Website: Central Bank of the Philippines

BSP says its website’s mobile-friendly design and chatbot has boosted effectiveness of communication

Websites are an important channel through which central banks communicate and engage with members of the general public and other external stakeholders. However, in a number of regions, central banks’ websites remain outdated and reliant on legacy templates.

In August 2020, the governor of the Bank of Canada, Tiff Macklem, said central banks needed to spend “more effort speaking and listening” to the citizens they serve. That is precisely what the Central Bank of the Philippines (BSP) has done with its new website.

The previous version of the BSP’s website had been in place since 2006. In the 14 years it was in action, most of the changes made were limited to the layout, content, functionality and operational processes.

“It became necessary to enhance our website,” explains IT systems management department director Reynaldo Zipagan.

“We needed to strengthen security controls against cyber attacks, replace obsolete technology, reorganise the content, and rebalance the design to [a] less text-based and more visual-based layout.”

The new website was built prior to the height of the Covid-19 outbreak, which hit much of the world in March 2020. The launch had already been scheduled for the third quarter of the year.

“It was important to launch the website, even during the pandemic, to move towards a more secured environment,” BSP governor Benjamin Diokno tells Central Banking.

To finalise and test the website prior to launch, the BSP and external project teams worked remotely, and collaborated using virtual platforms. Launching a website in the middle of a pandemic is no easy feat, but the BSP had several years of consumer research to support it.

In 2017, the central bank’s Economic and Financial Learning Center conducted a survey to understand how satisfied consumers were with the website, their primary reason for visiting the site, how often they visited, and how likely they were to find what they were looking for.

Following the findings of the survey, the BSP organised several focus group sessions with content owners. The BSP Web Committee also used site analytics to identify the most-viewed pages and content – technology used before embarking on the redesign. In addition, the BSP explored the websites of other central banks and financial institutions.

“Based on website analytics, the ‘key rates’ section was noted as the most frequently visited section of the website, and has thus been given more prominence on the homepage,” says Economic and Financial Learning Center director Maria Farah Angka.

Reorganisation of content

While a lot of decisions were taken in-house, the BSP tapped a third-party service provider to assist in the design and development of the website. This was to ensure the overall design would lead to a “better user experience”, Angka explains.

At the base level, the new site has been redesigned to be more responsive to mobile and other portable devices. In 2017, only 32% of users accessed the website from a mobile device. It subsequently increased to 37% in 2018, 44% in 2019, and 47% in the first three quarters of 2020.

Greater impetus has been given to communicate the central bank’s core mandate: price stability, financial stability and details of the country’s payment system are now prominently displayed on the website’s homepage, as well as on its main menu.

More prominence has been also been given to visual features and widgets – a major shift away from the old design, which was heavily text-based.

A new core element added to the homepage is a carousel that features photos and infographics with short text descriptions to highlight specific information, a story or an event. The carousel affords the central bank a means to draw users’ attention to select content at a specific time.

“The new BSP website has been updated to look current, professional and world-class, as benchmarked against the websites of other central banks,” says Diokno – adding that the Monetary Authority of Singapore is widely seen as a leader in the region.

Closer to the people

In an effort to bring the central bank closer to members of the public, the redesign includes a section dedicated to the governor.

“The governor is considered the key spokesperson of the BSP, and allocating a space for him in the new website was important to maintain trust and confidence in the institution,” says communication office acting director Elisha Lirios.

The central bank has also taken a leap, integrating new artificial intelligence elements into the redesign in the form of a chatbot.

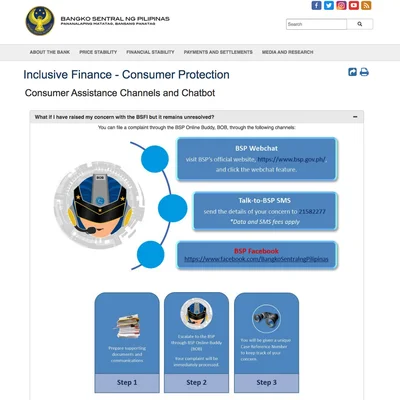

Named BOB (BSP Online Buddy), the chatbot has been increasing the efficiency of handling consumer queries in areas related to banking, financial services and insurance. The chatbot uses artificial intelligence and natural language processing (NLP), enabling it to handle queries and complaints using English, Tagalog and ‘Taglish’.

“The chatbot was launched as a pioneering regtech solution to improve the speed, efficiency and convenience of ensuring consumer protection and promoting financial inclusion,” says Diokno.

While the chatbot is fairly new, the BSP did deploy an early version of the technology on its old website. Between August 1 and August 31, 2020, the chatbot processed over 3,806 concerns, 541 of which were complaints.

Human intervention during a live conversation with the chatbot is not yet possible. However, the chatbot is able to refer a consumer to an appropriate channel for them to communicate with a BSP consumer specialist, should the need arise.

Reaping the rewards

Since the launch of the new website in 2020, traffic has increased approximately 30%. Diokno believes the majority of new visitors have been attracted by the new layout of the site, but the new chatbot is likely to have also had an impact.

“The chatbot facility is a good channel for reaching out to the people, and getting their inquiries and feedback,” says Diokno.

So far, engagements through the chat function average around 1,700 a month, equating to around 40% of total public engagement through all the central bank’s communication channels.

The Central Banking Awards were written by Christopher Jeffery, Daniel Hinge, Dan Hardie, Rachael King, Victor Mendez-Barreira, William Towning and Alice Shen

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: subscriptions.centralbanking.com/subscribe

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com test test test

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com test test test