Daniel Hinge

Editor, Benchmarking

Daniel Hinge is editor of Central Banking’s benchmarking service and subject specialist for economics and monetary policy. He has reported on the central banking community since 2012, in roles including news editor and comment editor. He holds a degree in politics, philosophy and economics from the University of Oxford.

You can follow Daniel on Bluesky.

Follow Daniel

Articles by Daniel Hinge

Podcast: Greg Kaplan on heterogeneous-agent models

Monetary and fiscal policy are much more closely connected than many central banks would like

Should central banks be more aggressive on climate change?

Discussion weighs up whether central banks should take more drastic action via monetary policy channels, but some warn they may overreach

Markets still in thrall to central banks – BIS

But some apparent anomalies may be signs of healthier market function, says Claudio Borio

Central Bank of Liberia officials arrested over banknote allegations

Kroll report finds “discrepancies” in CBL’s handling of two banknote contracts

Book notes: Where economics went wrong, by David Colander and Craig Freedman

Chicago economics’ gladiatorial debating style has cost the discipline dearly, the authors argue

Former Fed chairs join over 3,000 economists in call for carbon tax

Economists including central bankers and Nobel laureates demand action on climate change

IMF prepares to overhaul its financial surveillance

Fund agrees with IEO report that there is much room for improvement, but budget remains an issue

BoE offers bleak forecasts as Brexit 'fog' deepens further

Rates stay on hold as central bank eyes growing damage from Brexit uncertainty

RBI unexpectedly cuts rates as elections loom

Inflation lowest for 18 months, but cut will be welcome to Modi administration; governor refuses to answer political influence question

BoE opens doors for debate on the future of central banking

Event breaks new ground in central bank engagement with the public; participants offer both positive and negative feedback

Key Brexit vote complicates outlook for UK economy

Vote this evening leaves UK’s political and economic future uncertain; analysts optimistic on outlook for sterling

Basel Committee softens impact of revised market risk framework

Final framework cuts expected increase in average capital requirements almost in half; committee may consider some further rule-making in 2019

Icelandic central bank questions reform proposals

Publishing rate paths may not work as intended, external MPC members warn

2018: The year in review

The past year marked a return to instability, but also saw some innovations among central banks

Malaysia charges Goldman Sachs over 1MDB scandal

Bank allegedly benefited from inflated fees after employees bribed officials

BoE revamps expenses rules after criticism from MPs

MP says some officials’ expenses claims are “staggeringly high”

Podcast: How to fight the next crisis

In the last of the series, Yale’s Andrew Metrick warns we may be less prepared for crisis-fighting now than we were before 2008

Podcast: Preventative measures

Many central banks currently lack a key power that could help them deal with crises, argues Yale University’s Andrew Metrick

Podcast: The global regulatory landscape

Capital rules have made the core banking system safer, but other parts of the system may still be at risk, says Andrew Metrick

Podcast: Post-crisis monetary policy

Many things behave like money in the modern economy and central banks have not yet figured out how to control them all, says Andrew Metrick

Podcast: Crisis lessons

Central banks may have learned the lessons of the crisis, but are they fully on top of the risks?

Podcast: The post-crisis world

Andrew Metrick says central banks have changed dramatically since 2008, but more work may be needed to develop new models

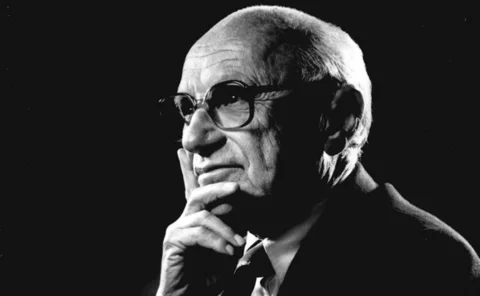

Oxford academic argues Milton Friedman is misunderstood

James Forder says Friedman had a bigger impact on neoclassical economics than on monetarism