Financial Stability

European insurance resolution needs major reform – ESRB

Insurance sector’s contribution to systemic risk has increased but current tools are insufficient, report says

RBI closes in on ‘endgame’ in bank clean-up

Governor Urjit Patel says the central bank’s new powers have allowed it to overcome “severe” moral hazard problems; state-owned banks will need recapitalisation, he says

IMF paper explores sustainability of price rises in Colombia

House prices have increased more than 110% in real terms in major cities, but houses are just 13% overvalued

Russian central bank alleges criminal behaviour at several closed banks

Bank of Russia closes five banks and reports shortfalls or malpractice at four more

Denmark’s central bank proposes reforms to mortgage credit market

National Bank of Denmark suggests increasing competition between mortgage banks and other financial institutions as a way to reduce financial instability

Banks are scrambling to hit IFRS 9 deadline – survey

Many banks appear to have been caught off-guard by the complexity of adapting to IFRS 9; impact assessments still patchy, but some see provisioning needs up by 40% or more

Sarb expands financial supervision

Deputy governor explains the Sarb’s new financial supervisory structure, and indicates it may affect central bank independence

RBA payments board backs ‘digital identity’ for Australians

Board encourages payments industry to work on a framework that could make online transactions more convenient and secure

Philippines sees strong ‘hot money’ inflow despite currency weakness

Net inflow of foreign portfolio investments into Philippines hits six-month high, in contrast to weakness in peso

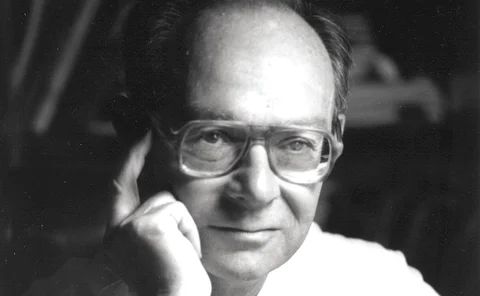

Archive – Interview: Allan Meltzer

Robert Pringle talks to Allan Meltzer, Carnegie Mellon professor and chair of the US Congress’s International Financial Institution Advisory Commission (the “Meltzer Commission”); first published in February 2003

China’s current credit trajectory is ‘dangerous’, IMF warns

Fund revises up China’s GDP growth forecast, but warns debt-fuelled growth is unsustainable

Regulators wary of machine learning in bank models

Banks acknowledge they “cannot hide behind a complex tool” to assess interconnectedness

Ghanaian central bank closes two commercial banks

IMF staff called for action in February over problems at some commercial banks

Fed’s Fischer criticises efforts to unwind banking regulation in the US

The economist describes attempts to reduce capital standards as “extremely dangerous and extremely short-sighted”

RBA’s Kent warns mortgages are still risky, despite offsets

RBA assistant governor says use of offset accounts does not remove the need for tighter lending standards; new securitisation database sheds light on housing market

PRA’s tough line on Pillar 2 disclosure divides lenders

Watchdog seeks to level playing field with public disclosure of total capital requirements

Bank resolution regime rolls out in Hong Kong

HKMA chief outlines how the new bank resolution regime can end the use of taxpayers’ money in case of a bank failure; authority also plans to conduct a public consultation on loss absorbency

Maltese banks’ assets rise as loans fall, central bank says

Assets pushed up by growth in mortgage and placements with eurozone banks

Islamic State looted $800m in funds, says Iraqi central bank

IMF says central bank cannot avoid financing government deficit

Fed and FDIC extend resolution plan-filing deadline for banks

Nineteen foreign banks granted more time were already given one-year extensions in 2016

Shadow banks ‘interfere’ with macro-pru – paper

Institutional function should determine whether institutions are regulated, say researchers