Central Banking Newsdesk

Follow Central Banking

Articles by Central Banking Newsdesk

IMF paper links Chinese growth to ‘drastic increase’ in inequality

Rapid growth in recent decades linked to rising economic inequality, with consumption and income inequality co-moving closely

IMF officials say they want less austerity for Greece, not more

Fund and European creditors still disagree on design of Greek programme, as IMF says fiscal targets must be realistic

Icelandic paper finds evidence of rising natural rate

Authors attempt the notoriously difficult process of estimating the natural rate, using various models; rate appears to be on the rise

ECB backs EC plan to consolidate macro-prudential policy

Central bank says it should be handed new and clearer powers, while toolkit should go “beyond banking”

Eight banks struggle in Czech stress tests

Adverse scenario pushes many banks below regulatory capital minimums, though the system as a whole remains resilient, central bank says

BIS economists model benefits of leaning against the wind

Endogenous model of financial crises points to benefits of using monetary policy to lean against financial imbalances, in contrast to many other studies

French governor sees outlines of possible Basel III deal

Internal models will still regulate some portfolios, governor predicts; output floors still a matter for “debate”

BoE paper drops rational expectations to solve unemployment puzzles

Replacing rational expectations with adaptive learning helps fit the standard theory of unemployment to the data, economists find

Riksbank’s Jansson rejects calls to scrap inflation target

Critics likely underestimate the benefits of the current monetary policy framework when calling for it to change, deputy governor says

Basel III challenging to implement in Islamic countries – Kuwait’s Al-Hashel

Central bank governor says discretion for Islamic systems, “though well-intended”, could create divergence and opportunities for regulatory arbitrage

IMF to tackle effects of globalisation in 2017

Fund says it will focus on bringing the benefits of globalisation and technology to a wider section of society, amid a populist backlash against openness

Researcher uses dynamic factor model for ‘nowcasting’

Research makes three additions to widely-used model

Nabiullina warns of low growth in Russian economy

Bank of Russia governor advocates three-year budget rule and structural reforms to counteract economic weaknesses

BoE’s Salmon seeks to fix deadline for delayed Libor replacement

Chris Salmon sets three-month target to finalise transition plan and reach decision on design for risk-free rate

Patel defends approach to banknote crisis, as RBI holds

Governor offers some clarity on progress with note withdrawals and question of “extinguishing” parts of balance sheet; rate hold surprises market

St Louis Fed president may support rate increase

Bullard cautions future real interest rates likely to stay flat; says Trump administration can only alter low interest rate environment by improving productivity

BIS paper identifies spillovers from targeted macro-prudential policies

Applying tools narrowly to a sector may nevertheless affect other sections of the financial system, authors find

Ukraine’s central bank calls for action against illegal forex dealers

NBU says authorities failed to act against 32 illegal operations in Kyiv; says it will publicise further information on unauthorised forex dealers

Changing policy impact may knock forecasts askew – Riksbank economists

Economists suggest systematic errors of forecasts in recent years may reflect changes in the effectiveness of monetary policy

Spanish paper looks at eurozone inflation expectations

Pan-eurozone factors are more important than country-specific forces, paper says

Route ahead unclear for Italian banks

At least one bank faces major loan book problems; European law may present difficulties with recapitalisation and “bad banks”

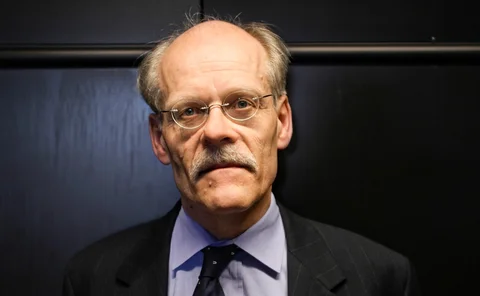

Ingves: internal modelling may create too much complexity

Basel Committee chair says complexity created by internal modelling has a range of adverse effects, though more research is needed

Tajik central bank launches consumer protection push

Plan could create stability and growth if it is successful, but resource constraints are a challenge, National Bank of Tajikistan says

BoE unveils database of macro-prudential policies

Researchers attempt to classify the myriad forms of macro-prudential policy, compiling panel data on when policies were tightened and loosened in different countries