international disunity