Bank of England (BoE)

Research notes three trends in currency crises

Research published by the Bank of England on the role of external balance-sheet variables as determinants of currency crises has three key findings.

Bank publishes first QE quarterly

Quantitative easing by the Bank of England has succeeded in reducing gilt yields, and narrowing spreads on commercial paper and corporate bonds, but the Bank on Monday cautioned that it will take some time to determine the full effect of its purchases.

Bank launches new lending report

21 April saw the publication of the first Trends in Lending report, a new monthly publication from the Bank of England which will present a regular assessment of lending to the UK economy.

Monetary policy in turbulent times

The global financial crisis has hit the British economy hard, but this does not mean monetary policy should change its focus, said Andrew Sentance, a member of the Bank of England's rate-setting Monetary Policy Committee.

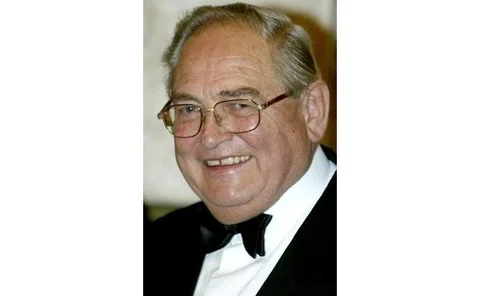

Eddie George on independence and supervision

In 2000, Sir Eddie George, the former governor of the Bank of England who died at the weekend, spoke on the Bank's then new-found independence and the loss of its supervisory function

Lord George, former Bank governor, dies

Eddie George, governor of the Bank of England from 1993 to 2003, died of cancer Saturday, aged 70.

Crisis highlights shortfalls in UK payments: BoE

The financial crisis has uncovered uncertainties and knowledge gaps among market participants in the United Kingdom's payment and settlement infrastructure, the Bank of England said on Tuesday.

Bank of England holds on quantitative easing

The Bank of England has opted to wait and see what impact its quantitative easing programme is having before pledging a further boost to the money supply.

Fed sets up sterling, yen, euro, franc swap lines

The Federal Reserve will be able to provide sterling, euro, yen and Swiss franc liquidity to banks with American operations after agreeing swap lines with the relevant monetary authorities.

BoE - Credit Conditions Survey

Lenders reduced the availability of secured credit to households in the three months to mid-March, according to the latest Bank of England Credit Conditions Survey.

Harsh standards prompt drop in secured UK loans

Tighter lending conditions have sparked the steepest-ever climb in British housing equity in the last quarter of 2008.

G20 protests converge on Bank of England

The Bank of England on Wednesday was surrounded by anti-capitalist protesters, converging on Threadneedle Street to vent their anger at the crisis on the eve of the London G20 summit.

Tucker: macroprudential is more than macro + micro

A macroprudential approach to financial supervision requires more than simply bringing together the central bank's macroeconomists and the regulator's line supervisors, said Paul Tucker, a deputy governor of the Bank of England.

Inflation-targeting regime improves policy

During the Bank of England's inflation-targeting regime, monetary policy shocks have been more muted and inflation expectations have been lower than before, a new paper from the central bank posits.

A guide for would-be MPC members

An ability to challenge convention, courage in one's convictions and a thick skin are some of the qualities essential for Monetary Policy Committee members, two external members of the Bank of England's committee have said.

Calls for Bank to retake control of regulation

The leader of Britain's main opposition party wants the Bank of England to regain its role in regulating the overall level of debt in the banking system.

MPC dove slams policy orthodoxy

David Blanchflower, an external member of the Bank of England's Monetary Policy Committee, has launched a scathing attack on monetary-policy orthodoxy, questioning inflation targeting's intellectual roots and advocating consideration of whether to use…

King details vision for quantitative easing

The Bank of England expects to spend the first £75 billion ($110.5 billion) tranche set aside for quantitative easing, within the next three months, Mervyn King, the governor of the Bank, said on Tuesday.

Monetary policy can affect relative prices

Monetary policy can affect relative prices in the economy, a new paper from the Bank of England posits.

Household consumption key for rate riddle

Households' consumption habits explain the uncovered interest rate parity puzzle, a new paper from the Bank of England reveals.

Bank to begin buying corporate bonds next week

The Bank of England said on Thursday that it would begin buying corporate bonds outright next week.

King moots Glass-Steagall revival

Mervyn King, the governor of the Bank of England, has called for a debate on whether the global financial crisis has shown that a Glass-Steagall type provision is needed to prevent retail deposits from being used to fund investment-banking activities.

Policy can make deflationary episodes more costly

The costs of previous deflationary episodes have been exacerbated by inappropriate policy responses, a new paper from the Bank of England posits.

Old Lady begins quantitative easing

The Bank of England began its first round of gilt purchases on Wednesday, buying £2 billion ($2.8 billion) of the instruments outright in an attempt to boost the money supply.