Federal Reserve System

Fed caps dividends after stress tests show big potential losses

Brainard says decision not enough as tests show loan losses could exceed those during financial crisis

ECB offers euros to non-eurozone central banks

Eurep facility aims to reduce international risks spilling over to eurozone, ECB says

The Fed must be careful to avoid bank deposit crowding out

Rising US government debt will have a major effect on bank funding, write Wenhao Li, Yiming Ma and Yang Zhao

Fed to assess banks’ management during Covid-19

Supervisors evaluating business and operational strategies, cyber security and market risk assessments

Why has the euro failed as a global reserve currency?

ECB's Klöckers says fragmented capital markets and incomplete banking union holding euro back; while sovereign crisis and low yields contributed to 'underperformance' as a reserve currency, survey finds

Fed develops new fraud prevention model

Federal Reserve wants model to be voluntarily adopted across US payments system by 2024

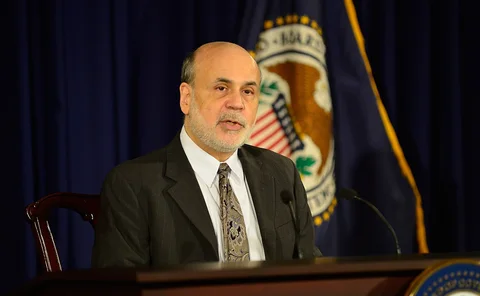

Bernanke and Yellen join call for new fiscal stimulus in US

Former Fed chairs among 148 economists warning of “disastrous” effects if Congress fails to act

US economy entering ‘bounce back’ phase – Powell

Fed chair forced to defend move to follow through with corporate bond purchases in Senate hearing

Fed poised to purchase corporate bonds next week

New York Fed will create a portfolio to track the US corporate bond market under new plans

US citizens think Fed’s communication strategy needs adapting – Fed report

“Fed Listens” events revealed a lack of understanding about inflation targeting, report shows

Fears rise over breakdown in Basel and IFRS standards

Bretton Woods institutions worried about growing divergence in capital and accounting standards as credit impairment tsunami looms; US and many emerging economies skirting the rules

High US inflation should not be ruled out

A prolonged health crisis raises the risk that supply-side factors, monetary expansion and rising personal savings could stoke hidden inflationary pressures

Fed policy is too tight given FOMC projections – former Fed economist

“An outlook that bad for that long is a clear sign that policy is too tight,” Joseph Gagnon says

Fed promises to keep buying assets at current rate

Fed will hold accommodation in place for “however long it takes”, chair Jerome Powell says; FOMC releases first projections this year

Balance sheets could grow by 23% of GDP in largest advanced economies – BIS

Economists forecast balance sheets will remain large for the foreseeable future

Fed makes last-minute changes to ‘Main Street’ programme

Programme will be open “soon”, despite plans to launch in May

Mass bankruptcies should feature in Fed stress tests – former officials

Crowding of bankruptcy courts can effectively double loss given default, says Jeremy Stein

US unemployment falls sharply in May

Unemployment rate declined to 13.3% from 14.7% in April, despite widespread fears it would rise

Former officials say Fed should impose tighter regime

Donald Kohn and Jeremy Stein warn of risks and say Fed should stop US banks paying dividends

Chilean central bank requests access to NY Fed’s repo facility

Central Bank of Chile also seeks to expand renminbi swap line with PBoC

Central banking enters a new era

Central banks face a delicate balancing act to preserve their reputations as they evolve into ‘buyers of last resort’ and some of their actions appear functionally equivalent to ‘monetary financing’

US needs aggressive fiscal policy and negative rates – St Louis Fed economist

Policy response must be powerful enough to overshoot previous growth trend for a period, researcher says

Stress levels rising: investment funds and the Covid-19 shock

Extreme market stresses due to Covid-19 are underscoring the central role non-banks play in crisis contagion, as in 2008. Were regulators better prepared this time?

What would yield curve control mean for Fed’s asset purchases?

Policy may imply shift in rationale from crisis to recovery, and potentially more volatility in purchases